Fillable Connecticut Transfer-on-Death Deed Document

In the realm of estate planning, the Connecticut Transfer-on-Death Deed (TODD) form stands out as a valuable tool for individuals looking to streamline the transfer of property upon their passing. This unique form allows property owners to designate beneficiaries who will automatically receive their real estate without the need for probate, simplifying the process significantly. By completing the TODD, individuals can ensure that their wishes are honored while also minimizing the administrative burden on their loved ones. It's important to note that the deed must be properly executed and recorded to be effective, and it can be revoked or modified at any time before the owner's death. Understanding the nuances of this form can empower property owners to make informed decisions about their estate, providing peace of mind for both themselves and their beneficiaries. As you navigate the intricacies of the Connecticut TODD, consider the implications it holds for your estate plan and the lasting impact it can have on your family's future.

Documents used along the form

When considering a Transfer-on-Death Deed in Connecticut, it is important to understand that several other forms and documents may be necessary to ensure a smooth transfer of property. Each of these documents plays a crucial role in the estate planning process, helping to clarify intentions and protect the rights of all parties involved.

- Will: A legal document that outlines how a person's assets will be distributed after their death. It can also name guardians for minor children.

- Quitclaim Deed: A document used to transfer ownership of real estate without warranties; often utilized in family property transfers. For more details, visit Texas Documents.

- Power of Attorney: This document allows someone to make financial or legal decisions on behalf of another person if they become incapacitated.

- Living Will: A type of advance directive that specifies a person's wishes regarding medical treatment in situations where they cannot communicate their preferences.

- Affidavit of Heirship: A sworn statement that identifies the heirs of a deceased person, often used when property is transferred without a will.

- Revocable Trust: A legal entity that holds a person's assets during their lifetime and allows for easy transfer of those assets upon death, avoiding probate.

- Deed: The legal document that conveys ownership of real estate from one party to another. It must be properly executed and recorded.

- Notice of Death: A formal notification that may be required to inform interested parties and the public about an individual’s passing.

Understanding these documents can empower individuals to make informed decisions regarding their estate planning. Each form serves a specific purpose, and together, they can help create a comprehensive plan that reflects your wishes and protects your loved ones.

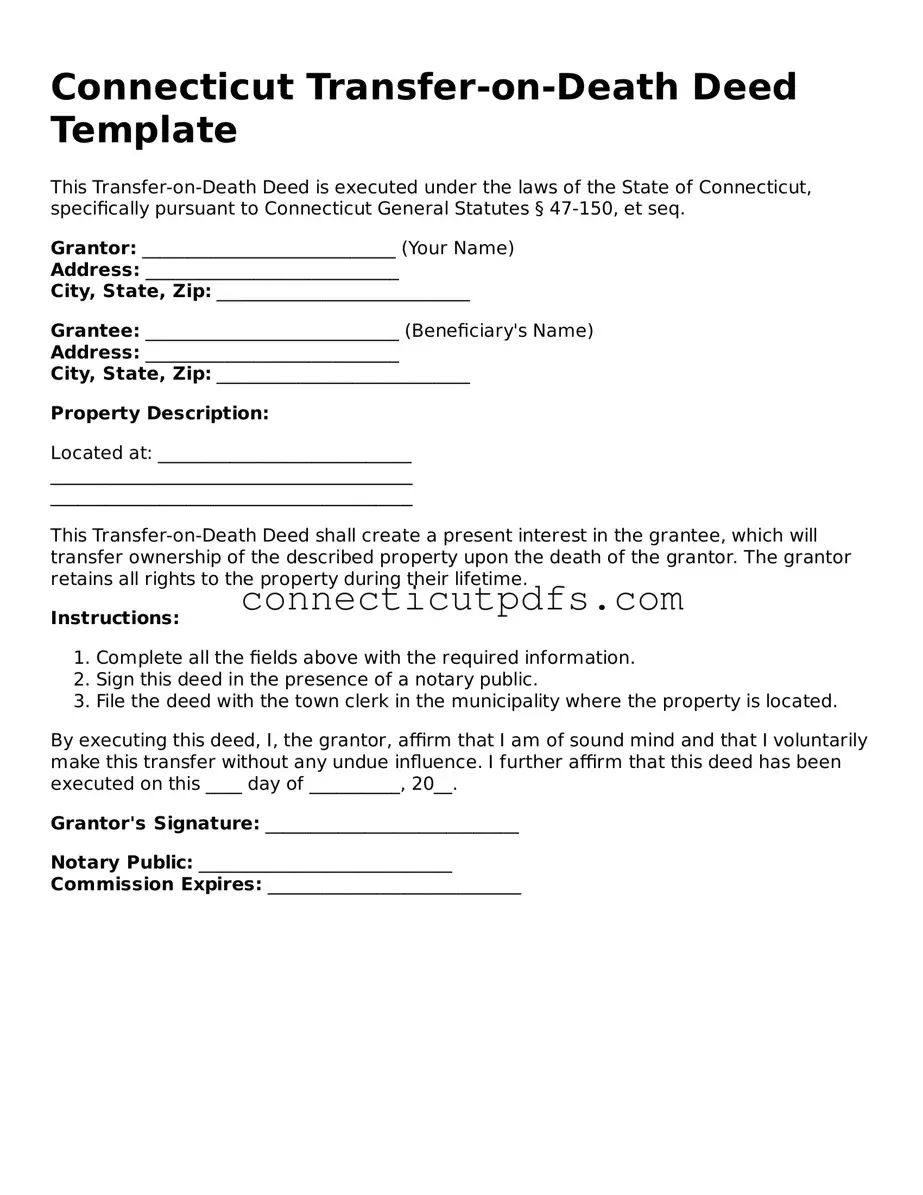

Preview - Connecticut Transfer-on-Death Deed Form

Connecticut Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed under the laws of the State of Connecticut, specifically pursuant to Connecticut General Statutes § 47-150, et seq.

Grantor: ____________________________ (Your Name)

Address: ____________________________

City, State, Zip: ____________________________

Grantee: ____________________________ (Beneficiary's Name)

Address: ____________________________

City, State, Zip: ____________________________

Property Description:

Located at: ____________________________

________________________________________

________________________________________

This Transfer-on-Death Deed shall create a present interest in the grantee, which will transfer ownership of the described property upon the death of the grantor. The grantor retains all rights to the property during their lifetime.

Instructions:

- Complete all the fields above with the required information.

- Sign this deed in the presence of a notary public.

- File the deed with the town clerk in the municipality where the property is located.

By executing this deed, I, the grantor, affirm that I am of sound mind and that I voluntarily make this transfer without any undue influence. I further affirm that this deed has been executed on this ____ day of __________, 20__.

Grantor's Signature: ____________________________

Notary Public: ____________________________

Commission Expires: ____________________________

Common Questions

What is a Transfer-on-Death Deed in Connecticut?

A Transfer-on-Death Deed (TOD Deed) in Connecticut allows an individual to transfer real property to a designated beneficiary upon the individual's death. This deed does not require the beneficiary to take any action during the property owner's lifetime. The property is transferred automatically upon death, avoiding the probate process.

Who can create a Transfer-on-Death Deed?

Any individual who is the sole owner of real property or who holds property as a joint tenant can create a Transfer-on-Death Deed. It is important that the person creating the deed is of sound mind and legal age to make such decisions.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, the property owner must fill out the form with the necessary information, including the property description and the name of the beneficiary. The deed must be signed by the owner and acknowledged before a notary public. It is also advisable to check local regulations to ensure compliance.

Is there a specific format for the Transfer-on-Death Deed?

Yes, Connecticut law requires that the Transfer-on-Death Deed be in writing and include specific language that clearly indicates the intent to transfer property upon death. The form must also be properly executed and recorded in the town clerk's office where the property is located.

Do I need to notify the beneficiary when I create a Transfer-on-Death Deed?

While it is not legally required to notify the beneficiary, it is advisable to do so. Informing the beneficiary can help avoid confusion or disputes later on. It also allows the beneficiary to understand their rights and responsibilities regarding the property.

Can I revoke or change a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time during the property owner's lifetime. This can be done by executing a new deed that explicitly revokes the previous one or by creating a new deed with different terms. The revocation must also be recorded in the town clerk's office.

What happens if the beneficiary dies before the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed becomes void for that beneficiary. The property owner can then designate a new beneficiary or allow the property to pass according to their will or state intestacy laws if no will exists.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. However, the property may be subject to estate taxes upon the owner's death, depending on the total value of the estate. Beneficiaries should consult a tax professional to understand potential tax consequences.

Check out More Forms for Connecticut

Connecticut Prenup - A prenuptial agreement can act as a safeguard for individual achievements.

For those seeking to understand the essential aspects of an Operating Agreement, the complete guide to Operating Agreement documentation provides valuable insights into creating a robust operating framework for your LLC.

Vacate Quit Notice Letter From Landlord to Tenant - Landlords use this form to initiate the process of eviction if necessary.

Guide to Filling Out Connecticut Transfer-on-Death Deed

After obtaining the Connecticut Transfer-on-Death Deed form, it is important to fill it out accurately to ensure that the transfer of property is executed as intended. Following the steps below will help guide you through the process.

- Begin by entering the name of the property owner(s) in the designated section. This should include all individuals who hold title to the property.

- Provide the current address of the property. This information must be complete and accurate to avoid any confusion.

- Identify the beneficiaries who will receive the property upon the owner's passing. List their full names and addresses clearly.

- Include a legal description of the property. This may be found on the property deed or through local property records.

- Sign the form in the presence of a notary public. The notary will verify the identity of the signers and witness the signing.

- Have the deed recorded at the local town or city clerk's office where the property is located. This step is crucial for the deed to take effect.

Once the form is completed and submitted, it will be processed by the appropriate authorities. Ensure that you keep a copy for your records and confirm that the deed has been recorded properly.

Dos and Don'ts

When filling out the Connecticut Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure everything is completed correctly. Here’s a list of what you should and shouldn’t do:

- Do provide accurate property details, including the legal description.

- Do include the names of all intended beneficiaries clearly.

- Do sign the deed in front of a notary public.

- Do keep a copy of the completed deed for your records.

- Don't leave any sections of the form blank; fill in all required information.

- Don't forget to check for any errors before submitting the form.

- Don't use vague language when describing the property.

- Don't assume that oral agreements will suffice; everything must be in writing.