Fillable Connecticut Durable Power of Attorney Document

In Connecticut, a Durable Power of Attorney (DPOA) serves as a crucial legal document that empowers individuals to designate someone they trust to make financial and legal decisions on their behalf, particularly in the event that they become incapacitated. This form is not just a simple authorization; it remains effective even if the individual becomes unable to manage their affairs due to illness or injury. The DPOA can cover a wide range of decisions, from managing bank accounts and paying bills to handling real estate transactions and filing taxes. Importantly, the individual granting this power, known as the principal, can specify the extent of authority granted, allowing for tailored arrangements that reflect personal preferences and needs. Additionally, the DPOA must be signed and witnessed according to Connecticut law to ensure its validity, providing peace of mind that the designated agent can act when necessary. Understanding the nuances of this form is essential for anyone looking to safeguard their interests and ensure that their wishes are honored during challenging times.

Documents used along the form

When establishing a Connecticut Durable Power of Attorney, it is essential to consider several other forms and documents that can complement this important legal tool. Each of these documents serves a unique purpose and can help ensure that your wishes are respected and your affairs are managed according to your preferences.

- Advance Healthcare Directive: This document outlines your medical treatment preferences in the event you become unable to communicate your wishes. It allows you to appoint a healthcare agent and specify your desires regarding life-sustaining treatments.

- Living Will: A living will is a specific type of advance directive that details your wishes regarding medical care and end-of-life decisions. It provides guidance to healthcare providers and loved ones about your treatment preferences.

- RV Bill of Sale: The Texas Documents form is important for transferring ownership of recreational vehicles, protecting both buyer and seller by detailing the terms of the transaction.

- HIPAA Authorization: This form allows you to authorize certain individuals to access your medical records and health information. It is crucial for ensuring that your healthcare agent can make informed decisions on your behalf.

- Revocation of Power of Attorney: If you ever wish to cancel or change your Durable Power of Attorney, this document serves as a formal notice. It is important to communicate your decision to all parties involved, including your appointed agent.

- Financial Power of Attorney: While a Durable Power of Attorney can address financial matters, a separate financial power of attorney may be necessary for specific transactions or to grant broader powers to your agent.

- Will: A will is a legal document that outlines how you want your assets distributed after your death. It can work alongside your Durable Power of Attorney to ensure that both your financial and healthcare wishes are honored.

Understanding these documents and their functions is vital for anyone looking to establish a comprehensive plan for their future. Taking the time to prepare and organize these forms can provide peace of mind and clarity for both you and your loved ones.

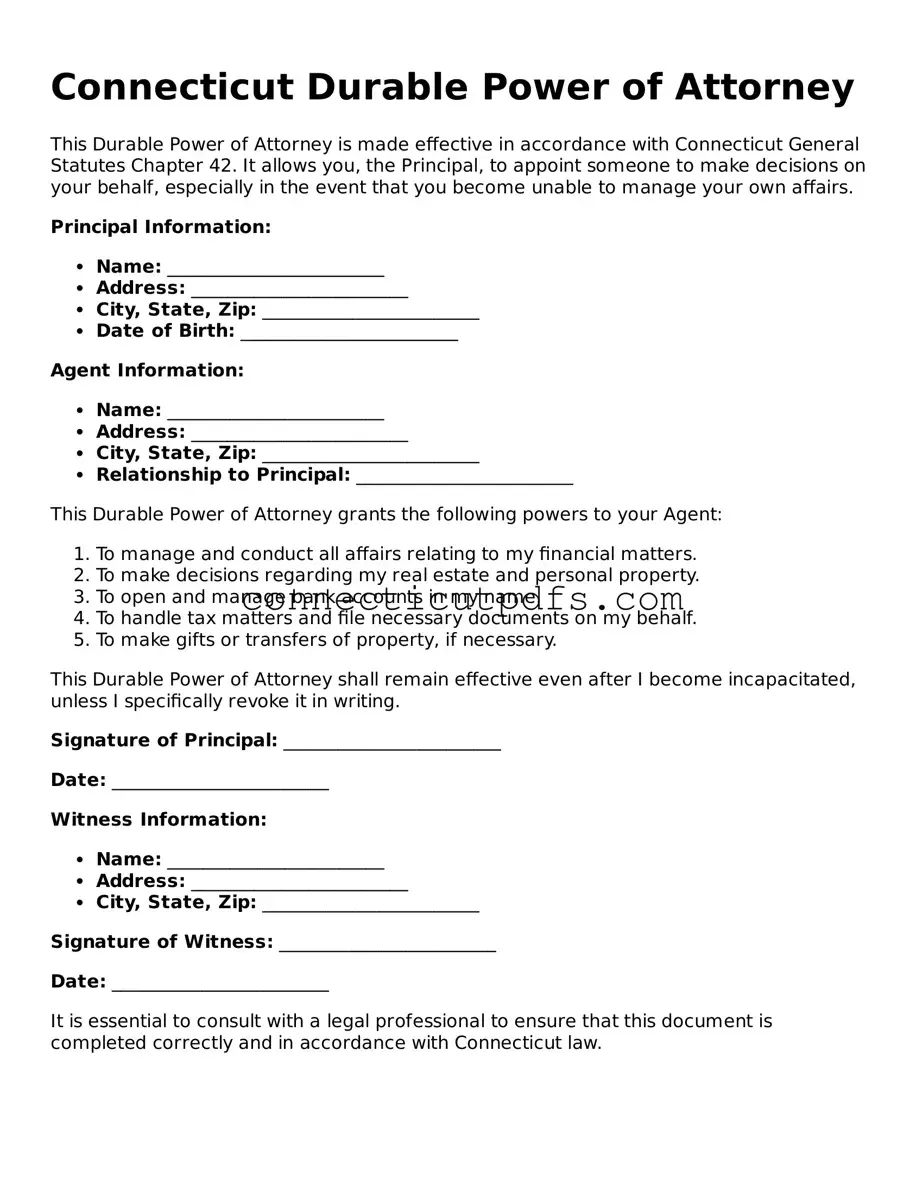

Preview - Connecticut Durable Power of Attorney Form

Connecticut Durable Power of Attorney

This Durable Power of Attorney is made effective in accordance with Connecticut General Statutes Chapter 42. It allows you, the Principal, to appoint someone to make decisions on your behalf, especially in the event that you become unable to manage your own affairs.

Principal Information:

- Name: ________________________

- Address: ________________________

- City, State, Zip: ________________________

- Date of Birth: ________________________

Agent Information:

- Name: ________________________

- Address: ________________________

- City, State, Zip: ________________________

- Relationship to Principal: ________________________

This Durable Power of Attorney grants the following powers to your Agent:

- To manage and conduct all affairs relating to my financial matters.

- To make decisions regarding my real estate and personal property.

- To open and manage bank accounts in my name.

- To handle tax matters and file necessary documents on my behalf.

- To make gifts or transfers of property, if necessary.

This Durable Power of Attorney shall remain effective even after I become incapacitated, unless I specifically revoke it in writing.

Signature of Principal: ________________________

Date: ________________________

Witness Information:

- Name: ________________________

- Address: ________________________

- City, State, Zip: ________________________

Signature of Witness: ________________________

Date: ________________________

It is essential to consult with a legal professional to ensure that this document is completed correctly and in accordance with Connecticut law.

Common Questions

What is a Durable Power of Attorney in Connecticut?

A Durable Power of Attorney is a legal document that allows you to appoint someone to make financial and legal decisions on your behalf. This authority remains in effect even if you become incapacitated. It is an essential tool for managing your affairs when you are unable to do so yourself.

Who can be appointed as an agent in a Durable Power of Attorney?

You can choose any competent adult as your agent, also known as an attorney-in-fact. This person should be someone you trust, as they will have the authority to handle your financial matters. It is advisable to discuss your intentions with them beforehand.

How does a Durable Power of Attorney differ from a regular Power of Attorney?

The key difference lies in durability. A regular Power of Attorney becomes invalid if you become incapacitated, while a Durable Power of Attorney remains effective even in such situations. This makes the Durable version particularly useful for long-term planning.

Do I need to have a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer, consulting one can be beneficial. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. This can prevent potential disputes or misunderstandings in the future.

What powers can I grant to my agent?

You can grant your agent a wide range of powers, including managing bank accounts, paying bills, buying or selling property, and making investment decisions. You can specify the powers you want to include or exclude in the document, giving you control over what your agent can do.

How do I revoke a Durable Power of Attorney?

If you decide to revoke a Durable Power of Attorney, you must do so in writing. It is important to notify your agent and any institutions or individuals who may have relied on the document. This ensures that your revocation is effective and recognized.

Does a Durable Power of Attorney need to be notarized?

Yes, in Connecticut, a Durable Power of Attorney must be signed in the presence of a notary public. This adds a layer of authenticity and helps prevent fraud. It is also advisable to have witnesses present, although they are not required by law.

Can I use a Durable Power of Attorney for healthcare decisions?

No, a Durable Power of Attorney is specifically for financial and legal matters. For healthcare decisions, you need a separate document called a Health Care Proxy or Advance Directive. This document allows you to appoint someone to make medical decisions on your behalf.

What happens if my agent cannot serve or is unavailable?

If your chosen agent is unable or unwilling to serve, the Durable Power of Attorney may name an alternate agent. If no alternate is designated, a court may need to appoint someone to act on your behalf, which can be a lengthy process.

Is a Durable Power of Attorney valid in other states?

A Durable Power of Attorney created in Connecticut may be recognized in other states, but it is wise to check the specific laws of those states. Some states have their own requirements, and having a local attorney review your document can help ensure its validity elsewhere.

Check out More Forms for Connecticut

Quitclaim Deed Form Connecticut - This deed does not release the grantor from any liabilities.

For anyone navigating vehicle transfers, understanding the complete process around a Motor Vehicle Bill of Sale template is vital. This document not only secures the sale but also provides peace of mind to both parties involved.

Free Connecticut Will Template - Can clarify funeral and burial wishes to alleviate confusion for survivors.

Guide to Filling Out Connecticut Durable Power of Attorney

Filling out the Connecticut Durable Power of Attorney form is an important step in ensuring that your financial and legal affairs can be managed according to your wishes should you become unable to do so yourself. Following the steps below will help you complete the form accurately.

- Obtain the Connecticut Durable Power of Attorney form. You can find it online or at legal offices.

- Carefully read the instructions that accompany the form. Understanding the requirements will help you fill it out correctly.

- Begin by providing your full name and address in the designated sections at the top of the form.

- Identify the person you are appointing as your agent. This should include their full name and address as well.

- Clearly outline the powers you wish to grant to your agent. Be specific about the decisions they can make on your behalf.

- If desired, you can include any limitations or specific instructions regarding the authority you are granting.

- Sign and date the form in the appropriate section. Your signature indicates your consent to the terms outlined.

- Have the form witnessed by at least one person, as required by Connecticut law. The witness should also sign and date the form.

- Consider having the form notarized for added legal strength, although this is not mandatory.

- Keep a copy of the completed form for your records and provide copies to your agent and any relevant institutions.

Dos and Don'ts

When completing the Connecticut Durable Power of Attorney form, it is essential to follow certain guidelines to ensure that the document is valid and effective. Below is a list of things to do and avoid during this process.

Things You Should Do:

- Clearly identify the principal, who is the person granting the power.

- Designate an agent, specifying their full name and contact information.

- Include a specific date or condition under which the power becomes effective.

- Sign the document in the presence of a notary public to ensure its legality.

- Discuss your intentions with the agent to ensure they understand their responsibilities.

Things You Shouldn't Do:

- Do not leave any sections of the form blank, as this can lead to confusion or invalidation.

- Avoid using vague language that may lead to misinterpretation of your intentions.

- Do not forget to keep a copy of the signed document for your records.

- Refrain from naming multiple agents without clear instructions on how they should act together.