Fill Your Connecticut Reg 15 Form

The Connecticut Reg 15 form serves as an essential application for wineries seeking to obtain a Small Winery Certificate, which allows them to benefit from a reduced alcoholic beverages tax rate. Specifically designed for wineries that produced no more than 55,000 wine gallons in the previous calendar year, this form is crucial for licensed distributors who wish to sell still wine at a lower tax rate of 15¢ per gallon, compared to the standard rate of 60¢ per gallon. To initiate the process, applicants must provide detailed information, including the names of owners or partners, business contact details, and tax identification numbers. Additionally, the form requires confirmation of the winery’s licensing with the Connecticut Department of Consumer Protection, Division of Liquor Control. Once the Department of Revenue Services reviews and approves the application, a Small Winery Certificate (Form OR-267) will be issued. This certificate not only validates the winery’s eligibility but also outlines the specific conditions under which the reduced tax rate applies. It’s important to note that the Reg 15 form must be renewed annually by submitting a new application before the June 30 expiration date. Failure to comply with these requirements may result in penalties, including fines or imprisonment for false statements. For any questions or clarifications, applicants can reach out to the Excise/Public Services Taxes Subdivision during business hours.

Documents used along the form

When applying for a Small Winery Certificate in Connecticut using the REG-15 form, there are several other documents and forms that may be required or beneficial to accompany your application. Understanding these additional forms can help streamline the process and ensure compliance with state regulations.

- Form OR-267: This is the Small Winery Certificate itself, which is issued by the Department of Revenue Services (DRS) once your application is approved. Holding this certificate allows a licensed distributor to benefit from a reduced alcoholic beverages tax rate on qualifying sales.

- Connecticut Tax Registration Number Application: If you do not already have a Connecticut Tax Registration Number, you will need to complete this application. This number is essential for tax purposes and allows you to operate legally within the state.

- Motorcycle Bill of Sale: For those involved in motorcycle transactions, it is imperative to have a properly completed bill of sale. This document serves as proof of purchase and is crucial for registration and legal processes. To create yours, visit https://billofsaleforvehicles.com/editable-texas-motorcycle-bill-of-sale/.

- Federal Employer Identification Number (EIN): This document is necessary for tax identification purposes at the federal level. It is often required when applying for various state permits and licenses, including those related to alcohol distribution.

- Liquor Control Permit: If you plan to distribute alcoholic beverages, you must obtain a permit from the Connecticut Department of Consumer Protection, Division of Liquor Control. This permit verifies that you are legally authorized to distribute alcohol in the state.

By preparing these documents alongside the REG-15 form, you can enhance your application process and ensure that all necessary information is readily available. This proactive approach can help avoid delays and facilitate a smoother approval process for your Small Winery Certificate.

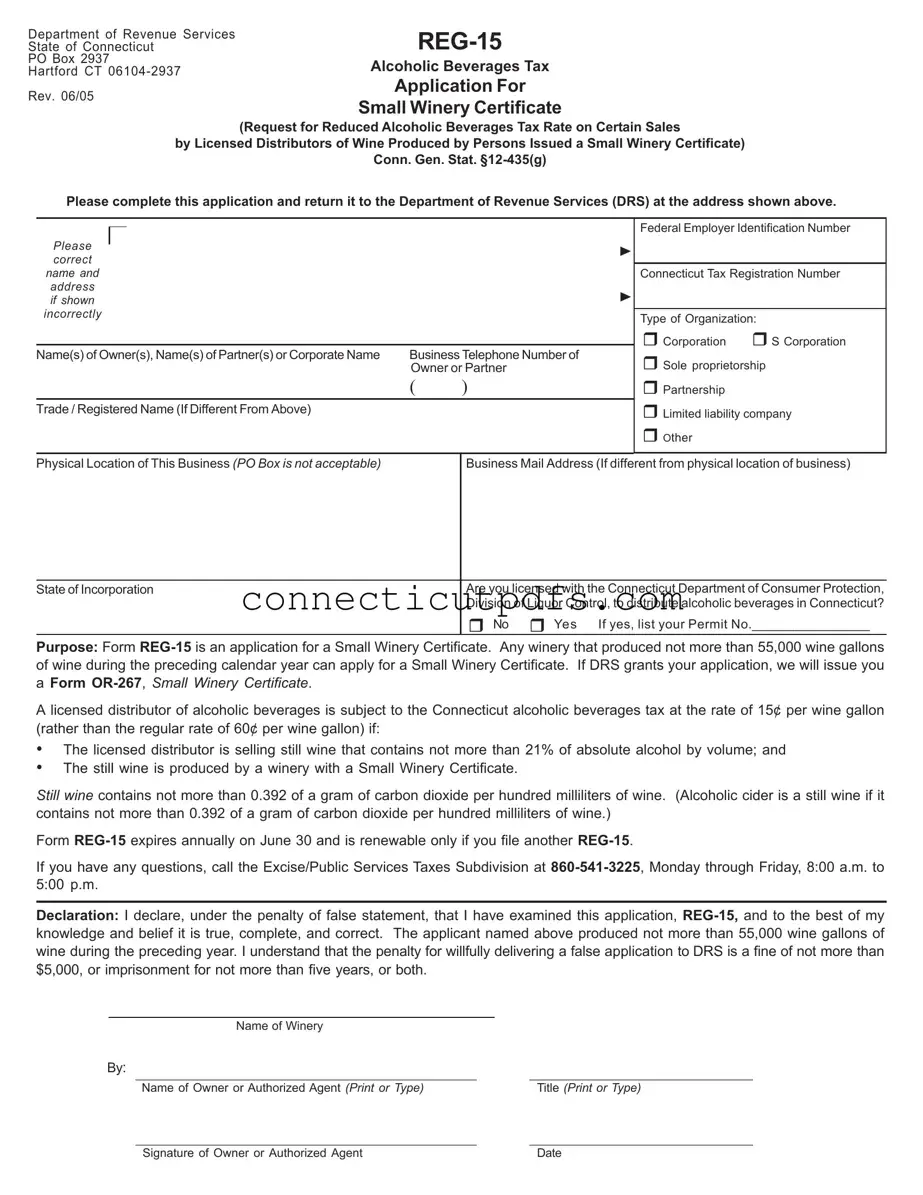

Preview - Connecticut Reg 15 Form

Department of Revenue Services |

||

State of Connecticut |

||

PO Box 2937 |

Alcoholic Beverages Tax |

|

Hartford CT |

||

|

||

Rev. 06/05 |

Application For |

|

Small Winery Certificate |

||

|

(Request for Reduced Alcoholic Beverages Tax Rate on Certain Sales

by Licensed Distributors of Wine Produced by Persons Issued a Small Winery Certificate)

Conn. Gen. Stat.

Please complete this application and return it to the Department of Revenue Services (DRS) at the address shown above.

Please correct name and address if shown incorrectly

Name(s) of Owner(s), Name(s) of Partner(s) or Corporate Name |

Business Telephone Number of |

|

|

Owner or Partner |

|

|

( |

) |

Trade / Registered Name (If Different From Above)

Federal Employer Identification Number

Connecticut Tax Registration Number

Type of Organization:

Corporation |

S Corporation |

Sole proprietorship

Partnership

Limited liability company

Other

Physical Location of This Business (PO Box is not acceptable)

Business Mail Address (If different from physical location of business)

State of Incorporation

Are you licensed with the Connecticut Department of Consumer Protection, Division of Liquor Control, to distribute alcoholic beverages in Connecticut?

No |

Yes If yes, list your Permit No._________________ |

Purpose: Form

aForm

A licensed distributor of alcoholic beverages is subject to the Connecticut alcoholic beverages tax at the rate of 15¢ per wine gallon (rather than the regular rate of 60¢ per wine gallon) if:

•The licensed distributor is selling still wine that contains not more than 21% of absolute alcohol by volume; and

•The still wine is produced by a winery with a Small Winery Certificate.

Still wine contains not more than 0.392 of a gram of carbon dioxide per hundred milliliters of wine. (Alcoholic cider is a still wine if it contains not more than 0.392 of a gram of carbon dioxide per hundred milliliters of wine.)

Form

If you have any questions, call the Excise/Public Services Taxes Subdivision at

Declaration: I declare, under the penalty of false statement, that I have examined this application,

Name of Winery

By: __________________________________________________________ |

______________________________________ |

Name of Owner or Authorized Agent (Print or Type) |

Title (Print or Type) |

__________________________________________________________ |

______________________________________ |

Signature of Owner or Authorized Agent |

Date |

Common Questions

What is the purpose of the Connecticut Reg 15 form?

The Connecticut Reg 15 form is an application for a Small Winery Certificate. This certificate allows wineries that produce no more than 55,000 gallons of wine per year to benefit from a reduced tax rate. If your application is approved, you will receive a Small Winery Certificate, which enables licensed distributors to pay a lower tax rate on certain sales of your wine. This can significantly help smaller wineries manage their costs and remain competitive in the market.

Who is eligible to apply for the Small Winery Certificate?

To be eligible for the Small Winery Certificate, a winery must have produced no more than 55,000 gallons of wine during the previous calendar year. Additionally, the winery must be licensed with the Connecticut Department of Consumer Protection, Division of Liquor Control, to distribute alcoholic beverages in Connecticut. If you meet these criteria, you can complete the REG-15 form and submit it for consideration.

What are the tax benefits associated with the Small Winery Certificate?

If your winery is granted the Small Winery Certificate, licensed distributors can sell your still wine at a reduced tax rate of 15 cents per gallon, instead of the standard 60 cents per gallon. This applies to still wine that contains no more than 21% alcohol by volume. Such a reduction can make your wine more appealing to distributors and retailers, potentially leading to increased sales.

How often do I need to renew my Small Winery Certificate?

The Small Winery Certificate issued through the REG-15 form must be renewed annually. The certificate expires on June 30 each year. To maintain your eligibility, you must file a new REG-15 form before the expiration date. It is important to keep track of this deadline to avoid any interruptions in your tax benefits.

Common PDF Forms

State of Ct Property Liens - You must describe the personal property on which the lien is placed.

Ct Title Application - The donee must also sign the form, acknowledging the receipt of the gifted vehicle or vessel.

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the property’s title. This form is often utilized in situations such as transferring property between family members or clearing up title issues. To begin the process of transferring property, fill out the form by visiting Texas Documents and clicking the button below.

Connecticut W 1130 - It allows individuals to express their preferences regarding living situations.

Guide to Filling Out Connecticut Reg 15

Filling out the Connecticut Reg 15 form is an important step for wineries seeking a Small Winery Certificate. This certificate allows eligible wineries to benefit from a reduced alcoholic beverages tax rate. To ensure a smooth application process, follow these steps carefully.

- Obtain the Connecticut Reg 15 form from the Department of Revenue Services website or your local office.

- At the top of the form, fill in the name(s) of the owner(s) or partner(s) or the corporate name.

- Provide the business telephone number of the owner or partner.

- If applicable, enter the trade or registered name, if it differs from the name provided above.

- Fill in the Federal Employer Identification Number (FEIN).

- Enter the Connecticut Tax Registration Number.

- Select the type of organization from the options provided: Corporation, S Corporation, Sole proprietorship, Partnership, Limited liability company, or Other.

- Provide the physical location of the business. Note that a PO Box is not acceptable.

- If the business mailing address differs from the physical location, include that information.

- Indicate the state of incorporation.

- Answer whether you are licensed with the Connecticut Department of Consumer Protection, Division of Liquor Control, to distribute alcoholic beverages in Connecticut. Mark “Yes” or “No.”

- If you answered “Yes,” list your Permit Number.

- Read the declaration carefully. Confirm that the information is true and complete, and understand the penalties for false statements.

- Sign the form as the owner or authorized agent. Print or type your name and title below the signature.

- Include the date of signing.

- Submit the completed form to the Department of Revenue Services at the address provided on the form.

After submitting the form, the Department of Revenue Services will review your application. If approved, you will receive a Small Winery Certificate (Form OR-267). Ensure you renew your application annually by filing another REG-15 before June 30 to maintain your eligibility for the reduced tax rate.

Dos and Don'ts

When filling out the Connecticut Reg 15 form, follow these guidelines to ensure accuracy and compliance.

- Do provide correct and complete information for all required fields.

- Do double-check the name and address for any errors before submission.

- Do include your Federal Employer Identification Number and Connecticut Tax Registration Number.

- Do ensure that the physical location of the business is accurate; a PO Box is not acceptable.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't forget to sign and date the application before sending it in.

- Don't submit the form without confirming your eligibility for the Small Winery Certificate.