Fillable Connecticut Small Estate Affidavit Document

In Connecticut, the Small Estate Affidavit form serves as a vital tool for individuals managing the estate of a deceased person when the total value of the estate falls below a certain threshold. This form allows heirs or beneficiaries to bypass the lengthy and often costly probate process, enabling them to access assets more quickly. Typically, the Small Estate Affidavit can be used when the total value of the estate is less than $40,000, excluding certain assets like real property. The form requires specific information, including the decedent's details, a list of assets, and the identities of the heirs. Once completed, the affidavit must be signed under oath, affirming that the information provided is accurate. This process not only simplifies the transfer of assets but also ensures that the rightful heirs can claim their inheritance without unnecessary delays. Understanding the requirements and steps involved in using this form is essential for anyone navigating the complexities of small estate management in Connecticut.

Documents used along the form

When navigating the process of settling a small estate in Connecticut, several forms and documents may be necessary in addition to the Connecticut Small Estate Affidavit. Each of these documents plays a crucial role in ensuring that the estate is administered properly and that the wishes of the deceased are honored. Below is a list of commonly used forms and documents that may accompany the Small Estate Affidavit.

- Death Certificate: This official document certifies the death of the individual and is often required to prove the decedent's passing.

- Will: If the deceased left a will, it should be presented to verify the distribution of assets as intended by the decedent.

- List of Assets: A comprehensive inventory of the decedent’s assets helps identify what is included in the estate and ensures that all items are accounted for.

- RV Bill of Sale: For those involved in the sale of a recreational vehicle in Texas, utilizing the billofsaleforvehicles.com/editable-texas-rv-bill-of-sale can streamline the documentation process to ensure proper ownership transfer.

- Affidavit of Heirship: This document may be used to establish the identity of heirs when there is no will, clarifying who is entitled to inherit.

- Notice to Creditors: This notice informs creditors of the decedent’s passing and invites them to present any claims against the estate.

- Tax Returns: The decedent’s final income tax returns may be necessary to settle any outstanding tax obligations and ensure compliance with state and federal tax laws.

- Court Filings: If any disputes arise or if a formal probate process is initiated, additional court filings may be required to address these issues.

Each of these documents serves a specific purpose in the estate administration process. Collecting and preparing them diligently can help facilitate a smoother transition during a challenging time. It is essential to approach this process with care and consideration for all parties involved.

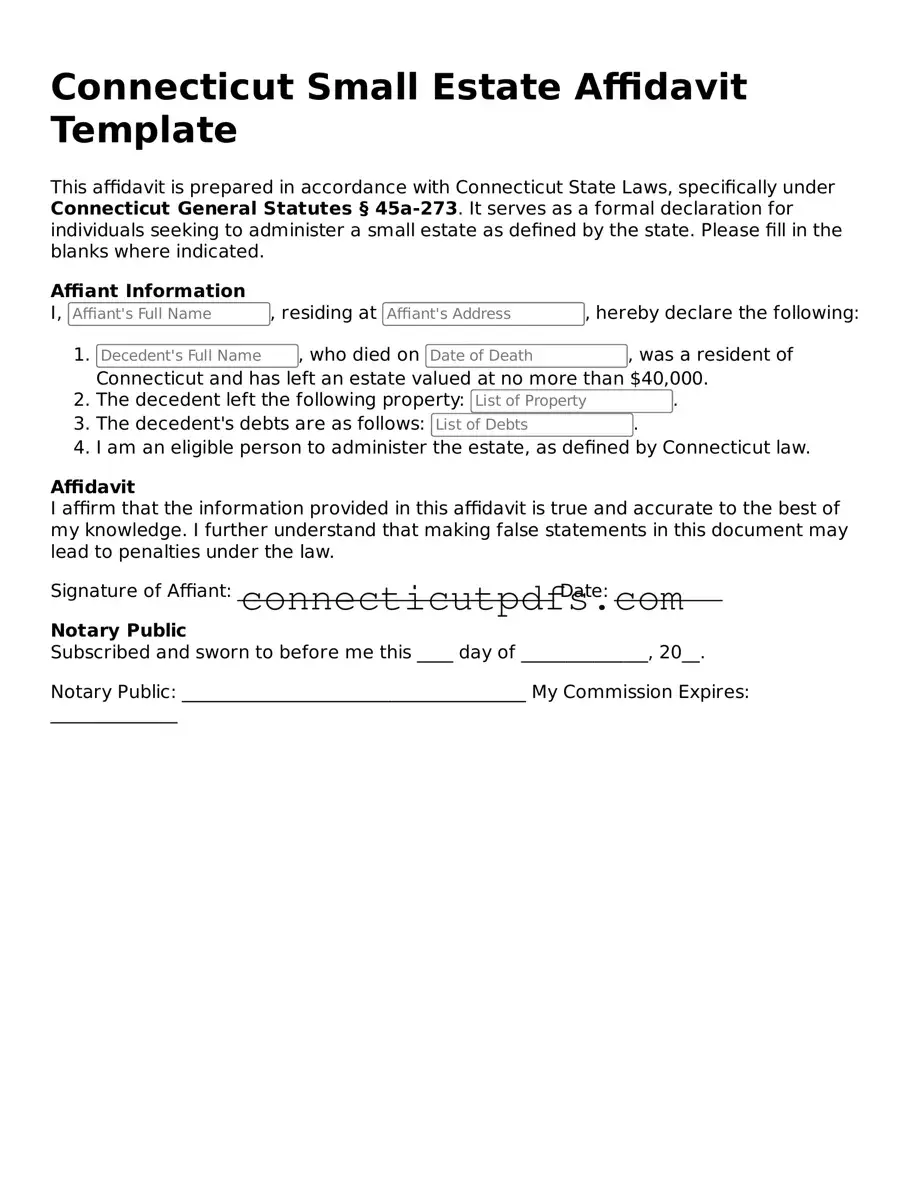

Preview - Connecticut Small Estate Affidavit Form

Connecticut Small Estate Affidavit Template

This affidavit is prepared in accordance with Connecticut State Laws, specifically under Connecticut General Statutes § 45a-273. It serves as a formal declaration for individuals seeking to administer a small estate as defined by the state. Please fill in the blanks where indicated.

Affiant Information

I, , residing at , hereby declare the following:

- , who died on , was a resident of Connecticut and has left an estate valued at no more than $40,000.

- The decedent left the following property: .

- The decedent's debts are as follows: .

- I am an eligible person to administer the estate, as defined by Connecticut law.

Affidavit

I affirm that the information provided in this affidavit is true and accurate to the best of my knowledge. I further understand that making false statements in this document may lead to penalties under the law.

Signature of Affiant: ___________________________________ Date: ____________

Notary Public

Subscribed and sworn to before me this ____ day of ______________, 20__.

Notary Public: ______________________________________ My Commission Expires: ______________

Common Questions

What is a Connecticut Small Estate Affidavit?

The Connecticut Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the full probate process. This option is available when the total value of the estate is below a certain threshold, making it simpler and faster for heirs to claim their inheritance.

Who can use the Small Estate Affidavit in Connecticut?

Generally, any individual who is an heir or beneficiary of the deceased can use the Small Estate Affidavit. This includes spouses, children, parents, and other relatives. However, the total value of the estate must meet the specified limit set by Connecticut law for the affidavit to be applicable.

What is the value limit for a small estate in Connecticut?

As of October 2023, the value limit for a small estate in Connecticut is $40,000. This amount applies to the total value of the estate, excluding certain exempt assets. If the estate exceeds this limit, the full probate process will be required.

How do I complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to fill out the form with the necessary information about the deceased and the estate. This includes details about assets, debts, and the relationship of the affiant to the deceased. After filling it out, the form must be signed in front of a notary public.

Where do I submit the Small Estate Affidavit?

The completed Small Estate Affidavit should be submitted to the financial institutions or entities that hold the deceased's assets. This could include banks, insurance companies, or other organizations. Each institution may have its own requirements for accepting the affidavit, so it's advisable to check with them beforehand.

What happens after I submit the Small Estate Affidavit?

Once the Small Estate Affidavit is submitted, the institutions will review it. If everything is in order, they will release the assets to the affiant or distribute them according to the deceased's wishes. This process can take some time, so patience may be necessary while waiting for the assets to be transferred.

Check out More Forms for Connecticut

Ct Homeschool Laws - Use this document to effectively communicate your curriculum choices.

The importance of having a solid understanding of the Texas Real Estate Purchase Agreement cannot be overstated, as it ensures both parties are aware of their responsibilities and rights. For those looking to navigate the intricacies of real estate transactions in Texas, the form can be easily accessed through resources like Texas Documents, setting the stage for a smooth transaction.

Connecticut Sales Contract for a House - It can outline how possession and occupancy will be handled post-closing.

Guide to Filling Out Connecticut Small Estate Affidavit

After gathering the necessary information and documents, you’re ready to fill out the Connecticut Small Estate Affidavit form. This form allows you to claim assets from a deceased person’s estate without going through the full probate process, provided the estate qualifies as a small estate under Connecticut law. Follow these steps to complete the form accurately.

- Obtain the form: You can download the Connecticut Small Estate Affidavit form from the official state website or obtain a physical copy from a local courthouse.

- Fill in your information: Start by entering your name, address, and relationship to the deceased in the designated sections at the top of the form.

- Provide details about the deceased: Enter the full name, date of death, and last known address of the deceased person.

- List the estate's assets: Clearly itemize all assets of the deceased that you are claiming. Include bank accounts, real estate, and personal property, along with their estimated values.

- Indicate the total value: Calculate the total value of the estate. Ensure it does not exceed the small estate limit set by Connecticut law.

- Sign the affidavit: At the bottom of the form, you must sign and date it. Make sure to read any declarations or affirmations before signing.

- Notarize the document: Take the completed form to a notary public to have it notarized. This step is crucial for the affidavit to be legally binding.

- Submit the form: Finally, file the notarized affidavit with the appropriate court or financial institution to claim the assets.

Dos and Don'ts

When filling out the Connecticut Small Estate Affidavit form, it is essential to follow specific guidelines to ensure the process goes smoothly. Below is a list of things you should and shouldn't do.

- Do ensure that the total value of the estate does not exceed the limit set by Connecticut law.

- Do provide accurate and complete information about the deceased and their assets.

- Do sign the affidavit in the presence of a notary public.

- Do keep copies of the completed affidavit for your records.

- Don't forget to include all relevant debts and liabilities of the estate.

- Don't attempt to use the affidavit for estates that exceed the small estate limit.

- Don't leave any sections of the form blank; every part must be filled out.

- Don't submit the affidavit without first reviewing it for errors or omissions.