Fillable Connecticut Promissory Note Document

In Connecticut, a Promissory Note serves as a vital financial instrument that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This document typically includes essential details such as the principal amount, interest rate, repayment schedule, and any provisions for default. By clearly stating the obligations of both parties, the Promissory Note helps to prevent misunderstandings and disputes. It can be tailored to suit various lending scenarios, whether for personal loans, business financing, or real estate transactions. Additionally, the form may specify collateral, if applicable, to secure the loan, providing the lender with an added layer of protection. Understanding the components and significance of the Connecticut Promissory Note is crucial for both borrowers and lenders, as it establishes a legally binding agreement that governs the repayment process and ensures clarity in financial relationships.

Documents used along the form

When dealing with a Connecticut Promissory Note, several other forms and documents may be useful to ensure clarity and legal protection for all parties involved. Here are four commonly used documents that often accompany a promissory note.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the obligations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets that back the loan. It protects the lender's interests by providing a legal claim to the collateral in case of default.

- Disclosure Statement: This document provides important information about the loan terms, including any fees, penalties, and the total cost of borrowing. It ensures that the borrower fully understands their obligations before signing the promissory note.

- Mobile Home Bill of Sale: For transactions involving mobile homes, a Mobile Home Bill of Sale form is essential to document the sale legally and protect the interests of both parties involved.

- Payment Schedule: A separate document that outlines the specific dates and amounts due for each payment. This helps both parties keep track of the payment timeline and ensures that payments are made on time.

Using these documents alongside the Connecticut Promissory Note can help clarify the terms of the loan and protect the rights of both the lender and the borrower. Always consider consulting a legal professional for guidance tailored to your specific situation.

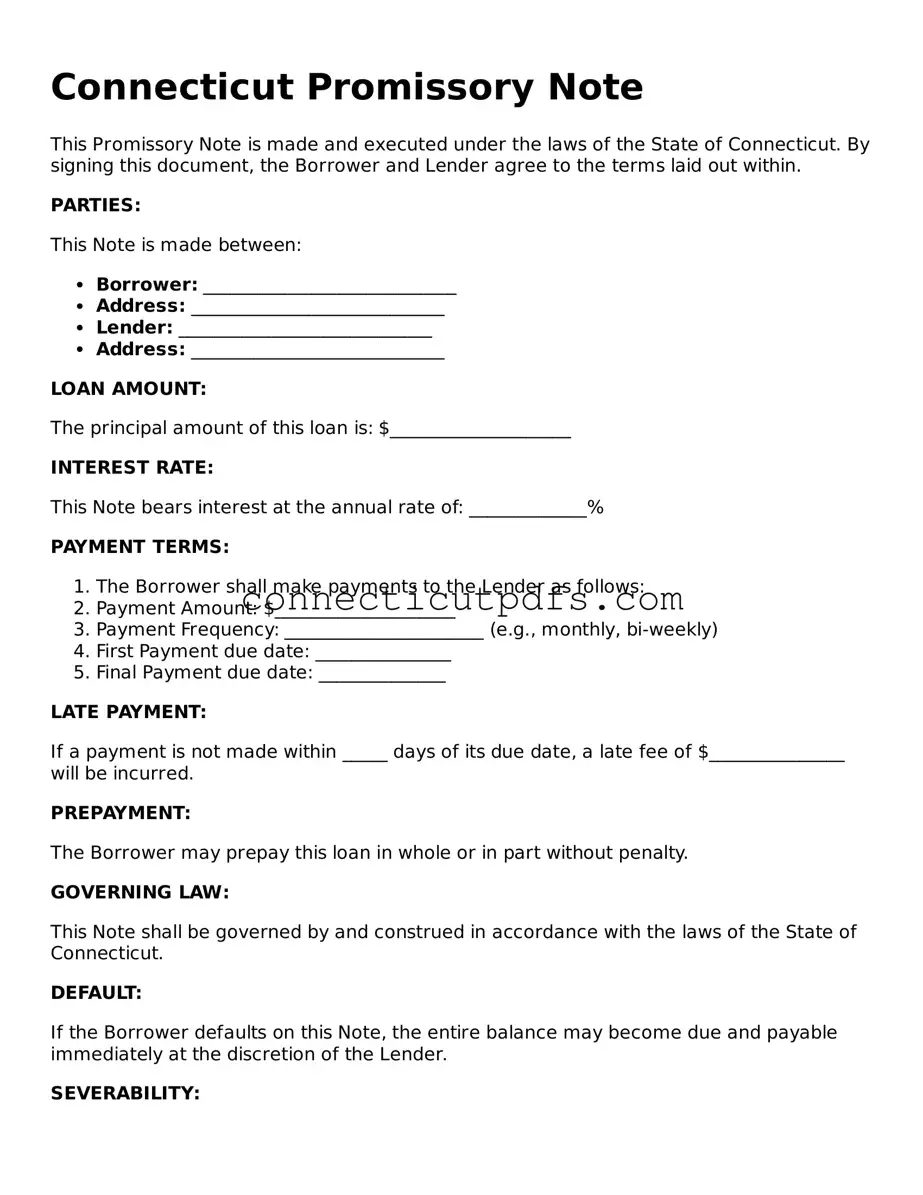

Preview - Connecticut Promissory Note Form

Connecticut Promissory Note

This Promissory Note is made and executed under the laws of the State of Connecticut. By signing this document, the Borrower and Lender agree to the terms laid out within.

PARTIES:

This Note is made between:

- Borrower: ____________________________

- Address: ____________________________

- Lender: ____________________________

- Address: ____________________________

LOAN AMOUNT:

The principal amount of this loan is: $____________________

INTEREST RATE:

This Note bears interest at the annual rate of: _____________%

PAYMENT TERMS:

- The Borrower shall make payments to the Lender as follows:

- Payment Amount: $____________________

- Payment Frequency: ______________________ (e.g., monthly, bi-weekly)

- First Payment due date: _______________

- Final Payment due date: ______________

LATE PAYMENT:

If a payment is not made within _____ days of its due date, a late fee of $_______________ will be incurred.

PREPAYMENT:

The Borrower may prepay this loan in whole or in part without penalty.

GOVERNING LAW:

This Note shall be governed by and construed in accordance with the laws of the State of Connecticut.

DEFAULT:

If the Borrower defaults on this Note, the entire balance may become due and payable immediately at the discretion of the Lender.

SEVERABILITY:

If any provision of this Note is found to be unenforceable or invalid, the remaining provisions shall continue to be valid and enforceable.

IN WITNESS WHEREOF:

The parties have executed this Promissory Note as of the ______________ day of ________________, 20__.

Borrower Signature: ____________________________

Date: ____________________________

Lender Signature: ____________________________

Date: ____________________________

Common Questions

What is a Connecticut Promissory Note?

A Connecticut Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of the loan, including the interest rate, payment schedule, and any consequences for non-payment.

Who uses a Promissory Note in Connecticut?

Individuals and businesses commonly use Promissory Notes. Lenders, such as banks or private investors, utilize these documents to formalize loans. Borrowers may include anyone needing to secure funds, whether for personal use, business expansion, or other financial needs.

What information should be included in a Connecticut Promissory Note?

A valid Promissory Note should include the following details: the names and addresses of the borrower and lender, the principal amount, the interest rate, the repayment schedule, and any late fees or penalties. Additionally, it should specify the governing law, which in this case is Connecticut law.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. Once signed by both parties, it creates an enforceable obligation for the borrower to repay the loan according to the agreed terms. If the borrower defaults, the lender can take legal action to recover the owed amount.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it is advisable, especially for larger loans or complex agreements. A lawyer can help ensure that the document complies with state laws and adequately protects the interests of both parties.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is essential to document any modifications in writing and have both parties sign the amended note to maintain its enforceability.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They can pursue legal action to recover the owed amount, initiate collection procedures, or negotiate a new payment plan. The specific actions depend on the terms outlined in the Promissory Note.

Where can I obtain a Connecticut Promissory Note form?

You can obtain a Connecticut Promissory Note form from various sources, including online legal document providers, local stationery stores, or by consulting with a legal professional. Ensure that the form you choose complies with Connecticut state laws.

Check out More Forms for Connecticut

Durable Power of Attorney Ct - By choosing this form, you can delegate responsibilities while still retaining control.

Newington Gun Exchange - The document may have a section to note any conditions of sale or warranties given.

The Texas RV Bill of Sale form is not only essential for transferring ownership of recreational vehicles in Texas, but it also ensures a smooth transaction by minimizing misunderstandings between buyers and sellers. For those looking to fill out this important document, you can find the necessary template at Texas Documents, making it easier to complete your RV deal with confidence.

Power of Attorney Form Connecticut - Families can benefit from having this document to navigate complex medical and financial landscapes.

Guide to Filling Out Connecticut Promissory Note

Once you have gathered all the necessary information, you can proceed to fill out the Connecticut Promissory Note form. This document will outline the terms of the loan agreement between the borrower and the lender. Completing it accurately is crucial for ensuring clarity and legal enforceability.

- Obtain the Form: Download the Connecticut Promissory Note form from a reliable source or obtain a hard copy from a legal office.

- Identify the Parties: Fill in the names and addresses of both the borrower and the lender at the top of the form.

- Loan Amount: Clearly state the total amount of money being borrowed.

- Interest Rate: Specify the interest rate that will apply to the loan. Ensure this is in compliance with state laws.

- Payment Terms: Indicate how and when payments will be made, including the payment frequency (monthly, quarterly, etc.) and the due date.

- Maturity Date: Write the date when the loan will be fully repaid.

- Signatures: Both the borrower and the lender must sign and date the form to make it legally binding.

- Witness or Notary: Depending on your needs, consider having a witness or notary public sign the document for added legal protection.

After completing the form, make copies for both parties. This ensures that everyone has a record of the agreement. Store the original document in a safe place, as it may be needed in the future for reference or legal purposes.

Dos and Don'ts

When filling out the Connecticut Promissory Note form, it is essential to follow certain guidelines to ensure accuracy and legality. Below is a list of things to do and avoid during this process.

- Do read the entire form carefully before beginning.

- Do provide accurate information regarding the borrower and lender.

- Do specify the loan amount clearly.

- Do include the interest rate, if applicable.

- Do outline the repayment schedule in detail.

- Don't leave any sections blank unless instructed.

- Don't use ambiguous language that could lead to misunderstandings.

- Don't forget to date and sign the document.

- Don't overlook the need for witnesses or notarization, if required.