Fill Your Uc 2 Connecticut Form

The UC-2 Connecticut form is an essential tool for employers who need to correct previously filed information regarding employee wages and employer contributions. This form serves two main purposes: it corrects the Employer Contribution Return (Form UC-2) and the Employee Quarterly Earnings Report (Form UC-5A). Each quarter, employers may find discrepancies in their reports that necessitate adjustments. The UC-2 form ensures that these corrections are officially documented. It's important to note that this form is not for correcting social security numbers or employee names; instead, it focuses solely on wage corrections. Employers must submit a separate form for each quarter that requires changes, along with a detailed letter explaining the reason for the correction. Properly filling out the UC-2 involves entering specific information, such as the Connecticut Registration Number, the correct contribution rates, and the adjusted wage amounts. Attention to detail is critical, as any errors can lead to complications down the line. Understanding how to accurately complete this form can save employers time and prevent potential penalties. By following the outlined instructions carefully, employers can ensure compliance with state regulations while maintaining accurate records of their payroll contributions.

Documents used along the form

When filing the UC-2 Connecticut form, several other forms and documents may be necessary to ensure compliance with state regulations. Below is a list of commonly used forms that complement the UC-2 form. Each entry includes a brief description to clarify its purpose.

- Form UC-5A: This is the Employee Quarterly Earnings Report. Employers use it to report wages paid to employees during a specific quarter. It is essential for tracking employee earnings and contributions.

- New Jersey Promissory Note: To accurately outline a borrower's promise to repay a specified amount of money to a lender, download the form and get started at https://promissorynotepdf.com/.

- Form UC-2: The Employer Contribution Return is used to report the total contributions owed by the employer based on the wages reported. It details gross wages and calculates the necessary contributions.

- Form UC-5A (Corr): This is the correction form for the Employee Quarterly Earnings Report. It allows employers to amend previously submitted earnings reports to correct any inaccuracies.

- Form UC-2 (Corr): Similar to UC-5A (Corr), this form is used to correct errors in the Employer Contribution Return. It ensures that the contributions reported are accurate and up to date.

- Continuation Sheet: If there are more employees than can be listed on the UC-5A or UC-5A (Corr), a continuation sheet may be used. It should include the same information and format as the original form.

- Detailed Letter to Department of Labor: This letter explains the reason for any corrections made in the UC-2 or UC-5A forms. It should be submitted along with the correction forms to provide context for the changes.

- Form W-2: Employers issue this form to report annual wages and taxes withheld for each employee. It is necessary for tax reporting purposes and complements the quarterly earnings reports.

- Form 941: This federal form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is filed quarterly and is essential for federal compliance.

- Form 1099: This form reports income paid to non-employees, such as independent contractors. It is crucial for accurate reporting of all wages and payments made by the employer.

- State Tax Registration Certificate: This document proves that an employer is registered to collect and remit state taxes. It is often required when submitting forms related to employee wages and contributions.

Understanding these forms and documents can streamline the process of reporting wages and contributions. Ensuring accuracy in these filings helps avoid penalties and maintains compliance with state regulations.

Preview - Uc 2 Connecticut Form

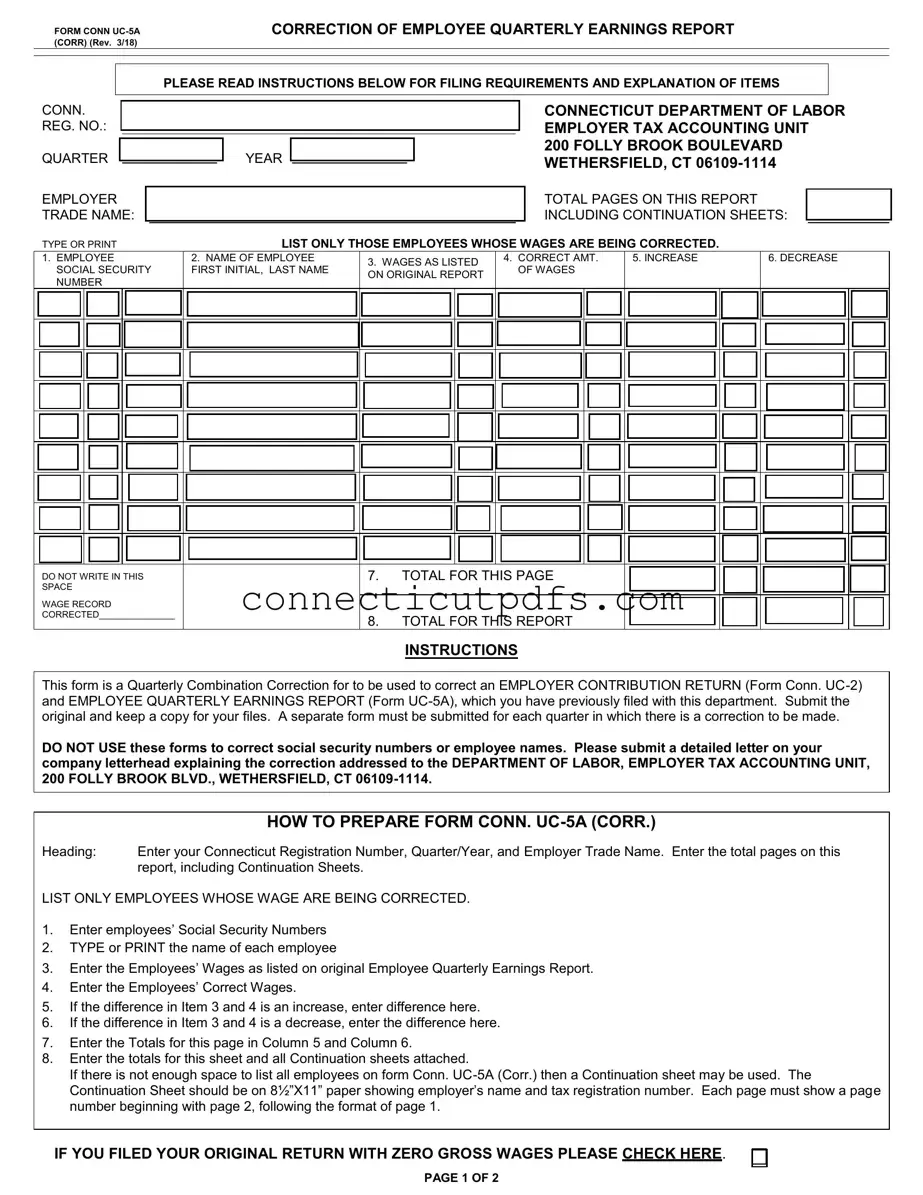

FORM CONN

CORRECTION OF EMPLOYEE QUARTERLY EARNINGS REPORT

PLEASE READ INSTRUCTIONS BELOW FOR FILING REQUIREMENTS AND EXPLANATION OF ITEMS

CONN.

REG. NO.:

QUARTER

EMPLOYER TRADE NAME:

YEAR

CONNECTICUT DEPARTMENT OF LABOR EMPLOYER TAX ACCOUNTING UNIT 200 FOLLY BROOK BOULEVARD WETHERSFIELD, CT

TOTAL PAGES ON THIS REPORT INCLUDING CONTINUATION SHEETS:

TYPE OR PRINT |

LIST ONLY THOSE EMPLOYEES WHOSE WAGES ARE BEING CORRECTED. |

1.EMPLOYEE SOCIAL SECURITY NUMBER

2.NAME OF EMPLOYEE

FIRST INITIAL, LAST NAME

3.WAGES AS LISTED ON ORIGINAL REPORT

4.CORRECT AMT. OF WAGES

5. INCREASE

6. DECREASE

DO NOT WRITE IN THIS SPACE

WAGE RECORD

CORRECTED_______________

7.TOTAL FOR THIS PAGE

8.TOTAL FOR THIS REPORT

INSTRUCTIONS

This form is a Quarterly Combination Correction for to be used to correct an EMPLOYER CONTRIBUTION RETURN (Form Conn.

DO NOT USE these forms to correct social security numbers or employee names. Please submit a detailed letter on your company letterhead explaining the correction addressed to the DEPARTMENT OF LABOR, EMPLOYER TAX ACCOUNTING UNIT, 200 FOLLY BROOK BLVD., WETHERSFIELD, CT

|

HOW TO PREPARE FORM CONN. |

Heading: |

Enter your Connecticut Registration Number, Quarter/Year, and Employer Trade Name. Enter the total pages on this |

|

report, including Continuation Sheets. |

LIST ONLY EMPLOYEES WHOSE WAGE ARE BEING CORRECTED.

1.Enter employees’ Social Security Numbers

2.TYPE or PRINT the name of each employee

3.Enter the Employees’ Wages as listed on original Employee Quarterly Earnings Report.

4.Enter the Employees’ Correct Wages.

5.If the difference in Item 3 and 4 is an increase, enter difference here.

6.If the difference in Item 3 and 4 is a decrease, enter the difference here.

7.Enter the Totals for this page in Column 5 and Column 6.

8.Enter the totals for this sheet and all Continuation sheets attached.

If there is not enough space to list all employees on form Conn.

Continuation Sheet should be on 8½”X11” paper showing employer’s name and tax registration number. Each page must show a page number beginning with page 2, following the format of page 1.

IF YOU FILED YOUR ORIGINAL RETURN WITH ZERO GROSS WAGES PLEASE CHECK HERE.

PAGE 1 OF 2

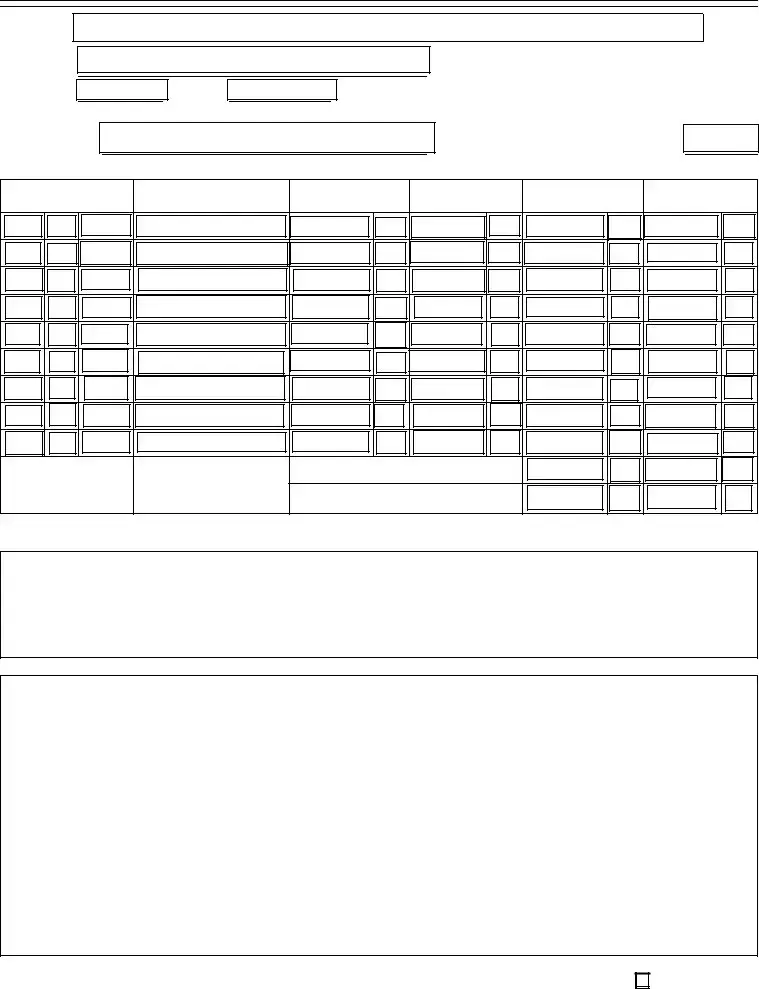

FORM CONN.

CORRECTION OF

EMPLOYER CONTRIBUTION RETURN

PLEASE COMPLETE BOTH PAGES OF THIS RETURN

QUARTER |

|

|

|

YEAR |

|

|

|

|

|

CONN. REG. NO.:

CORPORATE NAME OR

TRADE NAME

CONNECTICUT DEPARTMENT OF LABOR EMPLOYER TAX ACCOUNTING UNIT 200 FOLLY BROOK BOULEVARD WETHERSFIELD, CT

Pay Online at: www.ct.gov/doltax

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLUMN A |

|

COLUMN B |

COLUMN C |

|

COLUMN D |

|||||

|

|

|

|

|

ORIGINAL |

|

CORRECTED |

INCREASE |

|

DECREASE |

|||||

1 |

CONTRIBUTION RATE |

% |

|

RETURN |

|

RETURN |

(Difference between Column |

|

(Difference between Column |

||||||

|

|

|

|

|

|

|

|||||||||

|

See original return filed for contribution rate. |

|

(Enter below amounts |

|

|

|

A and Column B when |

|

A and Column B, when |

||||||

|

|

reported on original return for |

|

|

|

Column B is larger) |

|

Column B is smaller) |

|||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

corresponding items) |

|

|

|

|

|

|

|

|

|

|

2 |

TOTAL GROSS WAGES PAID TO ALL EMPLOYEES FOR WORK |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

PERFORMED IN CONNECTICUT THIS QTR |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

TOTAL GROSS WAGES PAID DURING THIS QUARTER TO EACH |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

EMPLOYEE IN EXCESS OF THE LIMITATION FOR THE |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

CALENDAR YEAR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4 |

TOTAL TAXABLE |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

DIFFERENCE BETWEEN COL. A AND B IN COL. C OR D. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

CONTRIBUTION OR CREDIT DUE: SEE INSTRUCTIONS BELOW. |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

INTEREST DUE. IF CORRECTION RESULTED IN AN INCREASE IN CONTRIBUTION (LINE 5, COLUMN C), ENTER INTEREST |

|

|

|

********** |

|

|||||||||

|

|

|

|

||||||||||||

DUE IN COLUMN C. SEE INSTRUCTIONS BELOW. |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

IF INCREASE IN CONTRIBUTIONS DUE (ITEM 5C), ENTER PENALTY DUE, IF ANY, IN COLUMN C. SEE INSTRUCTIONS |

|

|

|

********** |

|

|||||||||

|

|

|

|

||||||||||||

BELOW. |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

TOTAL ADDITIONAL AMOUNT DUE – SUM OF ITEMS 5C, 6C AND 7C. PAY ONLINE AT: WWW.CT.GOV/DOLTAX |

|

|

|

********** |

|

|||||||||

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9EXPLAIN REASON FOR CORRECTION

PHONE NUMBER (

)

TITLE

DATE

HOW TO PREPARE FORM CONN.

HEADING: Enter QUARTER/YEAR, Connecticut Registration Number, Employer Trade Name, Name of Owners, Partners, or Corporate name (if other than trade name) and your Mailing address

Item 1: Contribution Rate – enter Contribution Rate for this quarter. If Rate has been corrected, use Corrected Rate.

Item 2: Enter Column “A” the Gross Wages Listed on the Original Return. Enter in Column “B” the correct amount of Gross Wages. If

Column “B” is larger than Column “A”, enter the difference in Column “C”. If Column “B” is smaller than Column “A”, enter the difference in Column “D”.

Item 3: Excess Wages – Wages paid during quarter in excess of the limitation for the calendar year. Enter the Column “A” excess wages as listed on original Return. Enter in Column “B” the correct amount of Excess Wages. Enter the Difference between Columns “A” and “B” in appropriate Column “C” or “D”.

Item 4:

Item 5:

Item 6:

Item 7:

Item 8: Item 9:

Item 10:

Item 2 minus Item 3

Enter in Column “A” the taxable Wages subject to contributions as listed on the Original Return.

Enter in Column “B” the correct amount of Taxable Wages subject to contributions. Enter difference between Columns “A” and “B” in the appropriate Column “C” and “D”.

Enter in Column “A” the Contributions listed on the Original Return. Enter in Column “B” the amount of Contributions due on corrected wages by multiplying Item 4B by the Contribution rate in Item 1. If Column “B” is larger than Column “A”, it represents Additional Contributions Due, and the difference should be entered in Column “C” (INCREASE). IF Column “B” is less than Column “A”, it represents an Overstatement of Contributions and the difference should be entered in Column “D”

(DECREASE). If a DECREASE, a refund may be issued, if applicable.

Enter in Column “C” the interest due on the additional contributions due. Multiply item 5C by the appropriate interest rate. One percent interest is charged for each month, or part thereof, that this return is filed late. Example: If the quarter being filed is the first quarter, the due date is April 30. Beginning May 1st , calculate 1% interest due. On June 1, 2% interest; on July 1, 3% interest; etc. If it is a second quarter return, interest begins to accrue August 1st; for a 3rd quarter return, November 1st; and for a 4th quarter return, February 1st .

Enter in Column “C” any penalty on the additional contributions due. A penalty of ten percent (10%) or fifty dollars ($50), whichever is greater, is assessed if the balance of contributions due is not paid within thirty days of the due date. Penalty dates: 1st quarter

Enter the total Amount due (the Sum of Items “5C”, “6C” and “7C”). Pay online at: www.ct.gov/doltax

Explain the reason for Correction fully. If additional space is required, attach a letter furnishing all facts and refer to the letter in this space.

This correction return must be signed by a responsible and duly authorized person and mailed to the address listed above. Any payment due, however, must be made online at www.ct.gov/doltax.

Common Questions

What is the purpose of the UC-2 Connecticut form?

The UC-2 Connecticut form is used by employers to report corrections to their Employer Contribution Return. If you find discrepancies in previously reported wages or contributions, this form allows you to make the necessary adjustments. It is important for ensuring accurate tax reporting and compliance with state regulations.

Who should use the UC-2 form?

Employers who have filed an Employer Contribution Return and need to correct information should use the UC-2 form. This includes adjustments to gross wages, taxable wages, and contributions. Each quarter that requires corrections necessitates a separate form submission.

How do I fill out the UC-2 form?

Begin by entering your Connecticut Registration Number, the quarter and year, and your Employer Trade Name. Follow the instructions to fill in the contribution rate, gross wages, excess wages, and any corrections needed. Make sure to calculate any additional contributions or overstatements accurately. The form must be signed by an authorized person before submission.

What should I do if I need to correct employee wages?

To correct employee wages, you will need to use the UC-5A form. This form specifically addresses corrections to employee quarterly earnings. Ensure that you only list the employees whose wages are being corrected and provide the correct figures alongside the original amounts.

Can I correct social security numbers or employee names using this form?

No, the UC-2 and UC-5A forms should not be used for correcting social security numbers or employee names. Instead, you should submit a detailed letter on your company letterhead explaining the corrections to the Department of Labor's Employer Tax Accounting Unit.

What happens if I file the correction late?

If you file the correction after the due date, interest and penalties may apply. Interest is charged at a rate of 1% for each month the return is late. Additionally, a penalty of 10% or $50, whichever is greater, may be assessed if contributions due are not paid within thirty days of the due date.

Is there a specific format for continuation sheets?

Yes, if you need additional space for employee corrections, use a continuation sheet on 8.5” x 11” paper. Each continuation sheet must include your employer's name and tax registration number, and pages should be numbered sequentially, starting with page 2.

How do I submit the UC-2 form?

The completed UC-2 form must be mailed to the Connecticut Department of Labor, Employer Tax Accounting Unit at the specified address. Make sure to keep a copy for your records. If there are any payments due, they should be made online at the provided website.

What if I have more questions about the UC-2 form?

If you have additional questions or need clarification, you can contact the Employer Tax Accounting Unit at (860) 263-6470. They can provide guidance and support regarding the completion and submission of the UC-2 form.

Common PDF Forms

Exclusive Right to Represent Buyer Agreement Ct - This is a legal document for buying and selling real property in Connecticut.

Completing the Arizona Annual Report form not only ensures compliance with regulatory requirements but also provides an opportunity for businesses to showcase their achievements over the past year. By meticulously detailing operational metrics and changes, companies can maintain transparency and build trust with stakeholders. For valuable insights and guidance on this essential process, read more about the document to help navigate your reporting obligations effectively.

How to Transfer Ownership of a Car to a Family Member in Ct - This form is specifically designed for individuals serving in the U.S. Armed Forces who are residents of Connecticut.

Guide to Filling Out Uc 2 Connecticut

Filling out the UC-2 Connecticut form is an important step in correcting previously submitted employer contribution returns and employee quarterly earnings reports. After completing the form, ensure that it is submitted along with any necessary documentation, including a detailed letter if applicable. Follow the steps below to accurately fill out the form.

- Heading: Enter your Connecticut Registration Number, the Quarter/Year, and your Employer Trade Name. Include the total number of pages for this report, including any continuation sheets.

- Employee Information: List only those employees whose wages are being corrected. For each employee, enter their Social Security Number.

- Name Entry: Type or print the name of each employee clearly.

- Wage Information: Enter the employees’ wages as listed on the original Employee Quarterly Earnings Report.

- Correct Wages: Enter the employees’ correct wages.

- Increase Entry: If the difference between the original and corrected wages is an increase, enter that difference.

- Decrease Entry: If the difference is a decrease, enter that amount here.

- Totals: Calculate and enter the totals for this page in Columns 5 and 6.

- Continuation Sheets: If you need more space for additional employees, use a continuation sheet on 8½” x 11” paper. Include your name and tax registration number on each sheet.

- Employer Contribution Return: On the second page, enter the Quarter/Year, Connecticut Registration Number, Employer Trade Name, and mailing address.

- Contribution Rate: Enter the contribution rate for the quarter. If corrected, use the corrected rate.

- Gross Wages: Enter the gross wages from the original return in Column A and the correct amount in Column B. Calculate the differences in Columns C and D as needed.

- Excess Wages: Record excess wages as listed on the original return in Column A and the correct amount in Column B. Note the differences in Columns C and D.

- Taxable Wages: Enter taxable wages subject to contributions in Columns A and B, and calculate differences in Columns C and D.

- Contributions: Fill in contributions listed on the original return in Column A and the correct amount due in Column B. Note any increases or decreases in Columns C and D.

- Interest Due: Calculate interest due on additional contributions and enter it in Column C.

- Penalty: Enter any penalties due in Column C.

- Total Amount Due: Calculate the total amount due and enter it in the appropriate space.

- Reason for Correction: Explain the reason for the correction fully. If more space is needed, attach a letter and refer to it in this section.

- Signature: Ensure that the correction return is signed by a responsible and authorized person before mailing it to the appropriate address.

Dos and Don'ts

When filling out the UC-2 Connecticut form, it's essential to approach the process carefully. Here are nine important dos and don'ts to keep in mind:

- Do enter your Connecticut Registration Number, Quarter/Year, and Employer Trade Name in the heading.

- Don't use this form to correct social security numbers or employee names; instead, submit a detailed letter for such corrections.

- Do list only the employees whose wages are being corrected.

- Don't forget to keep a copy of the submitted form for your records.

- Do ensure that all amounts are accurate and reflect the corrections needed.

- Don't leave any required fields blank; all necessary information must be provided.

- Do sign the correction return to validate it before mailing.

- Don't submit multiple corrections on one form; a separate form is needed for each quarter.

- Do attach any necessary continuation sheets if there isn’t enough space for all employees.