Fillable Connecticut Last Will and Testament Document

Creating a Last Will and Testament is an essential step for anyone wanting to ensure their wishes are honored after they pass away. In Connecticut, this legal document serves several important purposes, including the distribution of assets, the appointment of guardians for minor children, and the designation of an executor to manage the estate. The form allows individuals to specify who will receive their property, whether it's family members, friends, or charitable organizations. Additionally, it provides clarity on how debts and taxes should be settled, helping to avoid potential disputes among heirs. Understanding the key components of the Connecticut Last Will and Testament form is crucial, as it not only reflects personal intentions but also adheres to state laws to ensure its validity. By taking the time to create a comprehensive will, individuals can provide peace of mind for themselves and their loved ones, knowing that their affairs will be handled according to their wishes.

Documents used along the form

When preparing a Last Will and Testament in Connecticut, several other forms and documents may be necessary to ensure a comprehensive estate plan. Each of these documents serves a specific purpose and can help clarify your intentions and protect your assets.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated.

- Healthcare Proxy: Designate an individual to make medical decisions on your behalf if you are unable to communicate your wishes.

- Living Will: This document outlines your preferences for medical treatment and end-of-life care, guiding your healthcare proxy and medical providers.

- Revocable Trust: A trust that can be altered or revoked during your lifetime, allowing for the management and distribution of your assets while avoiding probate.

- Affidavit of Heirship: Used to establish the heirs of a deceased person when there is no will, helping to clarify the distribution of assets.

- Beneficiary Designations: Forms that specify who will receive certain assets, like life insurance policies or retirement accounts, bypassing probate.

- Pet Trust: A legal arrangement that ensures your pets are cared for according to your wishes after your passing.

- Letter of Intent: A non-binding document that provides guidance to your executor or loved ones about your wishes regarding your estate.

- Business Registration: To legally establish your entity, ensure you complete the Business Registration Form, as it outlines the foundational details required for your corporation in Illinois.

- Guardianship Designation: This document allows you to name a guardian for your minor children in the event of your death or incapacitation.

By considering these documents alongside your Last Will and Testament, you can create a more robust and effective estate plan. It is essential to ensure that your wishes are clearly articulated and legally binding to avoid confusion and disputes among your loved ones.

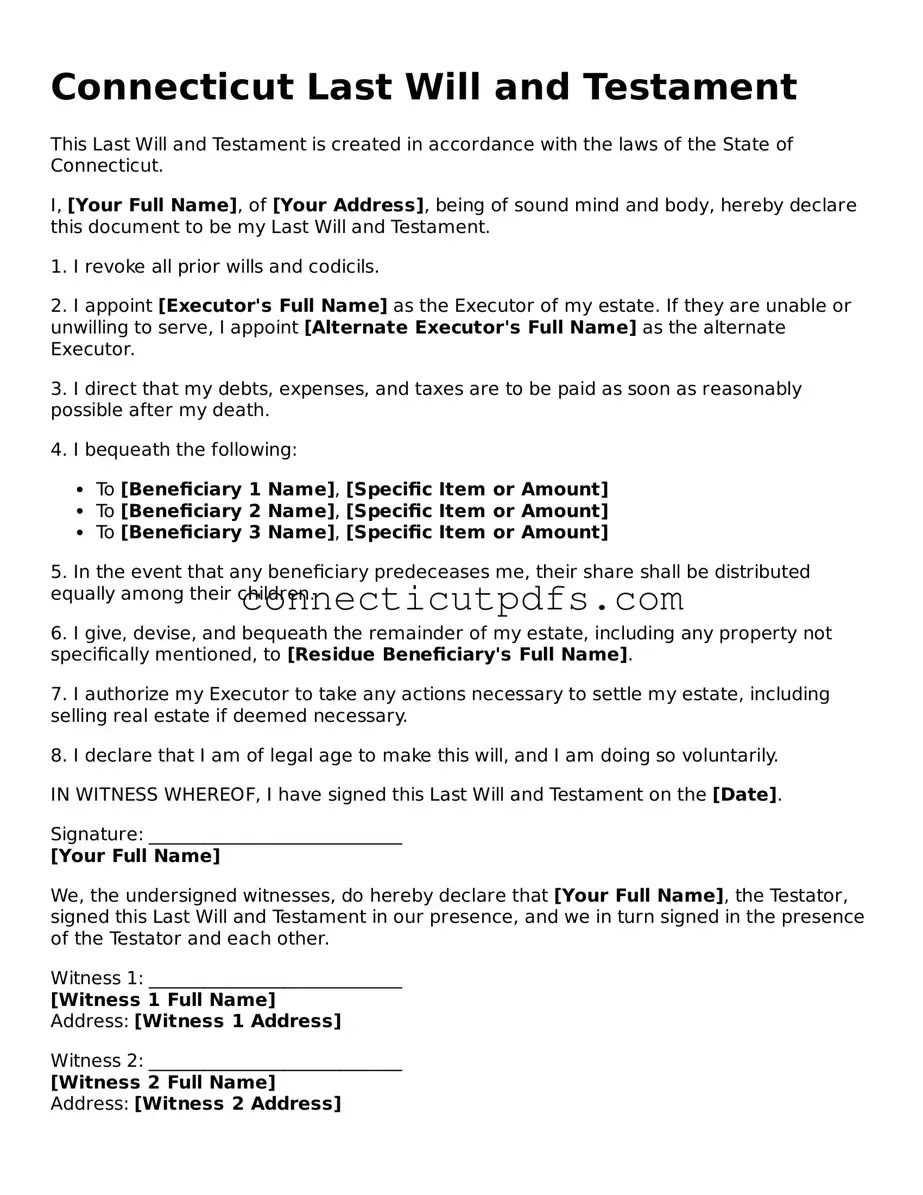

Preview - Connecticut Last Will and Testament Form

Connecticut Last Will and Testament

This Last Will and Testament is created in accordance with the laws of the State of Connecticut.

I, [Your Full Name], of [Your Address], being of sound mind and body, hereby declare this document to be my Last Will and Testament.

1. I revoke all prior wills and codicils.

2. I appoint [Executor's Full Name] as the Executor of my estate. If they are unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

3. I direct that my debts, expenses, and taxes are to be paid as soon as reasonably possible after my death.

4. I bequeath the following:

- To [Beneficiary 1 Name], [Specific Item or Amount]

- To [Beneficiary 2 Name], [Specific Item or Amount]

- To [Beneficiary 3 Name], [Specific Item or Amount]

5. In the event that any beneficiary predeceases me, their share shall be distributed equally among their children.

6. I give, devise, and bequeath the remainder of my estate, including any property not specifically mentioned, to [Residue Beneficiary's Full Name].

7. I authorize my Executor to take any actions necessary to settle my estate, including selling real estate if deemed necessary.

8. I declare that I am of legal age to make this will, and I am doing so voluntarily.

IN WITNESS WHEREOF, I have signed this Last Will and Testament on the [Date].

Signature: ____________________________

[Your Full Name]

We, the undersigned witnesses, do hereby declare that [Your Full Name], the Testator, signed this Last Will and Testament in our presence, and we in turn signed in the presence of the Testator and each other.

Witness 1: ____________________________

[Witness 1 Full Name]

Address: [Witness 1 Address]

Witness 2: ____________________________

[Witness 2 Full Name]

Address: [Witness 2 Address]

Common Questions

What is a Last Will and Testament in Connecticut?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs will be handled after their death. In Connecticut, this document allows individuals to specify beneficiaries, appoint guardians for minor children, and designate an executor to manage the estate. It ensures that your wishes are followed and can help avoid disputes among family members.

What are the requirements for creating a valid Last Will and Testament in Connecticut?

To create a valid Last Will and Testament in Connecticut, the individual must be at least 18 years old and of sound mind. The will must be in writing and signed by the testator (the person making the will). Additionally, it must be witnessed by at least two individuals who are present at the same time. These witnesses cannot be beneficiaries of the will to avoid conflicts of interest.

Can I change or revoke my Last Will and Testament in Connecticut?

Yes, you can change or revoke your Last Will and Testament at any time while you are alive, as long as you are of sound mind. To make changes, you can create a new will that explicitly revokes the previous one or add a codicil, which is an amendment to the existing will. It's essential to follow the same signing and witnessing requirements to ensure that the changes are legally valid.

What happens if I die without a Last Will and Testament in Connecticut?

If you die without a will, you are considered to have died "intestate." In this case, Connecticut law dictates how your assets will be distributed. Generally, your estate will be divided among your surviving relatives, starting with your spouse and children. If there are no immediate family members, the estate may go to more distant relatives or, in some cases, to the state. This process can lead to delays and disputes, making it advisable to have a will in place.

How can I ensure my Last Will and Testament is properly executed?

To ensure your Last Will and Testament is properly executed, follow the legal requirements closely. Have the document signed in the presence of at least two witnesses, and ensure they are not beneficiaries. It is also beneficial to store the will in a safe place, such as a safe deposit box or with an attorney, and inform your executor of its location. Regularly review and update the will as needed to reflect any changes in your circumstances or wishes.

Check out More Forms for Connecticut

Quitclaim Deed Form Connecticut - Quitclaim Deeds are often used in gift transactions between family members.

What Is a Hold Harmless Letter - This form can provide peace of mind for individuals engaging in high-risk activities.

When renting a property in New York, having a comprehensive understanding of the terms outlined in a Lease Agreement form is essential, as it serves as a legally binding contract between the landlord and tenant, ensuring clarity and compliance from both parties. For more details, you can refer to the Lease Agreement form, which highlights the crucial elements involved in the rental process.

Connecticut Bill of Sale - A handy form to record the sale, making it beneficial for future reference.

Guide to Filling Out Connecticut Last Will and Testament

After gathering all necessary information, you can begin filling out the Connecticut Last Will and Testament form. Ensure that all details are accurate and complete to avoid any issues in the future.

- Begin by entering your full name at the top of the form.

- Provide your address, including city, state, and zip code.

- Specify the date on which you are completing the will.

- Identify your beneficiaries. List their full names and relationships to you.

- Designate an executor. This person will be responsible for managing your estate after your passing. Include their full name and contact information.

- Detail any specific gifts you wish to leave to your beneficiaries. Be clear about what items or amounts of money are designated for each individual.

- Outline how you would like the remainder of your estate to be distributed after specific gifts have been made.

- Sign and date the form in the presence of witnesses. Connecticut law requires at least two witnesses.

- Have your witnesses sign the form, including their names and addresses.

Once you have completed the form, store it in a safe place. Inform your executor and close family members about the location of the will. This will help ensure that your wishes are honored when the time comes.

Dos and Don'ts

When filling out the Connecticut Last Will and Testament form, it's important to follow certain guidelines to ensure that your wishes are clearly expressed and legally valid. Here’s a helpful list of things you should and shouldn't do:

- Do clearly state your full name and address at the beginning of the document.

- Do designate an executor who will be responsible for carrying out the terms of your will.

- Do list all your assets and how you wish to distribute them among your beneficiaries.

- Do sign and date the will in the presence of at least two witnesses, who should also sign it.

- Don't use ambiguous language that could lead to confusion about your intentions.

- Don't forget to update your will if your circumstances change, such as marriage, divorce, or the birth of a child.

- Don't attempt to fill out the form without understanding the legal requirements in Connecticut.

- Don't leave out important details, such as the names of your beneficiaries or specific bequests.

By following these guidelines, you can help ensure that your Last Will and Testament accurately reflects your wishes and stands up to legal scrutiny.