Fillable Connecticut Real Estate Purchase Agreement Document

When navigating the complexities of buying or selling property in Connecticut, the Real Estate Purchase Agreement (REPA) serves as a crucial document that outlines the terms and conditions of the transaction. This form typically includes essential elements such as the purchase price, financing details, and the timeline for closing the deal. Additionally, it addresses contingencies, which are conditions that must be met for the agreement to proceed, such as home inspections or securing a mortgage. The REPA also stipulates the responsibilities of both the buyer and seller, ensuring clarity in the transfer of ownership. Furthermore, it encompasses provisions related to earnest money deposits, which demonstrate the buyer's commitment to the purchase. By clearly detailing these aspects, the Connecticut Real Estate Purchase Agreement not only protects the interests of both parties but also facilitates a smoother transaction process, paving the way for a successful real estate exchange.

Documents used along the form

When engaging in a real estate transaction in Connecticut, several documents are typically utilized alongside the Connecticut Real Estate Purchase Agreement. Each of these forms serves a specific purpose and helps to ensure that all parties are protected and informed throughout the process. Below is a list of common forms and documents that you may encounter.

- Seller's Disclosure Statement: This document provides important information about the property's condition. Sellers are required to disclose known issues, such as structural problems, pest infestations, or environmental hazards, allowing buyers to make informed decisions.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is required to inform buyers about the potential presence of lead-based paint. It ensures that buyers are aware of the risks associated with lead exposure, particularly for children.

- Title Search and Title Insurance: A title search verifies the property's ownership history and uncovers any liens or claims against it. Title insurance protects the buyer and lender from potential disputes over property ownership after the sale.

- Property Inspection Report: Conducted by a professional inspector, this report details the condition of the property. It typically covers major systems like plumbing and electrical, helping buyers identify any necessary repairs before finalizing the purchase.

- Mortgage Pre-Approval Letter: This document from a lender indicates that a buyer is pre-approved for a loan, specifying the amount. It strengthens the buyer's position in negotiations, showing sellers that the buyer is serious and financially capable.

- Nursing License Application: For nursing professionals aiming to practice in Arizona, it is essential to complete the Nursing License Application. This comprehensive form includes all necessary details about education, practice history, and further requirements. For more information, read the document that outlines the licensure process and specific criteria necessary for obtaining your license.

- Closing Disclosure: Provided at least three days before closing, this form outlines the final terms of the mortgage, including loan costs and closing costs. It ensures that buyers understand their financial obligations before signing the final paperwork.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to ensure that the buyer has clear title to the property.

Understanding these documents can help you navigate the complexities of a real estate transaction. Each form plays a vital role in ensuring a smooth and successful purchase, protecting both buyers and sellers throughout the process.

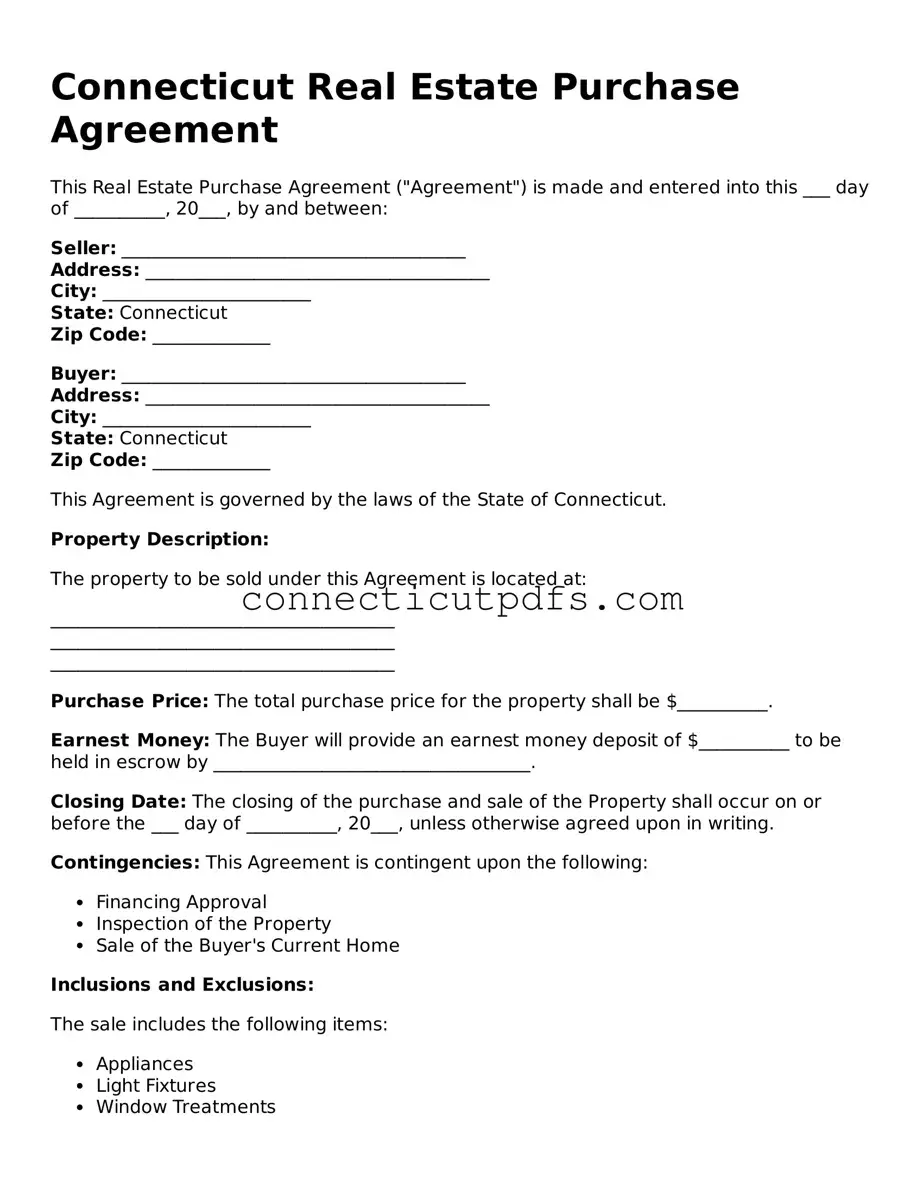

Preview - Connecticut Real Estate Purchase Agreement Form

Connecticut Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made and entered into this ___ day of __________, 20___, by and between:

Seller: ______________________________________

Address: ______________________________________

City: _______________________

State: Connecticut

Zip Code: _____________

Buyer: ______________________________________

Address: ______________________________________

City: _______________________

State: Connecticut

Zip Code: _____________

This Agreement is governed by the laws of the State of Connecticut.

Property Description:

The property to be sold under this Agreement is located at:

______________________________________

______________________________________

______________________________________

Purchase Price: The total purchase price for the property shall be $__________.

Earnest Money: The Buyer will provide an earnest money deposit of $__________ to be held in escrow by ___________________________________.

Closing Date: The closing of the purchase and sale of the Property shall occur on or before the ___ day of __________, 20___, unless otherwise agreed upon in writing.

Contingencies: This Agreement is contingent upon the following:

- Financing Approval

- Inspection of the Property

- Sale of the Buyer's Current Home

Inclusions and Exclusions:

The sale includes the following items:

- Appliances

- Light Fixtures

- Window Treatments

Any items excluded from the sale are:

- ________________________________

- ________________________________

Signatures: This Agreement shall be signed by both parties below:

_______________________________

_______________________________

This Agreement shall be binding upon the parties and their respective heirs, successors, and assigns.

Common Questions

What is a Connecticut Real Estate Purchase Agreement?

The Connecticut Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This form serves as a binding contract and includes essential details such as the purchase price, property description, and contingencies. It is crucial for both parties to understand the terms before signing to ensure a smooth transaction.

What key elements should be included in the agreement?

A comprehensive Connecticut Real Estate Purchase Agreement should include several key elements. First, it must identify the parties involved—both the buyer and the seller. Next, it should provide a detailed description of the property being sold, including its address and any specific features. The purchase price, payment terms, and any contingencies, such as financing or inspection clauses, should also be clearly stated. Additionally, the agreement should specify the closing date and any other important deadlines.

Are there contingencies that can be included in the agreement?

Yes, contingencies are an important part of the Connecticut Real Estate Purchase Agreement. Common contingencies include financing, where the purchase is dependent on the buyer securing a mortgage, and inspection, which allows the buyer to have the property inspected before finalizing the sale. Other contingencies may involve the sale of the buyer’s current home or specific repairs that need to be completed by the seller. These contingencies protect both parties and help manage expectations throughout the process.

What happens if either party breaches the agreement?

If either party breaches the Connecticut Real Estate Purchase Agreement, the other party may have several options. Generally, the non-breaching party can seek damages, which may include financial compensation for any losses incurred. In some cases, the non-breaching party might also pursue specific performance, which means they can request that the court compel the breaching party to fulfill their obligations under the contract. It’s essential to consult with a legal professional to understand the best course of action in such situations.

Is it necessary to have a lawyer review the agreement?

Can the agreement be modified after it is signed?

Yes, the Connecticut Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and the seller to ensure they are legally enforceable. It’s important to communicate openly and promptly if changes are needed, as this can help maintain a positive relationship between both parties throughout the transaction.

Check out More Forms for Connecticut

What Is a Hold Harmless Letter - This agreement is a proactive step towards safeguarding personal and business interests.

Connecticut Living Will - This document is especially important for individuals with serious or terminal illnesses.

For those looking to create a legally binding financial agreement, the Pennsylvania Promissory Note is an essential document. By utilizing this form, you can formalize your loan agreement and clarify the obligations of both parties involved. For further assistance and resources on how to generate this important document, visit https://promissorynotepdf.com.

Landlord Verification Form Ct - List your monthly income to evaluate your ability to pay rent.

Guide to Filling Out Connecticut Real Estate Purchase Agreement

Filling out the Connecticut Real Estate Purchase Agreement is a crucial step in the home buying process. Once you have gathered the necessary information, you can proceed to complete the form accurately. This ensures that all parties involved understand the terms of the sale and helps facilitate a smooth transaction.

- Begin by entering the date at the top of the form. This marks when the agreement is being made.

- Fill in the names and addresses of both the buyer(s) and seller(s). Make sure to include full legal names to avoid any confusion.

- Specify the property address. Include the complete address, including city, state, and zip code.

- Indicate the purchase price of the property. This should be the agreed-upon amount between the buyer and seller.

- Outline the deposit amount. This is typically a percentage of the purchase price and shows the buyer's commitment.

- Detail the financing terms. If the buyer is obtaining a mortgage, include the lender's name and the loan amount.

- Include any contingencies. Common contingencies may involve inspections, financing approval, or the sale of the buyer's current home.

- Specify the closing date. This is when the ownership of the property will officially transfer from the seller to the buyer.

- Review any additional terms or conditions that need to be included. This could involve repairs, appliances, or other agreements made between the parties.

- Ensure both parties sign and date the agreement. Signatures indicate that all parties agree to the terms outlined in the document.

After completing the form, it's essential to keep a copy for your records. Ensure that all parties receive their signed copies as well, as this helps maintain transparency throughout the process. If you have any questions or need further assistance, consider consulting with a real estate professional.

Dos and Don'ts

When filling out the Connecticut Real Estate Purchase Agreement form, it's essential to be careful and thorough. Here’s a list of ten things you should and shouldn’t do:

- Do read the entire agreement carefully before you start filling it out.

- Don't leave any sections blank; ensure all required fields are completed.

- Do include accurate information about the property, including the address and legal description.

- Don't use vague language; be specific about terms and conditions.

- Do consult with a real estate agent or attorney if you have questions.

- Don't rush through the process; take your time to ensure accuracy.

- Do sign and date the agreement in the appropriate places.

- Don't forget to provide your contact information and that of the seller.

- Do keep a copy of the signed agreement for your records.

- Don't ignore deadlines; be aware of important dates mentioned in the agreement.