Fill Your Connecticut Op 300 Form

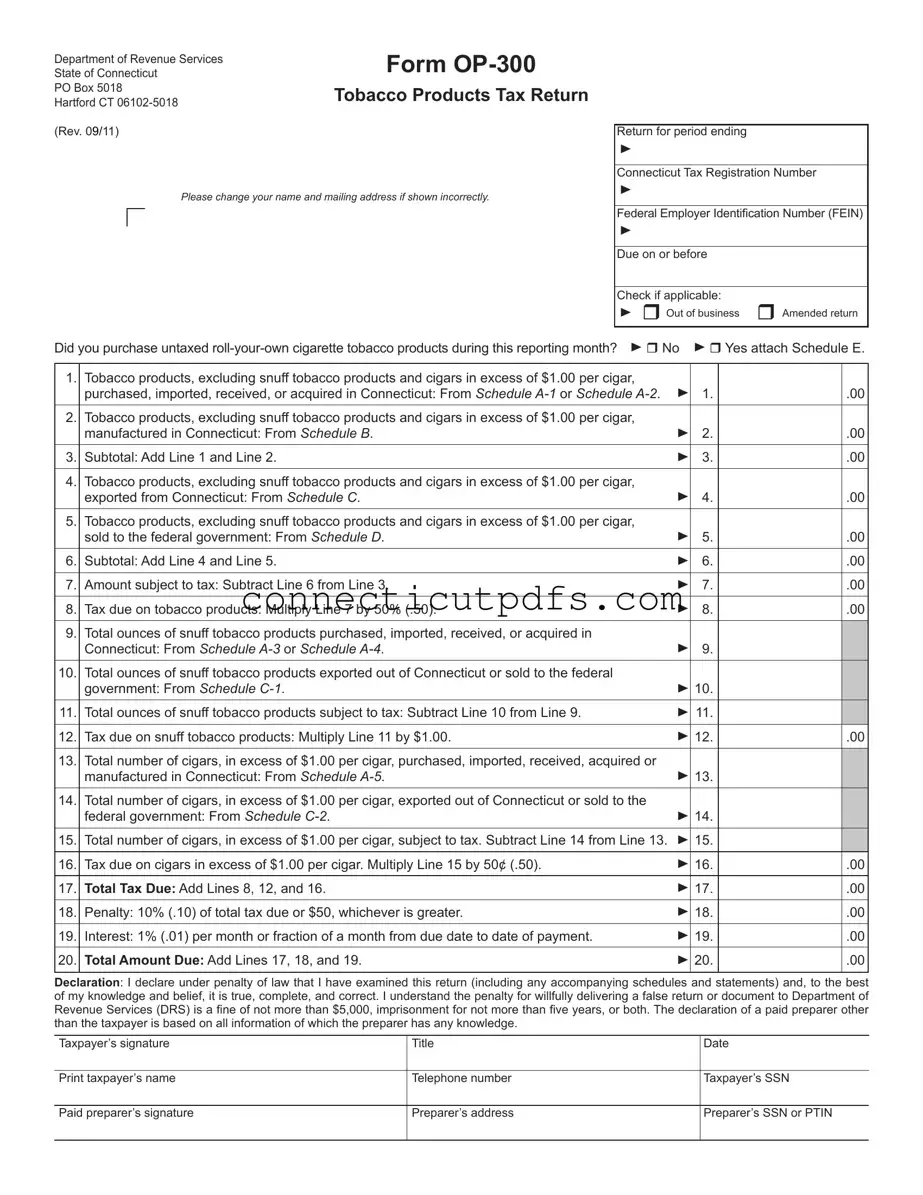

The Connecticut OP-300 form is an essential document for businesses involved in the tobacco industry within the state. It serves as the Tobacco Products Tax Return, allowing distributors to report their tobacco-related transactions for each calendar month. This form requires detailed information, including the Connecticut Tax Registration Number and the Federal Employer Identification Number (FEIN). Businesses must complete the form by the twenty-fifth day of the month following the reporting period, even if no tax is due. The OP-300 includes various sections where taxpayers must report the wholesale sales price of different tobacco products, such as snuff and cigars, and calculate the tax owed based on their activities. Additionally, it prompts users to indicate if they have purchased untaxed roll-your-own cigarette tobacco products, necessitating the attachment of Schedule E if applicable. The form also outlines penalties for late submissions and provides guidance on electronic payments, ensuring that all taxpayers understand their responsibilities. By accurately completing and submitting the OP-300, businesses can comply with state tax laws while contributing to Connecticut's revenue system.

Documents used along the form

The Connecticut Op 300 form is essential for reporting tobacco products tax. However, it often accompanies several other forms and documents that help ensure accurate reporting and compliance. Here’s a brief overview of some commonly used forms alongside the Op 300.

- Schedule A-1: This schedule is used by resident distributors to report the wholesale sales price of tobacco products purchased, imported, received, or acquired in Connecticut.

- Schedule A-2: Nonresident distributors use this schedule to report the wholesale sales price of tobacco products imported into Connecticut.

- Schedule B: This form captures the wholesale sales price of tobacco products manufactured in Connecticut by the distributor.

- Schedule F: This schedule is necessary for documenting the sale of tobacco products to out-of-state retailers, ensuring compliance with reporting requirements. For further details on related documentation, visit promissorynotepdf.com.

- Schedule C: Distributors report the wholesale sales price of tobacco products exported from Connecticut on this schedule. A separate Schedule C is needed for each destination state.

- Schedule D: This schedule is for reporting the wholesale sales price of tobacco products sold to the federal government that were imported, received, purchased, acquired, or manufactured in Connecticut.

- Schedule E: If a distributor purchases untaxed roll-your-own cigarette tobacco products, this schedule must be attached to the Op 300 form for proper reporting.

These documents work together to provide a comprehensive picture of tobacco transactions in Connecticut. Ensuring that all relevant forms are completed accurately can help avoid penalties and ensure compliance with state tax laws.

Preview - Connecticut Op 300 Form

Department of Revenue Services |

Form |

|

State of Connecticut |

||

PO Box 5018 |

Tobacco Products Tax Return |

|

Hartford CT |

||

|

||

(Rev. 09/11) |

|

Please change your name and mailing address if shown incorrectly.

Return for period ending

Connecticut Tax Registration Number

Federal Employer Identiication Number (FEIN)

Due on or before

Check if applicable:

Out of business Amended return

Did you purchase untaxed

1. |

Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar, |

|

|

|

|

|

purchased, imported, received, or acquired in Connecticut: From Schedule |

|

1. |

|

.00 |

|

|

|

|

|

|

2. |

Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar, |

|

|

|

|

|

manufactured in Connecticut: From Schedule B. |

|

2. |

|

.00 |

|

|

|

|

|

|

3. |

Subtotal: Add Line 1 and Line 2. |

|

3. |

|

.00 |

|

|

|

|

|

|

4. |

Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar, |

|

|

|

|

|

exported from Connecticut: From Schedule C. |

|

4. |

|

.00 |

|

|

|

|

|

|

5. |

Tobacco products, excluding snuff tobacco products and cigars in excess of $1.00 per cigar, |

|

|

|

|

|

sold to the federal government: From Schedule D. |

|

5. |

|

.00 |

|

|

|

|

|

|

6. |

Subtotal: Add Line 4 and Line 5. |

|

6. |

|

.00 |

|

|

|

|

|

|

7. |

Amount subject to tax: Subtract Line 6 from Line 3. |

|

7. |

|

.00 |

|

|

|

|

|

|

8. |

Tax due on tobacco products: Multiply Line 7 by 50% (.50). |

|

8. |

|

.00 |

|

|

|

|

|

|

9. |

Total ounces of snuff tobacco products purchased, imported, received, or acquired in |

|

|

|

|

|

Connecticut: From Schedule |

|

9. |

|

|

10. |

Total ounces of snuff tobacco products exported out of Connecticut or sold to the federal |

|

|

|

|

|

government: From Schedule |

|

10. |

|

|

11. |

Total ounces of snuff tobacco products subject to tax: Subtract Line 10 from Line 9. |

|

11. |

|

|

12. |

Tax due on snuff tobacco products: Multiply Line 11 by $1.00. |

|

12. |

|

.00 |

|

|

|

|

|

|

13. |

Total number of cigars, in excess of $1.00 per cigar, purchased, imported, received, acquired or |

|

|

|

|

|

manufactured in Connecticut: From Schedule |

|

13. |

|

|

14. |

Total number of cigars, in excess of $1.00 per cigar, exported out of Connecticut or sold to the |

|

|

|

|

|

federal government: From Schedule |

|

14. |

|

|

15. |

Total number of cigars, in excess of $1.00 per cigar, subject to tax. Subtract Line 14 from Line 13. |

|

15. |

|

|

16. |

Tax due on cigars in excess of $1.00 per cigar. Multiply Line 15 by 50¢ (.50). |

|

16. |

|

.00 |

17. |

Total Tax Due: Add Lines 8, 12, and 16. |

|

17. |

|

.00 |

|

|

|

|

|

|

18. |

Penalty: 10% (.10) of total tax due or $50, whichever is greater. |

|

18. |

|

.00 |

|

|

|

|

|

|

19. |

Interest: 1% (.01) per month or fraction of a month from due date to date of payment. |

|

19. |

|

.00 |

|

|

|

|

|

|

20. |

Total Amount Due: Add Lines 17, 18, and 19. |

|

20. |

|

.00 |

|

|

|

|

|

|

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to Department of

Revenue Services (DRS) is a ine of not more than $5,000, imprisonment for not more than ive years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer’s signature |

Title |

Date |

Print taxpayer’s name

Telephone number

Taxpayer’s SSN

Paid preparer’s signature

Preparer’s address

Preparer’s SSN or PTIN

General Instructions

Complete the return in blue or black ink only.

Taxpayers must ile a return for each calendar month by the

Example: The tobacco products tax return for January 1 through

January 31 must be iled on or before February 25.

Taxpayers must ile a return even if no tax is due. All

supporting schedules can be found on the Department of Revenue Services (DRS) website at www.ct.gov/DRS

The owner, a partner, or a principal oficer must sign this

return.

Pay Electronically: Visit www.ct.gov/TSC to use the Taxpayer Service Center (TSC) to make a direct tax

payment. After logging onto the TSC, select the Make Payment Only option and choose a tax type from the drop down box. Using this option authorizes the DRS to electronically withdraw from your bank account (checking or savings) a payment on a date you select up to the due date.

As a reminder, even if you pay electronically you must still ile your return by the due date. Tax not paid on or before the

due date will be subject to penalty and interest.

If you do not pay electronically, make check payable to Commissioner of Revenue Services. DRS may submit

your check to your bank electronically.

Mail to: Department of Revenue Services

State of Connecticut

PO Box 5018

Hartford CT

Deinitions

TOBACCO PRODUCTS means: Cigars, cheroots, stogies, periques, granulated, plug cut, crimp cut, ready rubbed and

other smoking tobacco, cavendish, plug and twist tobacco, ine cut and other chewing tobaccos, shorts, refuse scraps,

clippings, cuttings and sweepings of tobacco, and all other kinds and forms of tobacco prepared in a manner as to be suitable for chewing or smoking in a pipe or otherwise for both

chewing and smoking, but does not include any cigarettes as deined in Conn. Gen. Stat.

SNUFF TOBACCO PRODUCTS means: Tobacco products that have imprinted on the packages the designation “snuff” or

“snuff lour” or the federal tax designation “Tax Class M,” or

both.

WHOLESALE SALES PRICE means:

•In the case of a distributor that is the manufacturer of the tobacco products, the price set for these products or, if no price has been set, the wholesale value of these products.

•In the case of a distributor that is not the manufacturer of the tobacco products, the price at which the distributor purchased the products.

Speciic Instructions

Check Box: You must check the appropriate box concerning the purchase of untaxed

Line 1

Resident Distributor: Enter from Schedule

wholesale sales price of tobacco products (excluding snuff tobacco products and cigars in excess of $1.00 per cigar)

purchased, imported, received, or acquired in Connecticut by the distributor.

Nonresident Distributor: Enter from Schedule

tobacco products and cigars in excess of $1.00 per cigar)

imported into Connecticut by the distributor.

Line 2 - Enter from Schedule B the wholesale sales price

of tobacco products (excluding snuff tobacco products and cigars in excess of $1.00 per cigar) manufactured in

Connecticut by the distributor.

Line 4 - Enter from Schedule C the wholesale sales price

of tobacco products (excluding snuff tobacco products and cigars in excess of $1.00 per cigar) exported from Connecticut

that were imported, received, purchased, acquired, or manufactured in Connecticut by the distributor. Prepare a separate Schedule C for each state of destination. (Use Line 9 and Line 10 to report snuff products and Line 13 and

Line 14 to report cigars in excess of $1.00 per cigar.)

Line 5 - Enter from Schedule D the wholesale sales price

of tobacco products (excluding snuff tobacco products and cigars in excess of $1.00 per cigar) sold to the federal

government that were imported, received, purchased, acquired, or manufactured in Connecticut by the distributor.

Line 9 - Enter from Schedule

Line 10 - Enter from Schedule

Line 13 - Enter from Schedule

acquired, or manufactured in Connecticut.

Line 14 - Enter from Schedule

sold to the federal government.

For Further Information

If you need additional information or assistance, please call the Excise Taxes Unit at

Forms and Publications: Visit the DRS website at www.ct.gov/DRS to download and print Connecticut tax

forms and publications.

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling

Common Questions

What is the Connecticut OP-300 form used for?

The Connecticut OP-300 form serves as the Tobacco Products Tax Return. This form is required for businesses that purchase, import, manufacture, or sell tobacco products within the state. It helps the Department of Revenue Services (DRS) track the sale and distribution of tobacco products, ensuring that the appropriate taxes are collected. The form must be submitted monthly, even if no tax is due, to maintain compliance with state regulations.

How do I complete the OP-300 form?

To complete the OP-300 form, you will need to provide specific information, including your Connecticut Tax Registration Number and Federal Employer Identification Number (FEIN). You will also need to indicate whether you purchased untaxed roll-your-own cigarette tobacco products. The form requires you to report various categories of tobacco products, including those purchased, manufactured, exported, or sold to the federal government. Make sure to use blue or black ink and attach any necessary schedules as instructed. It is important to double-check all entries for accuracy before submission.

What are the deadlines for submitting the OP-300 form?

The OP-300 form must be filed by the twenty-fifth day of the month following the reporting period. For example, if you are reporting for January, your form is due by February 25. Timely submission is crucial, as late filings may incur penalties and interest. Even if there is no tax due, a return must still be filed to comply with state law.

What happens if I do not file the OP-300 form on time?

If the OP-300 form is not filed by the due date, penalties and interest may apply. The penalty is calculated as 10% of the total tax due or a minimum of $50, whichever is greater. Additionally, interest accumulates at a rate of 1% per month from the due date until payment is made. To avoid these additional costs, it is advisable to file your return on time and ensure that any taxes owed are paid promptly.

Common PDF Forms

Ct Foi Commission - For best results, utilize the form when all required information is available.

To empower someone to act on your behalf, it's important to familiarize yourself with the Texas Power of Attorney form, which can be easily accessed through Texas Documents. Properly completing this essential document ensures that your preferred choices are honored, especially in crucial moments when you may not be in a position to express them yourself.

Custody Petition - ADA compliance notice is included, ensuring accessibility for individuals with disabilities.

Har 3 Connecticut - Parents are encouraged to explain any "yes" answers in detail for clarity.

Guide to Filling Out Connecticut Op 300

After completing the Connecticut OP-300 form, you will need to submit it to the Department of Revenue Services along with any required schedules. Ensure that all information is accurate and that you adhere to the submission deadlines. Failure to do so may result in penalties or interest charges.

- Obtain the Connecticut OP-300 form from the Department of Revenue Services website or other official sources.

- Fill in your Connecticut Tax Registration Number and Federal Employer Identification Number (FEIN) at the top of the form.

- Indicate the period ending date and check the appropriate box if you are out of business or filing an amended return.

- Answer the question regarding the purchase of untaxed roll-your-own cigarette tobacco products. If "Yes," attach Schedule E.

- Complete Line 1 by entering the total wholesale sales price of tobacco products purchased, imported, received, or acquired in Connecticut from Schedule A-1 or Schedule A-2.

- For Line 2, enter the wholesale sales price of tobacco products manufactured in Connecticut from Schedule B.

- Add the amounts from Lines 1 and 2 to get the subtotal for Line 3.

- For Line 4, enter the wholesale sales price of tobacco products exported from Connecticut from Schedule C.

- Complete Line 5 with the wholesale sales price of tobacco products sold to the federal government from Schedule D.

- Add the amounts from Lines 4 and 5 to get the subtotal for Line 6.

- Subtract Line 6 from Line 3 to determine the amount subject to tax for Line 7.

- Multiply the amount in Line 7 by 50% to calculate the tax due on tobacco products for Line 8.

- For Line 9, enter the total ounces of snuff tobacco products purchased from Schedule A-3 or Schedule A-4.

- Complete Line 10 with the total ounces of snuff tobacco products exported or sold to the federal government from Schedule C-1.

- Subtract Line 10 from Line 9 for Line 11 to find the total ounces of snuff tobacco products subject to tax.

- Multiply the amount in Line 11 by $1.00 to calculate the tax due on snuff tobacco products for Line 12.

- For Line 13, enter the total number of cigars purchased, imported, received, or manufactured in Connecticut from Schedule A-5.

- Complete Line 14 with the total number of cigars exported or sold to the federal government from Schedule C-2.

- Subtract Line 14 from Line 13 for Line 15 to determine the total number of cigars subject to tax.

- Multiply the amount in Line 15 by 50¢ to calculate the tax due on cigars for Line 16.

- Add Lines 8, 12, and 16 to find the total tax due for Line 17.

- Calculate the penalty for Line 18 as 10% of total tax due or $50, whichever is greater.

- Determine interest for Line 19 as 1% per month from the due date to the payment date.

- Add Lines 17, 18, and 19 for the total amount due on Line 20.

- Sign and date the declaration at the bottom of the form, including your title and telephone number.

- If applicable, have the paid preparer sign and provide their information.

- Submit the completed form and any attachments to the Department of Revenue Services by the due date.

Dos and Don'ts

Things to Do When Filling Out the Connecticut OP-300 Form:

- Use blue or black ink only to complete the form.

- Check the appropriate box regarding untaxed roll-your-own cigarette tobacco products.

- Ensure all required schedules are attached, especially if you answer "Yes" to purchasing untaxed products.

- Sign the form where indicated; a partner or principal officer must sign.

- File your return by the 25th day of the following month, even if no tax is due.

- Double-check all calculations to avoid errors in tax amounts.

- Keep copies of all submitted forms and schedules for your records.

Things Not to Do When Filling Out the Connecticut OP-300 Form:

- Do not use any ink color other than blue or black.

- Avoid leaving any required fields blank; provide all necessary information.

- Do not forget to attach supporting schedules if applicable.

- Do not submit the form without a signature from the taxpayer or authorized representative.

- Do not file late; penalties and interest may apply for late submissions.

- Do not assume you are exempt from filing if no tax is due; a return is still required.

- Do not send cash; payments should be made by check or electronically.