Fillable Connecticut Operating Agreement Document

When establishing a limited liability company (LLC) in Connecticut, one of the most important documents to consider is the Operating Agreement form. This form serves as the foundational framework for how your LLC will operate, detailing the roles and responsibilities of its members, the management structure, and the distribution of profits and losses. It outlines the decision-making processes and procedures for adding or removing members, ensuring clarity and stability as the business grows. Additionally, the Operating Agreement addresses what happens in the event of a member's departure or the dissolution of the company, providing essential guidelines to navigate these situations smoothly. While Connecticut law does not mandate an Operating Agreement, having one in place is highly advisable, as it helps protect your personal assets and minimizes disputes among members. By clearly defining the operational aspects of your LLC, this document fosters a cooperative environment and sets the stage for successful business operations.

Documents used along the form

When forming a Limited Liability Company (LLC) in Connecticut, the Operating Agreement is a crucial document. However, there are several other forms and documents that often accompany it to ensure compliance and clarity in the operation of the business. Below is a list of these essential documents.

- Articles of Organization: This is the foundational document that officially creates the LLC. It includes basic information such as the company name, address, and the registered agent's details.

- Bill of Sale: For those looking to secure their sale or purchase, filling out a Bill of Sale form is a step in the right direction.

- Employer Identification Number (EIN): Issued by the IRS, this number is essential for tax purposes and is required if the LLC has employees or multiple members.

- Membership Certificates: These documents serve as proof of ownership for members of the LLC. They outline each member's percentage of ownership and can be important for internal records.

- Initial Resolutions: These are formal decisions made by the members at the inception of the LLC. They may cover topics such as the appointment of officers or the opening of bank accounts.

- Bylaws: While not always required, bylaws outline the internal rules and procedures for the LLC. They can cover meetings, voting rights, and other operational guidelines.

- Annual Reports: Connecticut requires LLCs to file an annual report. This document updates the state on the company's status, including any changes in management or address.

- Operating Agreement Amendments: If changes occur in the structure or management of the LLC, amendments to the Operating Agreement may be necessary. These documents ensure that the agreement remains current and reflects the members' intentions.

Understanding these documents and their roles can help streamline the formation and management of your LLC in Connecticut. Each document plays a vital role in ensuring that your business operates smoothly and in compliance with state regulations.

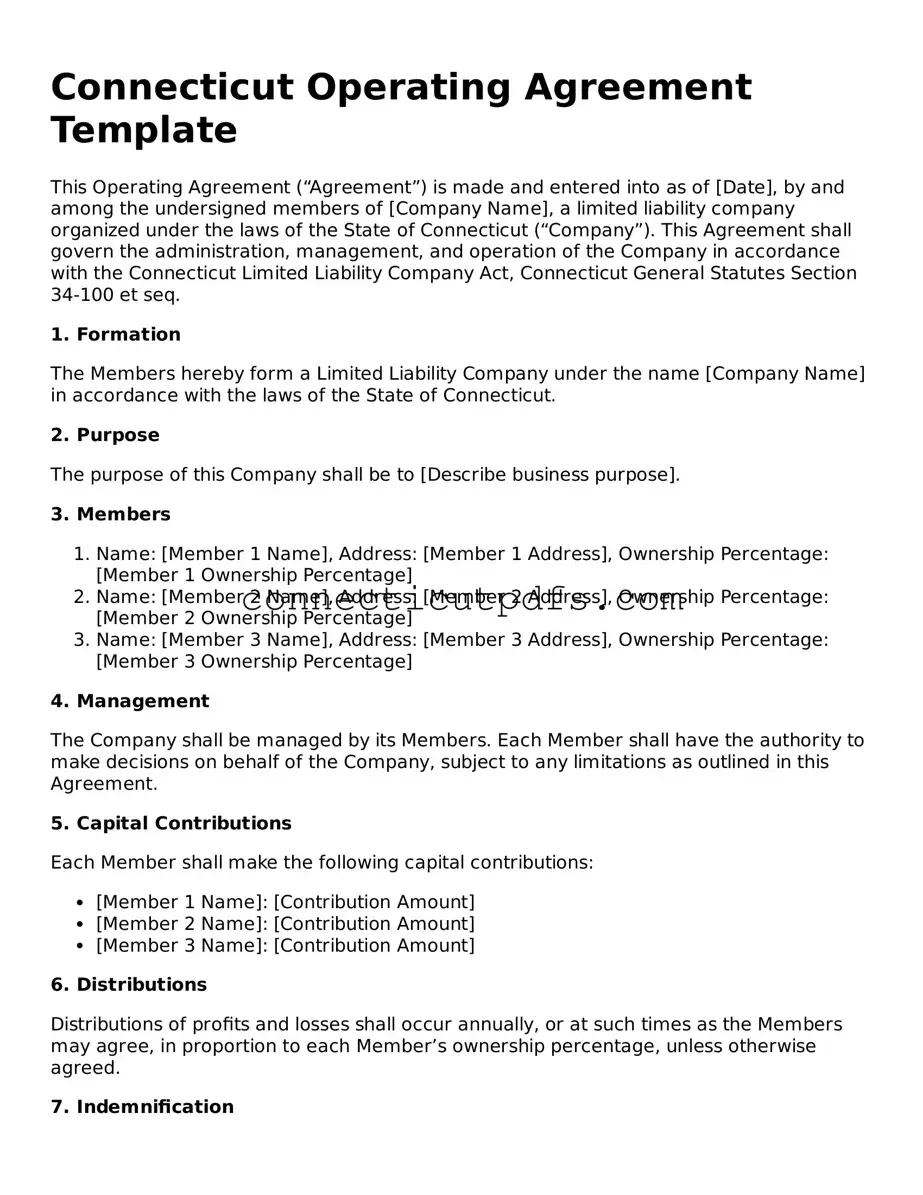

Preview - Connecticut Operating Agreement Form

Connecticut Operating Agreement Template

This Operating Agreement (“Agreement”) is made and entered into as of [Date], by and among the undersigned members of [Company Name], a limited liability company organized under the laws of the State of Connecticut (“Company”). This Agreement shall govern the administration, management, and operation of the Company in accordance with the Connecticut Limited Liability Company Act, Connecticut General Statutes Section 34-100 et seq.

1. Formation

The Members hereby form a Limited Liability Company under the name [Company Name] in accordance with the laws of the State of Connecticut.

2. Purpose

The purpose of this Company shall be to [Describe business purpose].

3. Members

- Name: [Member 1 Name], Address: [Member 1 Address], Ownership Percentage: [Member 1 Ownership Percentage]

- Name: [Member 2 Name], Address: [Member 2 Address], Ownership Percentage: [Member 2 Ownership Percentage]

- Name: [Member 3 Name], Address: [Member 3 Address], Ownership Percentage: [Member 3 Ownership Percentage]

4. Management

The Company shall be managed by its Members. Each Member shall have the authority to make decisions on behalf of the Company, subject to any limitations as outlined in this Agreement.

5. Capital Contributions

Each Member shall make the following capital contributions:

- [Member 1 Name]: [Contribution Amount]

- [Member 2 Name]: [Contribution Amount]

- [Member 3 Name]: [Contribution Amount]

6. Distributions

Distributions of profits and losses shall occur annually, or at such times as the Members may agree, in proportion to each Member’s ownership percentage, unless otherwise agreed.

7. Indemnification

The Company shall indemnify its Members and manage members to the fullest extent permitted by Connecticut law against any and all expenses and liabilities reasonably incurred in connection with the Company.

8. Amendments

This Agreement may be amended only by a written agreement signed by all Members.

9. Governing Law

This Agreement shall be governed by the laws of the State of Connecticut.

10. Additional Provisions

Any additional provisions agreed upon by the Members may be added here:

[Insert Additional Provisions]

IN WITNESS WHEREOF, the undersigned Members have executed this Operating Agreement as of the date first above written.

_________________________

[Member 1 Name]

_________________________

[Member 2 Name]

_________________________

[Member 3 Name]

Common Questions

What is a Connecticut Operating Agreement?

A Connecticut Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC) in Connecticut. It serves as a foundational agreement among members, detailing their rights, responsibilities, and the rules governing the LLC.

Is an Operating Agreement required in Connecticut?

While Connecticut does not legally require LLCs to have an Operating Agreement, it is highly recommended. Having this document in place can help prevent disputes among members and provide clarity regarding the management of the business.

What should be included in the Operating Agreement?

An Operating Agreement should include several key components, such as the LLC's name and address, the purpose of the business, member contributions, profit and loss distribution, management structure, and procedures for adding or removing members. It may also address how decisions are made and what happens if a member leaves the LLC.

Can I change the Operating Agreement after it is created?

Yes, the Operating Agreement can be amended after it is created. Any changes should be documented in writing and agreed upon by all members. This ensures that everyone is on the same page regarding the rules and procedures of the LLC.

How does an Operating Agreement protect members?

The Operating Agreement protects members by clearly outlining their rights and responsibilities. It helps prevent misunderstandings and disputes by providing a framework for decision-making and conflict resolution. Additionally, it reinforces the limited liability status of the LLC, which can protect personal assets from business liabilities.

Do I need a lawyer to draft my Operating Agreement?

While it is not mandatory to hire a lawyer, it is advisable, especially if your LLC has multiple members or complex operations. A legal professional can ensure that the Operating Agreement complies with state laws and adequately addresses the specific needs of your business.

How is the Operating Agreement executed?

The Operating Agreement is executed when all members sign the document. It is important to keep a copy of the signed agreement with the LLC's records. This ensures that all members have access to the agreed-upon terms and can refer to them as needed.

Where can I find a template for a Connecticut Operating Agreement?

Templates for Connecticut Operating Agreements can be found online through various legal websites or resources. However, it is essential to customize any template to fit the specific needs of your LLC and to ensure compliance with Connecticut laws.

Check out More Forms for Connecticut

Warranty Deed Connecticut - A deed is a legal document that formally conveys property ownership.

When engaging in the purchase or sale of a recreational vehicle, it is essential to utilize the Texas RV Bill of Sale form, which ensures a smooth and legally binding transfer of ownership in Texas. To obtain this important document, visit Texas Documents for a convenient solution that protects the interests of both parties involved in the transaction.

How Long Does Probate Take in Connecticut - This document allows heirs to claim property and assets more efficiently, easing the burden of the estate process.

Guide to Filling Out Connecticut Operating Agreement

Completing the Connecticut Operating Agreement form is a straightforward process that requires careful attention to detail. Once you have filled out the form, you will be ready to finalize your business structure and ensure all members are in agreement regarding the operation of the business.

- Obtain the Connecticut Operating Agreement form from the appropriate state website or legal resource.

- Begin by entering the name of your business at the top of the form. Ensure that the name matches the registered name with the state.

- Provide the principal address of the business. This should be a physical address where the business operates.

- List the names and addresses of all members involved in the business. Each member’s information must be accurate and complete.

- Specify the percentage of ownership for each member. This indicates how profits and losses will be distributed.

- Detail the management structure of the business. Indicate whether it will be member-managed or manager-managed.

- Outline the voting rights of each member. Clearly state how decisions will be made within the business.

- Include any additional provisions that are relevant to your business operations. This may cover topics such as profit distribution, meetings, or dispute resolution.

- Review the completed form for accuracy and completeness. Ensure that all necessary information is provided.

- Have all members sign the form to indicate their agreement to the terms outlined. Collect signatures in a manner that ensures all members are present or have consented.

Dos and Don'ts

When filling out the Connecticut Operating Agreement form, there are several important considerations to keep in mind. Here is a list of things to do and avoid during the process:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about all members of the LLC.

- Do include the date when the agreement is being signed.

- Do specify the management structure of the LLC clearly.

- Don't leave any sections blank; if a section does not apply, indicate that clearly.

- Don't use vague language; be specific about the roles and responsibilities of members.

- Don't forget to have all members sign the agreement to make it valid.

By following these guidelines, you can help ensure that your Operating Agreement is filled out correctly and meets the requirements set forth by the state of Connecticut.