Fill Your Ct 1040 Connecticut Form

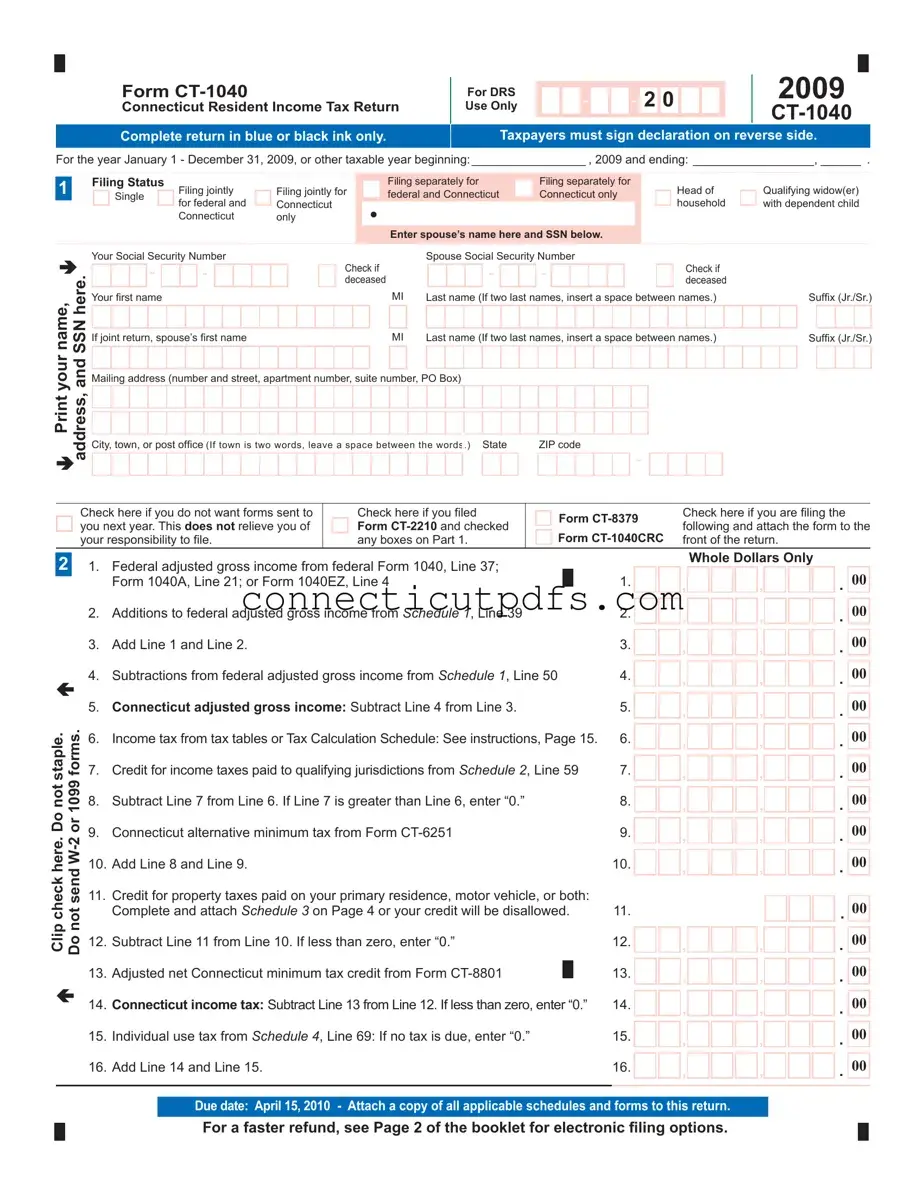

The CT-1040 form is an essential document for Connecticut residents filing their state income tax returns. This form is specifically designed for individuals and families who reside in Connecticut and need to report their income, deductions, and credits for the tax year. It requires taxpayers to provide their personal information, including Social Security numbers and filing status, which can range from single to married filing jointly. The form also includes sections for reporting federal adjusted gross income, along with any necessary additions or subtractions that pertain to Connecticut tax laws. Taxpayers must calculate their Connecticut adjusted gross income, determine their tax liability using tax tables, and account for any credits, such as those for property taxes or income taxes paid to other jurisdictions. Additionally, the CT-1040 form includes a declaration section where individuals must sign to affirm the accuracy of their return. Filing this form accurately and on time is crucial, as it impacts not only tax obligations but also eligibility for potential refunds. Understanding the various components of the CT-1040 can help taxpayers navigate the complexities of state tax regulations and ensure compliance with Connecticut's tax laws.

Documents used along the form

When filing your Connecticut income tax return using Form CT-1040, you may also need to include additional forms and documents. These documents help provide necessary information for accurate processing of your tax return. Below are some commonly used forms that accompany the CT-1040.

- Form CT-2210: This form is used to calculate penalties for underpayment of estimated tax. If you did not pay enough tax throughout the year, you may need to complete this form to determine any penalties owed.

- Form CT-6251: This form calculates the Connecticut alternative minimum tax. If your income is above a certain threshold, you may need to file this to ensure you are paying the correct amount of tax.

- Operating Agreement: To establish clear business operations, refer to our comprehensive Operating Agreement guidelines for effective LLC management in Colorado.

- Form CT-8801: This form is for claiming a credit for the Connecticut minimum tax. If you qualify, it helps reduce your tax liability.

- Schedule 1: This schedule is used for modifications to your federal adjusted gross income. It includes various additions and subtractions that affect your taxable income in Connecticut.

- Schedule 2: This schedule allows you to claim a credit for income taxes paid to other qualifying jurisdictions. It ensures you are not taxed twice on the same income.

- Schedule 3: This schedule is for claiming a property tax credit. If you paid property taxes on your primary residence or motor vehicle, you may be eligible for a credit to reduce your tax bill.

Including these forms and schedules with your CT-1040 ensures that your tax return is complete and accurate. Always check the latest instructions for each form to confirm you have the most current information and requirements.

Preview - Ct 1040 Connecticut Form

Form

Connecticut Resident Income Tax Return

Complete return in blue or black ink only.

For DRS |

|

|

2009 |

2 0 |

|

||

|

|

||

Use Only |

|

||

|

|

|

|

|

|

|

Taxpayers must sign declaration on reverse side.

For the year January 1 - December 31, 2009, or other taxable year beginning: _________________ , 2009 and ending: __________________, ______ .

1Filing Status

Single

Single

Filing jointly for federal and Connecticut

Filing jointly for |

|

Filing separately for |

|

Filing separately for |

|

|

|

||||

|

federal and Connecticut |

|

Connecticut only |

||

|

|

||||

|

|||||

Connecticut |

|

|

|

|

|

|

|

|

|

||

only |

|

|

|

||

|

|

|

|

|

|

Enter spouse’s name here and SSN below.

Head of household

Qualifying widow(er) with dependent child

|

|

name, |

SSN here. |

Print your |

address,and |

|

|

Your Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

Spouse Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Check if |

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

||||||||

Your first name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MI |

|

Last name (If two last names, insert a space between names.) |

Suffix (Jr./Sr.) |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s first name |

|

|

|

|

|

|

|

|

|

|

MI |

|

Last name (If two last names, insert a space between names.) |

Suffix (Jr./Sr.) |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street, apartment number, suite number, PO Box)

City, town, or post office (If town is two words, leave a space between the words.) State |

ZIP code |

-

Check here if you do not want forms sent to you next year. This does not relieve you of your responsibility to file.

Check here if you filed Form

Form |

Check here if you are filing the |

|

following and attach the form to the |

||

|

||

Form |

||

21. Federal adjusted gross income from federal Form 1040, Line 37;

|

|

|

|

Form 1040A, Line 21; or Form 1040EZ, Line 4 |

1. |

|||

|

|

|

2. |

Additions to federal adjusted gross income from Schedule 1, Line 39 |

2. |

|||

|

|

|

3. |

Add Line 1 and Line 2. |

3. |

|||

|

4. |

Subtractions from federal adjusted gross income from Schedule 1, Line 50 |

4. |

|||||

|

|

|

|

|

||||

staple.notDo |

forms.1099or |

5. |

Connecticut adjusted gross income: Subtract Line 4 from Line 3. |

5. |

||||

6. |

Income tax from tax tables or Tax Calculation Schedule: See instructions, Page 15. |

6. |

||||||

|

|

|

||||||

|

|

|

7. |

Credit for income taxes paid to qualifying jurisdictions from Schedule 2, Line 59 |

7. |

|||

|

|

|

8. |

Subtract Line 7 from Line 6. If Line 7 is greater than Line 6, enter “0.” |

8. |

|||

here.checkClip |

9. |

Connecticut alternative minimum tax from Form |

9. |

|||||

10. |

Add Line 8 and Line 9. |

10. |

||||||

|

|

|

||||||

|

|

|

11. |

Credit for property taxes paid on your primary residence, motor vehicle, or both: |

|

|||

|

|

|

|

Complete and attach Schedule 3 on Page 4 or your credit will be disallowed. |

11. |

|||

|

|

|

12. |

Subtract Line 11 from Line 10. If less than zero, enter “0.” |

12. |

|||

|

|

|

|

|

|

|||

|

|

|

13. |

Adjusted net Connecticut minimum tax credit from Form |

|

|

13. |

|

|

14. |

Connecticut income tax: Subtract Line 13 from Line 12. If less than zero, enter “0.” |

14. |

|||||

|

|

|

||||||

|

|

|

15. |

Individual use tax from Schedule 4, Line 69: If no tax is due, enter “0.” |

15. |

|||

|

|

|

16. |

Add Line 14 and Line 15. |

16. |

|||

|

|

|

|

|

|

|

|

|

Whole Dollars Only

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

. 00

. 00

. 00

. 00

. 00

Due date: April 15, 2010 - Attach a copy of all applicable schedules and forms to this return.

For a faster refund, see Page 2 of the booklet for electronic filing options.

Form |

Your Social |

|

|

|

Security Number |

||

|

|

|

|

-

-

17. Enter amount from Line 16. |

17. |

,

,

.00

|

|

|

|

|

|

|

|

|

|

|

|

Column A |

|

Column B |

|

|

|

|

|

|

|

|

Column C |

|

|

|

||||||||||||||

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

Employer’s federal ID No. from Box b of |

|

Connecticut wages, tips, etc. |

|

|

|

Connecticut income tax withheld |

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

or payer’s federal ID No. from Form 1099 |

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

18a. |

|

|

|

|

|

|

|

|

|

|

|

18a. |

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Information |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

. 00 |

18b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||

Only enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

information |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

. 00 |

18c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

00 |

|||||||||||||

from your |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

and 1099 forms |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18d. |

|

|

|

|

|

|

|

|

|

|

|

18d. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

00 |

||||||||||||

if Connecticut |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

income tax |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

. 00 |

18e. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

18e. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

00 |

|||||||||||||

was withheld. |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

18f. |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

18f. |

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

18g. |

|

|

|

– |

|

|

|

|

|

|

|

|

|

18g. |

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18h. Enter amount from Supplemental Schedule |

18h. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18.Total Connecticut income tax withheld: Add amounts in Column C and enter here.

|

|

|

You must complete Columns A, B, and C or your withholding will be disallowed. |

18. |

, |

, |

|

|

. |

|

00 |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

19. |

All 2009 estimated tax payments and any overpayments applied from a prior year |

19. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

20. |

Payments made with Form |

20. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

21. |

Total payments: Add Lines 18, 19, and 20. |

|

|

|

|

|

|

21. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

22. |

Overpayment: If Line 21 is more than Line 17, subtract Line 17 from Line 21. |

22. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|||||||||||||||||

23. |

Amount of Line 22 you want applied to your 2010 estimated tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|||||||||||||||||

23. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||

24. |

Total contributions of refund to designated charities from Schedule 5, Line 70 |

24. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||||||||

25. |

Refund: Subtract Lines 23 and 24 from Line 22. |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

For faster refund, use Direct Deposit by completing Lines 25a, 25b, and 25c. |

25. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25a. |

Checking |

25b. Routing |

|

|

|

|

|

|

|

|

|

25c. Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

number |

|

|

|

|

|

|

|

|

|

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25d.Will this refund go to a bank account outside the U.S.? |

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

526. Tax due: If Line 17 is more than Line 21, subtract Line 21 from Line 17.

27.If late: Enter penalty. Multiply Line 26 by 10% (.10).

28.If late: Enter interest. Multiply Line 26 by number of months or fraction of a month late, then by 1% (.01).

29. Interest on underpayment of estimated tax from Form

30. Total amount due: Add Lines 26 through 29.

26.

27.

28.

29.

30.

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

6Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Keep a copy for your records.

Sign Here

Your signature |

|

|

|

Date |

|

|

Daytime telephone number |

|||||||||||

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Spouse’s signature (if joint return) |

|

|

|

Date |

|

|

Daytime telephone number |

|||||||||||

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Paid preparer’s signature |

|

Date |

|

Telephone number |

|

Preparer’s SSN or PTIN |

||||||||||||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name, address, and ZIP code |

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Party Designee - Complete the following to authorize DRS to contact another person about this return.

Designee’s name |

Telephone number |

Personal identification number (PIN) |

|

|||||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete applicable schedules on Pages 3 and 4 and send all four pages of the return to DRS.

Form |

Your Social |

|

|

Security Number |

|

|

|

|

-

-

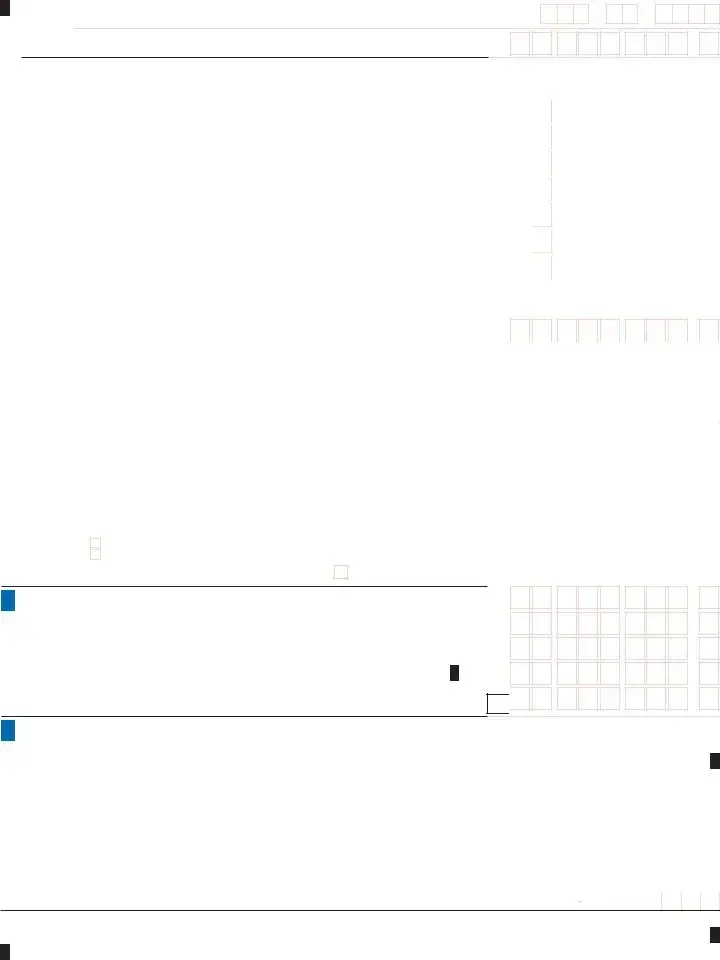

Schedule 1 - Modifi cations to Federal Adjusted Gross Income |

|

Enter all items as positive numbers. |

|

|

|

||||||||||||||||||||||||||||||||||||||||

See instructions, Page 18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||

31. Interest on state and local government obligations other than Connecticut |

31. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

32. Mutual fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||||||||

government obligations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

33. Cancellation of debt income: See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

34. Taxable amount of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||||||||

adjusted gross income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

35. Benefi ciary’s share of Connecticut fi duciary adjustment: Enter only if greater than zero. |

35. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36. Loss on sale of Connecticut state and local government bonds |

|

|

|

|

|

36. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

37. Domestic production activity deduction from federal Form 1040, Line 35 |

37. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38. Other - specify ________________________________________________________ |

38. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

39. Total additions: Add Lines 31 through 38. Enter here and on Line 2. |

39. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40. Interest on U.S. government obligations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

41. Exempt dividends from certain qualifying mutual funds derived from U.S. government obligations |

41. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

42. Social Security benefit adjustment: See Social Security Benefit Adjustment Worksheet, Page 20. |

42. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43. Refunds of state and local income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

44. Tier 1 and Tier 2 railroad retirement benefi ts and supplemental annuities |

44. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45. 50% of military retirement pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

46. Benefi ciary’s share of Connecticut fi duciary adjustment: Enter only if less than zero. |

46. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

47. Gain on sale of Connecticut state and local government bonds |

47. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

48. Connecticut Higher Education Trust (CHET) contributions |

48. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

Enter CHET account number: |

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(can be up to 14 digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49. Other - specify: Do not include out of state income. ___________________________ |

49. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

50. Total subtractions: Add Lines 40 through 49. |

Enter here and on Line 4. |

50. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 2 - Credit for Income Taxes Paid to Qualifying Jurisdictions

You must attach a copy of your return fi led with the qualifying jurisdiction(s) or your credit will be disallowed.

51.Modifi ed Connecticut adjusted gross income See instructions, Page 24.

52.Enter qualifying jurisdiction’s name and

code: See instructions, Page 24. |

52. |

53.

54.Divide Line 53 by Line 51. May not exceed 1.0000 54.

55.Income tax liability: Subtract Line 11 from Line 6. 55.

56. Multiply Line 54 by Line 55. |

56. |

57. Income tax paid to a qualifying jurisdiction |

|

See instructions, Page 25. |

57. |

58. Enter the lesser of Line 56 or Line 57. |

58. |

Column A

Name

, |

, |

. |

|

, |

, |

, |

, |

, |

, |

, |

, |

51.

Code

.00

.00

.00

. |

00 |

|

|

. |

00 |

, |

, |

Column B

Name

, |

, |

. |

|

, |

, |

, |

, |

, |

, |

, |

, |

. 00

Code

. 00

. 00

. 00

. 00

. 00

59. Total credit: Add Line 58, all columns. Enter here and on Line 7.

59. |

, |

, |

.00

Complete applicable schedules on Page 4 and send all four pages of the return to DRS.

Form |

Your Social |

|

|

Security Number |

-

-

Schedule 3 - Property Tax Credit See instructions, |

Page 25. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auto 2 |

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Qualifying Property |

|

|

|

Primary Residence |

|

|

|

|

|

|

|

Auto 1 |

|

|

|

|

|

|

|

|

(joint returns or qualifying widow(er) only) |

|

|

|

|||||||||||||||||||||||||||||||

Name of Connecticut Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Town or District |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Description of Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

If primary residence, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

street address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

If motor vehicle, enter year, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

make, and model. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Date(s) Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||||||||||||

|

Amount Paid 60. |

|

|

|

|

, |

|

|

|

. |

00 |

|

|

61. |

|

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|

62. |

|

|

|

|

|

, |

|

|

|

|

|

|

00 |

||||||||||||||

63. Total property tax paid: Add Lines 60, 61, and 62. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63. |

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

||||||||||||||||||||||||

64. Maximum property tax credit allowed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64. |

|

|

|

|

500 . |

|

00 |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

65. Enter the lesser of Line 63 or Line 64. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

00 |

|||||||||||||||||||||

66. Enter the decimal amount for your fi ling status and Connecticut AGI from the Property Tax |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Credit Table exactly as it appears on Page 27. If zero, enter the amount from Line 65 on Line 68. |

66. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

67. Multiply Line 65 by Line 66. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67. |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

00 |

||||||||||||||||||

68. Subtract Line 67 from Line 65. Enter here and on Line 11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||||

|

Attach Schedule 3 to your return or your credit will be disallowed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

68. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

Schedule 4 - Individual Use Tax - Do you owe use tax? See instructions, Page 28. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

Complete this worksheet to calculate your Connecticut individual use tax liability and attach Page 4 to your return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

Column A |

|

|

Column B |

|

|

Column C |

|

|

|

|

Column D |

|

Column E |

|

|

Column F |

|

|

|

Column G |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax, if any, |

|

|

Balance due |

||||||||||||||

|

Date of |

|

Description of |

|

|

Retailer or |

|

|

|

|

Purchase |

|

CT tax due |

|

|

|

|

paid to |

|

|

(Column E minus |

|||||||||||||||||||||||||||||||||||

|

purchase |

|

goods or services |

|

service provider |

|

|

|

|

|

price |

(.06 X Column D) |

|

|

|

another |

|

|

Column F but not |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

jurisdiction |

|

|

less than zero) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total of individual purchases under $300 not listed above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

69. Individual use tax: Add all amounts for Column G. Enter here and on Line 15. |

69. |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 5 - Contributions to Designated Charities

.00

70a. AIDS Research |

|

70a. |

70b. Organ Transplant |

|

70b. |

70c. Endangered Species/Wildlife |

|

70c. |

70d. Breast Cancer Research |

|

70d. |

70e. Safety Net Services |

|

70e. |

70f. Military Family Relief Fund |

|

70f. |

|

,

,

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

70. Total Contributions: Add Lines 70a through 70f. Enter amount here and on Line 24. |

70. |

|

|

, |

|

|

Use envelope provided, with correct mailing label, or mail to: |

|

|

|

|

|

|

,

.00

For refunds and all other tax forms without payment: Department of Revenue Services

PO Box 2976

Hartford CT

For all tax forms with payment: Department of Revenue Services PO Box 2977

Hartford CT

Make your check payable to: Commissioner of Revenue Services

To ensure proper posting, write your SSN(s) (optional) and “2009 Form

Common Questions

What is the CT-1040 form?

The CT-1040 form is the Connecticut Resident Income Tax Return. It is used by residents of Connecticut to report their income, calculate their taxes, and determine if they owe money or are due a refund. This form must be completed accurately and submitted to the Department of Revenue Services (DRS) by the tax deadline.

Who needs to file the CT-1040 form?

Any Connecticut resident who earns income during the tax year is required to file the CT-1040 form. This includes individuals who are single, married filing jointly, married filing separately, head of household, or qualifying widow(er). If you meet the income thresholds set by the state, you must file this form.

What information do I need to complete the CT-1040 form?

To complete the CT-1040 form, you will need several pieces of information. This includes your Social Security Number, your federal adjusted gross income, details about any income tax withheld, and any applicable credits or deductions. Additionally, you may need to provide information from your W-2 or 1099 forms, as well as any schedules that apply to your situation.

When is the CT-1040 form due?

The CT-1040 form is generally due on April 15th of the year following the tax year. For example, for income earned in 2009, the form was due on April 15, 2010. If you need more time to file, you can request an extension, but you must still pay any taxes owed by the original due date to avoid penalties.

How can I file the CT-1040 form?

You can file the CT-1040 form either by mailing a paper return or electronically through the DRS website. Electronic filing is encouraged as it can speed up processing times and refunds. If you choose to file by mail, ensure that you send all required schedules and forms to the correct address provided in the instructions.

What should I do if I made a mistake on my CT-1040 form?

If you discover an error after submitting your CT-1040 form, you can file an amended return using Form CT-1040X. It is important to correct any mistakes as soon as possible to avoid potential penalties or issues with your tax return. Follow the instructions for the amended form carefully to ensure that your corrections are processed smoothly.

Common PDF Forms

H13b Form Ct - Provide the purchaser’s details to finalize the sale on the form.

How to Gift a Car in Ct - Authorities might contact the owner for further details after submission.

To facilitate a smooth transaction, both parties should thoroughly review the Texas Real Estate Purchase Agreement, which can be accessed through Texas Documents, ensuring that they understand every stipulation and requirement laid out within the document.

Custody Petition - The form requires applicants to specify their relationship to the children involved.

Guide to Filling Out Ct 1040 Connecticut

Filling out the CT-1040 form is an important step in managing your state taxes in Connecticut. This guide will walk you through the process so you can complete your tax return accurately and efficiently.

- Gather all necessary documents, including your W-2s, 1099s, and any other income statements.

- Start with the top section of the form. Enter your name, Social Security Number, and address. If filing jointly, include your spouse's information as well.

- Select your filing status by checking the appropriate box. Options include Single, Married Filing Jointly, and others.

- For Line 1, enter your federal adjusted gross income from your federal tax return.

- On Line 2, list any additions to your federal adjusted gross income from Schedule 1.

- Calculate the total of Lines 1 and 2, and enter that amount on Line 3.

- For Line 4, enter any subtractions from your federal adjusted gross income from Schedule 1.

- Subtract Line 4 from Line 3 to find your Connecticut adjusted gross income. Enter this amount on Line 5.

- Calculate your income tax using the tax tables provided or the Tax Calculation Schedule, and enter the result on Line 6.

- On Line 7, enter any credit for income taxes paid to qualifying jurisdictions from Schedule 2.

- Subtract Line 7 from Line 6. If Line 7 is greater than Line 6, enter "0" on Line 8.

- Enter any Connecticut alternative minimum tax from Form CT-6251 on Line 9.

- Add Lines 8 and 9, and enter the total on Line 10.

- If applicable, enter the credit for property taxes paid on your primary residence on Line 11.

- Subtract Line 11 from Line 10 to determine your Connecticut income tax on Line 14.

- Enter any individual use tax on Line 15, if applicable.

- Add Lines 14 and 15, and enter the total on Line 16.

- Complete the payment sections, including any estimated tax payments or overpayments from prior years.

- Calculate any refund or tax due and enter those amounts in the appropriate sections.

- Sign and date the form. If filing jointly, your spouse must also sign.

- Attach any necessary schedules and forms, and send all four pages of the return to the Department of Revenue Services.

Once you have completed these steps, your CT-1040 form will be ready for submission. Make sure to keep a copy for your records. If you have any questions, consider consulting a tax professional for assistance.

Dos and Don'ts

When filling out the CT-1040 Connecticut form, consider the following dos and don'ts:

- Use blue or black ink only to complete the form.

- Sign the declaration on the reverse side of the form.

- Attach all applicable schedules and forms to your return.

- Double-check all entries for accuracy before submission.

- Do not leave any required fields blank.

- Avoid using red ink or pencil, as it may not be processed correctly.

- Do not forget to provide your Social Security Number and that of your spouse, if applicable.

- Do not submit your return without ensuring it is complete and correct.