Fillable Connecticut Deed Document

In Connecticut, the deed form plays a crucial role in the transfer of property ownership, serving as a legal document that outlines the specifics of a real estate transaction. This form typically includes essential details such as the names of the buyer and seller, a description of the property being conveyed, and any applicable terms or conditions of the sale. Additionally, the deed must be signed by the grantor, the person transferring the property, and may require notarization to ensure its validity. Understanding the different types of deeds available in Connecticut—such as warranty deeds, quitclaim deeds, and special warranty deeds—can help individuals choose the right one for their needs. Each type has its own implications regarding the guarantees made by the seller about the property's title. Properly completing and filing the deed is vital, as it not only facilitates a smooth transfer but also protects the interests of both parties involved in the transaction.

Documents used along the form

When dealing with property transactions in Connecticut, several forms and documents accompany the Deed form. Each of these documents serves a specific purpose in ensuring a smooth transfer of ownership and compliance with state regulations.

- Property Transfer Tax Return: This document is required to report the sale of the property to the state. It helps calculate any transfer taxes owed based on the property's sale price.

- RV Bill of Sale: For those dealing with recreational vehicles, it's important to utilize a Bill of Sale specific to RVs. The Texas RV Bill of Sale form is available for use and can be accessed at billofsaleforvehicles.com/editable-texas-rv-bill-of-sale/.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and that there are no undisclosed liens or claims against it. It provides assurance to the buyer regarding the title's status.

- Title Insurance Policy: This insurance protects the buyer and lender against potential defects in the title that may arise after the purchase. It ensures that the buyer has clear ownership of the property.

- Bill of Sale: In some cases, a Bill of Sale is necessary for personal property included in the transaction. This document formally transfers ownership of items such as appliances or furniture.

- Closing Statement: Also known as a HUD-1 Settlement Statement, this document outlines all financial aspects of the transaction. It details the costs, fees, and credits involved in the closing process.

Understanding these documents is crucial for anyone involved in a property transaction. They help protect your interests and ensure that the transfer process is legally sound.

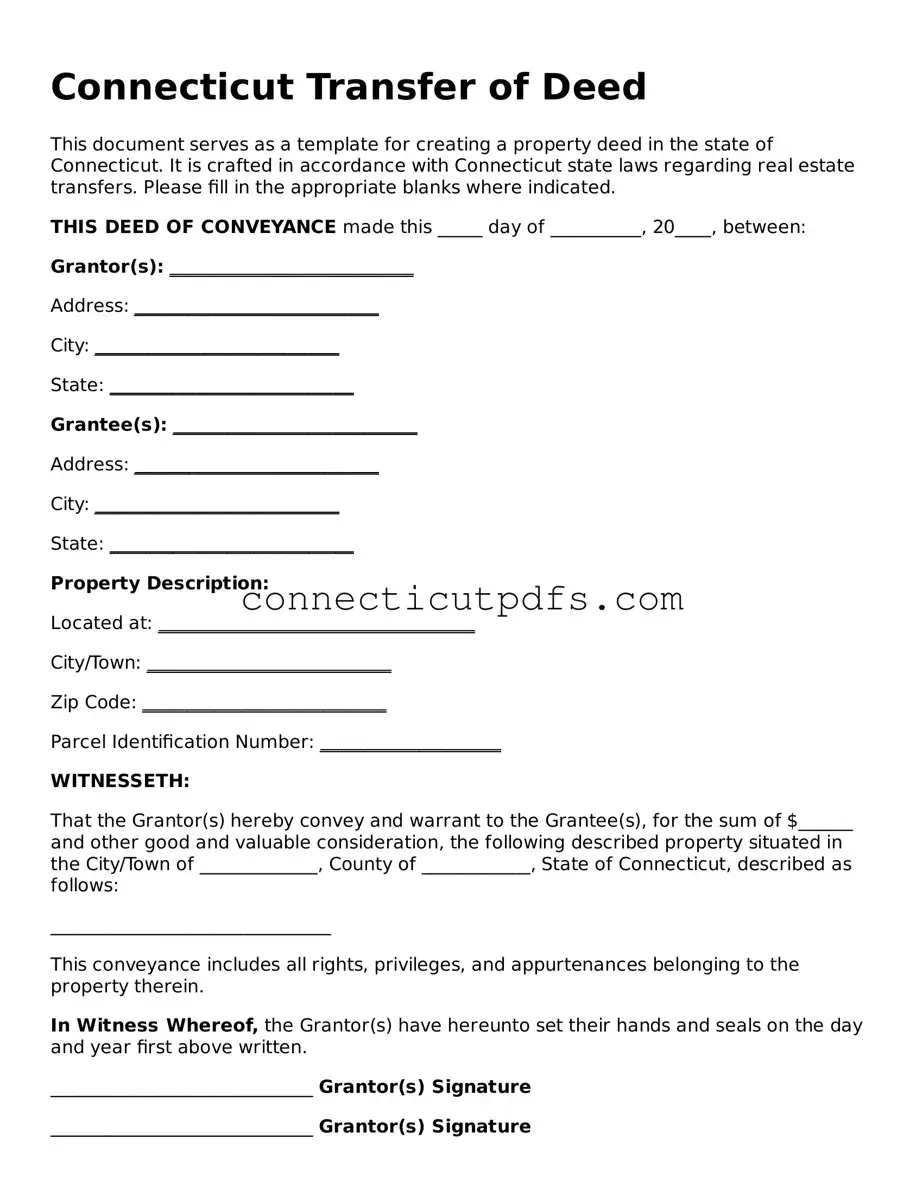

Preview - Connecticut Deed Form

Connecticut Transfer of Deed

This document serves as a template for creating a property deed in the state of Connecticut. It is crafted in accordance with Connecticut state laws regarding real estate transfers. Please fill in the appropriate blanks where indicated.

THIS DEED OF CONVEYANCE made this _____ day of __________, 20____, between:

Grantor(s): ___________________________

Address: ___________________________

City: ___________________________

State: ___________________________

Grantee(s): ___________________________

Address: ___________________________

City: ___________________________

State: ___________________________

Property Description:

Located at: ___________________________________

City/Town: ___________________________

Zip Code: ___________________________

Parcel Identification Number: ____________________

WITNESSETH:

That the Grantor(s) hereby convey and warrant to the Grantee(s), for the sum of $______ and other good and valuable consideration, the following described property situated in the City/Town of _____________, County of ____________, State of Connecticut, described as follows:

_______________________________

This conveyance includes all rights, privileges, and appurtenances belonging to the property therein.

In Witness Whereof, the Grantor(s) have hereunto set their hands and seals on the day and year first above written.

_____________________________ Grantor(s) Signature

_____________________________ Grantor(s) Signature

_____________________________ Notary Public Signature

My Commission Expires: ___________

State of Connecticut, County of ____________:

On this _____ day of ____________, 20____, before me personally appeared ___________________________ and ___________________________, known to me to be the person(s) whose name(s) are subscribed to this instrument, and acknowledged to me that they executed the same in their capacity as ____________.

In Witness Whereof, I have hereunto set my hand and affixed my official seal.

_____________________________ Notary Public Signature

My Commission Expires: ___________

This template provides a structured format for a property deed in Connecticut, ensuring that all essential details are captured accurately. Users should complete the provided blanks with their information to create a valid deed.Common Questions

What is a Connecticut Deed form?

A Connecticut Deed form is a legal document used to transfer ownership of real estate in the state of Connecticut. It outlines the details of the property being transferred, including its description and the names of the buyer and seller. This form is crucial for ensuring that the transfer is legally recognized and protects the rights of both parties involved.

What types of Deed forms are available in Connecticut?

Connecticut offers several types of Deed forms, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides the highest level of protection for the buyer, guaranteeing that the seller holds clear title to the property. A Quitclaim Deed transfers whatever interest the seller has without any warranties. Special Warranty Deeds offer limited protection, ensuring that the seller has not encumbered the property during their ownership.

How do I complete a Connecticut Deed form?

To complete a Connecticut Deed form, you need to fill in the necessary information, such as the names of the parties involved, the property description, and the consideration amount (the price paid for the property). It’s important to ensure all details are accurate. After filling out the form, both parties must sign it in the presence of a notary public to make it legally binding.

Do I need to record the Deed after signing it?

Yes, it is highly recommended to record the Deed with the town clerk in the municipality where the property is located. Recording the Deed provides public notice of the ownership transfer and protects the buyer's rights against future claims. It also helps establish a clear chain of title, which is important for any future transactions involving the property.

Are there any fees associated with filing a Deed in Connecticut?

Yes, there are typically fees associated with filing a Deed in Connecticut. These fees can vary by municipality and may include recording fees, transfer taxes, and possibly other charges. It’s a good idea to check with your local town clerk’s office for the exact amounts and any additional requirements that may apply.

Check out More Forms for Connecticut

Online Promissory Note - The promissory note must include the date of issuance to establish the timeline for repayment.

In order to facilitate a smooth transaction, it is advisable for both parties to utilize the Texas Real Estate Purchase Agreement, a crucial document in defining the terms of the sale. By ensuring clarity in the rights and obligations of buyers and sellers, this agreement helps in preventing disputes. For those looking to download the necessary form, you can find it at Texas Documents.

Connecticut Sales Contract for a House - The agreement may specify if the sale is contingent on the sale of another property.

What Is a Hold Harmless Letter - A solid agreement can save time and resources in the event of a legal dispute.

Guide to Filling Out Connecticut Deed

After gathering all necessary information, you are ready to fill out the Connecticut Deed form. This process requires attention to detail to ensure that all information is accurate and complete. Once the form is filled out, you will need to file it with the appropriate local authority to finalize the transfer of property.

- Obtain the Connecticut Deed form from a reliable source, such as the state’s official website or a legal office.

- Fill in the names of the parties involved in the transaction. Include the full legal names of both the grantor (seller) and the grantee (buyer).

- Provide the property description. This should include the address, lot number, and any other identifying details that clarify the property being transferred.

- Indicate the consideration amount. This is the price paid for the property, which may be a dollar amount or a statement indicating it is a gift.

- Include the date of the transaction. This is the date when the deed is being executed.

- Sign the deed. The grantor must sign the document in the presence of a notary public to validate the transfer.

- Have the deed notarized. The notary will confirm the identities of the signers and witness the signing of the document.

- Submit the completed deed to the appropriate local authority, typically the town or city clerk’s office, for recording.

Dos and Don'ts

When filling out the Connecticut Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of what you should and shouldn't do:

- Do double-check the names of all parties involved. Ensure they are spelled correctly and match official documents.

- Do include the correct property description. This should be clear and precise to avoid any confusion.

- Do sign the deed in the presence of a notary public. This step is essential for the deed's validity.

- Do provide the date of the transaction. This helps establish the timeline of ownership.

- Don't leave any fields blank. Every section of the form should be completed to prevent delays.

- Don't use abbreviations or informal language. Stick to formal terms to maintain clarity.

- Don't forget to file the deed with the appropriate local authority after signing. This step is crucial for legal recognition.