Fillable Connecticut Quitclaim Deed Document

When transferring property ownership in Connecticut, the Quitclaim Deed form serves as a crucial tool for individuals looking to convey their interest in real estate. This form allows a property owner, known as the grantor, to transfer their rights to another party, referred to as the grantee, without making any promises about the property's title. It is particularly useful in situations such as family transfers, divorce settlements, or when properties are gifted. The Quitclaim Deed does not guarantee that the title is free of liens or other claims, making it essential for both parties to understand the implications of this type of transfer. Additionally, the form must be filled out accurately, signed, and notarized to ensure its validity. Once completed, it should be filed with the appropriate local land records office to provide public notice of the ownership change. Understanding the Quitclaim Deed is important for anyone involved in real estate transactions in Connecticut, as it helps facilitate a smooth transfer of property rights while highlighting the need for clear communication and careful consideration of each party's interests.

Documents used along the form

When dealing with property transfers in Connecticut, the Quitclaim Deed is a crucial document. However, it often works in conjunction with several other forms and documents that help facilitate a smooth transaction. Below is a list of commonly used forms that you might encounter alongside the Quitclaim Deed.

- Property Transfer Tax Return (Form OP-236): This form is required to report the transfer of property and calculate any applicable transfer taxes. It provides the state with essential information about the transaction.

- Affidavit of Title: This document confirms that the seller has clear title to the property and that there are no outstanding liens or claims against it. It serves to protect the buyer from potential legal issues.

- Notice of Sale: This is a formal notice that informs interested parties about the sale of the property. It is particularly important in cases where the property is subject to certain legal obligations or restrictions.

- Title Search Report: A title search is conducted to verify the ownership history of the property. The report outlines any liens, encumbrances, or claims that may affect the title.

- Closing Statement: This document summarizes the financial details of the transaction, including the purchase price, closing costs, and any adjustments. It ensures that both parties are aware of their financial obligations.

- Real Estate Purchase Agreement: The Texas Documents form is essential for establishing the terms and conditions of a real estate transaction, protecting the rights of both buyers and sellers.

- Bill of Sale: While not always necessary, a Bill of Sale can accompany the Quitclaim Deed to transfer personal property associated with the real estate, such as appliances or fixtures.

- Power of Attorney: If one party is unable to be present during the transaction, a Power of Attorney allows another person to act on their behalf. This document must be properly executed to be valid.

- Certificate of Compliance: In some cases, this certificate verifies that the property complies with local zoning and building codes. It can be important for buyers to ensure they are acquiring a property that meets all legal requirements.

- Title Insurance Policy: This policy protects the buyer and lender from potential title issues that may arise after the purchase. It provides peace of mind and financial protection in the event of disputes over property ownership.

Understanding these documents can greatly enhance your experience during a property transaction. Each form plays a specific role in ensuring that the transfer is legally sound and protects the interests of all parties involved.

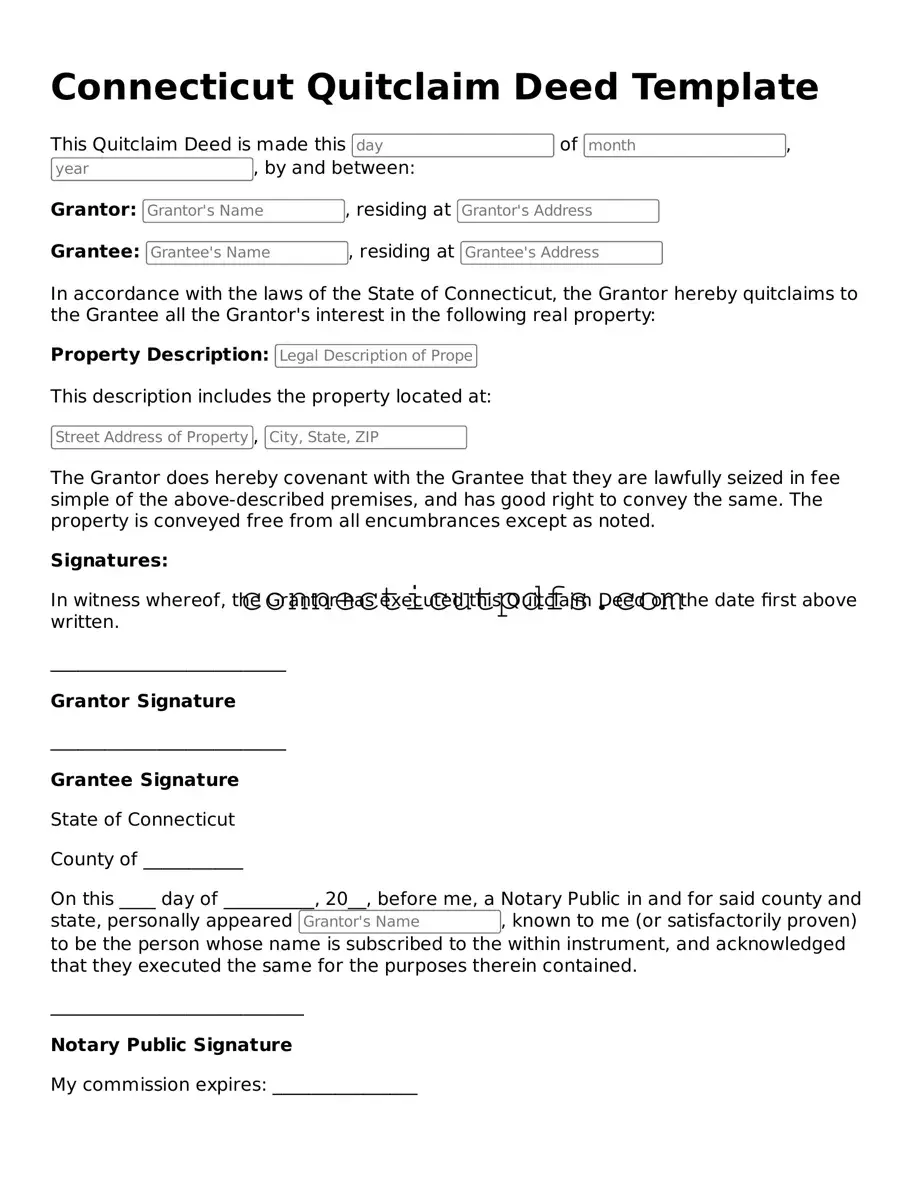

Preview - Connecticut Quitclaim Deed Form

Connecticut Quitclaim Deed Template

This Quitclaim Deed is made this of , , by and between:

Grantor: , residing at

Grantee: , residing at

In accordance with the laws of the State of Connecticut, the Grantor hereby quitclaims to the Grantee all the Grantor's interest in the following real property:

Property Description:

This description includes the property located at:

,

The Grantor does hereby covenant with the Grantee that they are lawfully seized in fee simple of the above-described premises, and has good right to convey the same. The property is conveyed free from all encumbrances except as noted.

Signatures:

In witness whereof, the Grantor has executed this Quitclaim Deed on the date first above written.

__________________________

Grantor Signature

__________________________

Grantee Signature

State of Connecticut

County of ___________

On this ____ day of __________, 20__, before me, a Notary Public in and for said county and state, personally appeared , known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

____________________________

Notary Public Signature

My commission expires: ________________

Common Questions

What is a Quitclaim Deed in Connecticut?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another in Connecticut. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title. Instead, it simply conveys whatever interest the grantor has in the property at the time of the transfer. This type of deed is often used between family members or in situations where the parties know each other well and trust that the transfer is valid.

How do I fill out a Quitclaim Deed form in Connecticut?

Filling out a Quitclaim Deed form involves several steps. First, you need to include the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Next, provide a legal description of the property, which can typically be found on the property’s tax records or previous deeds. Additionally, the form must be signed by the grantor in the presence of a notary public. Finally, once completed, the deed should be filed with the town clerk in the municipality where the property is located to make the transfer official.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. While a Quitclaim Deed transfers whatever interest the grantor has in the property without any warranties or guarantees, a Warranty Deed provides certain assurances. With a Warranty Deed, the grantor guarantees that they own the property and have the right to transfer it, and they will defend the title against any claims. This difference is crucial, especially for buyers who want assurance about the property’s title.

Do I need an attorney to prepare a Quitclaim Deed in Connecticut?

Are there any fees associated with filing a Quitclaim Deed in Connecticut?

Yes, there are fees associated with filing a Quitclaim Deed in Connecticut. The town clerk’s office typically charges a fee to record the deed, and this fee can vary by municipality. Additionally, if the property transfer involves a significant amount of money, there may be a conveyance tax. It is important to check with the local town clerk’s office for specific fee amounts and any other requirements that may apply.

Check out More Forms for Connecticut

Are Non Competes Enforceable in Ct - A non-compliance finding can impact an employee's future employment opportunities.

When completing a vehicle transaction, the essential components to consider include a properly executed Motor Vehicle Bill of Sale, which simplifies the entire process when you prepare for your transfer. Explore more about this vital document at our informative guide on the Motor Vehicle Bill of Sale.

How Long Does Probate Take in Connecticut - A Small Estate Affidavit may simplify the process for heirs who are not in close proximity to each other.

Guide to Filling Out Connecticut Quitclaim Deed

After gathering the necessary information, you are ready to fill out the Connecticut Quitclaim Deed form. This document needs to be completed accurately to ensure a smooth transfer of property ownership. Follow these steps carefully to complete the form.

- Begin by entering the date at the top of the form.

- In the section for the Grantor, write the full name of the person or entity transferring the property.

- Next, include the Grantor's address. Make sure to provide a complete address, including city, state, and ZIP code.

- In the Grantee section, write the full name of the person or entity receiving the property.

- Then, add the Grantee's address, ensuring it is complete with city, state, and ZIP code.

- Provide a description of the property being transferred. This should include the property's address and any relevant details that clearly identify it.

- Indicate the consideration amount. This is the price or value exchanged for the property, even if it is a nominal amount.

- Next, both the Grantor and Grantee must sign the form. Ensure that the signatures are dated.

- Finally, have the form notarized. A notary public will verify the identities of the signers and witness the signing.

Once the form is filled out and notarized, you can proceed with filing it with the appropriate local land records office. Make sure to keep a copy for your records.

Dos and Don'ts

When filling out the Connecticut Quitclaim Deed form, it is essential to approach the process with care. Here are seven important dos and don'ts to consider:

- Do ensure that all names are spelled correctly. Errors can lead to complications in the transfer of property.

- Do provide a complete legal description of the property. This description is crucial for accurately identifying the property being transferred.

- Do include the correct date of the transaction. This date is significant for legal and tax purposes.

- Do sign the document in the presence of a notary public. A notarized signature is often required for the deed to be valid.

- Don't leave any required fields blank. Incomplete forms can result in delays or rejection of the deed.

- Don't forget to check local recording requirements. Each county may have specific rules regarding the submission of deeds.

- Don't assume that a Quitclaim Deed is the best option for your situation. Consult with a professional if you have questions about property transfers.