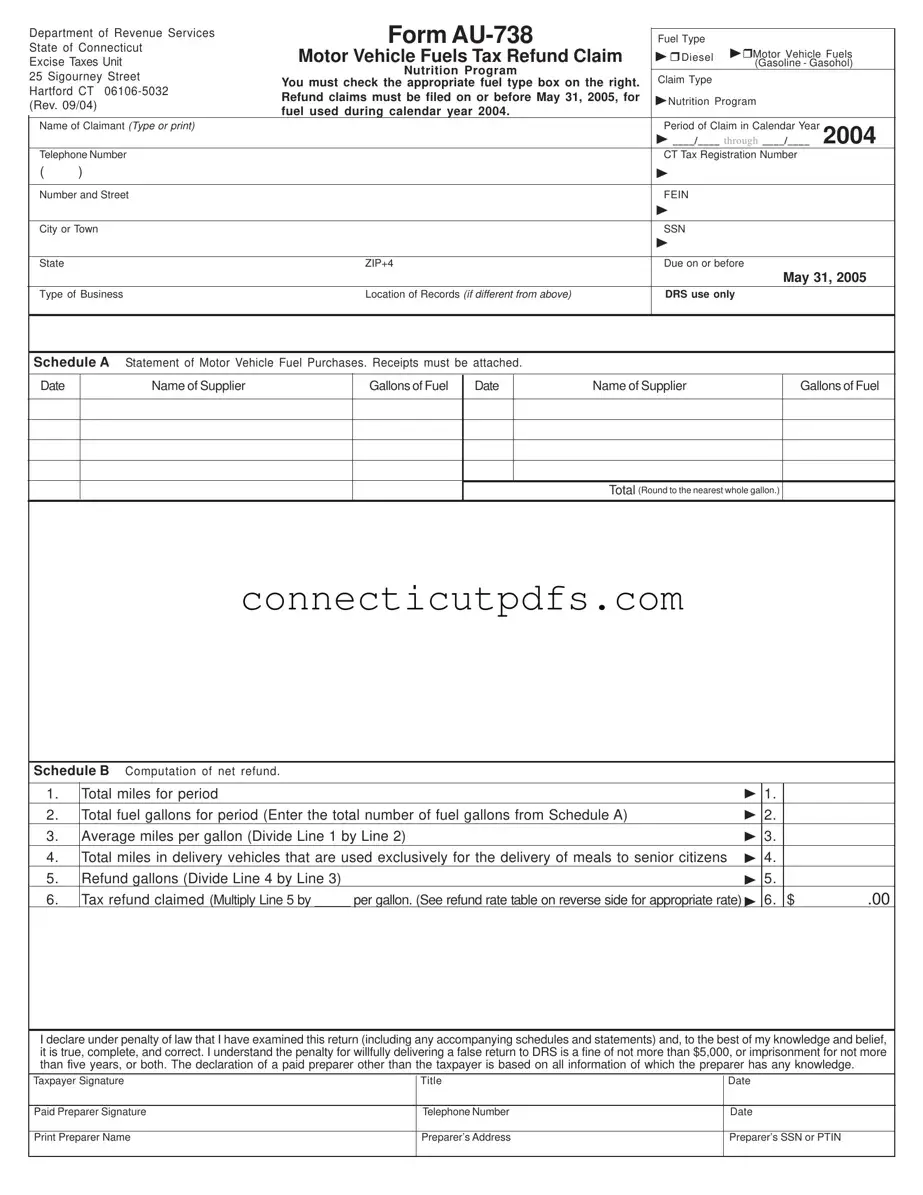

Fill Your Connecticut Au 738 Form

The Connecticut AU-738 form is an essential tool for individuals and businesses seeking to claim a refund on motor vehicle fuels tax. This form specifically caters to those who have utilized fuel for the Nutrition Program during the calendar year 2004. To successfully complete the AU-738, claimants must indicate the type of fuel used—whether diesel or gasoline—and ensure that their refund claims are submitted by the deadline of May 31, 2005. The form requires detailed information, including the claimant's name, contact information, and tax registration number. Additionally, claimants must provide a thorough account of their fuel purchases, including dates, supplier names, and gallons purchased, all supported by receipts. The calculation of the refund involves determining total miles driven and the average miles per gallon, ultimately leading to the tax refund amount based on the applicable rates for the year. It’s important to note that each fuel type requires a separate AU-738 submission, and claimants should keep their records for at least three years for verification purposes. Understanding these requirements will help ensure a smooth refund process and compliance with state regulations.

Documents used along the form

The Connecticut AU-738 form is essential for individuals and businesses seeking a refund on motor vehicle fuel taxes, particularly for fuel used in nutrition programs. When completing this form, it is often necessary to accompany it with other documents that provide further details or support the claim. Below is a list of forms and documents frequently used in conjunction with the AU-738 form, each serving a specific purpose in the refund process.

- Schedule A: Statement of Motor Vehicle Fuel Purchases - This schedule lists all fuel purchases made during the claim period. It requires details such as the date of purchase, supplier name, and gallons of fuel purchased. Receipts must be attached to substantiate the claims.

- Schedule B: Computation of Net Refund - This document helps calculate the total refund amount. It includes steps to determine total miles driven, fuel gallons used, and the average miles per gallon, leading to the final refund calculation.

- Quitclaim Deed Form - If you ever need to transfer property ownership without warranties, consider using a Texas Documents quitclaim deed form, especially for transactions among family members or resolving title issues.

- Proof of Payment Receipts - Copies of receipts or invoices for fuel purchases must be included. These documents verify the date, supplier, and total amount paid for the fuel, ensuring compliance with refund requirements.

- Contract with Local Area Agency on Aging - A copy of this contract serves as evidence of eligibility to provide Title III-C meals to senior citizens, which is crucial for claiming the refund.

- CT Tax Registration Number - This number is necessary for identification purposes when filing the claim. It ensures that the refund is processed accurately and linked to the correct taxpayer.

- Social Security Number (SSN) or Federal Employer Identification Number (FEIN) - These numbers are required to identify the claimant and must be provided on the AU-738 form to validate the refund claim.

- Additional Documentation of Fuel Usage - Any other relevant documents that can substantiate the fuel usage claims may also be required. This could include logs or records detailing the fuel used for qualifying activities.

- Contact Information - Providing a reliable telephone number is essential. This allows the Department of Revenue Services to reach the claimant if any further information is needed regarding the refund claim.

Each of these forms and documents plays a vital role in ensuring a smooth and successful refund process. Properly completing and submitting them alongside the AU-738 form can significantly enhance the chances of receiving the requested refund in a timely manner.

Preview - Connecticut Au 738 Form

Department of Revenue Services |

|

Form |

|

Fuel Type |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

State of Connecticut |

Motor Vehicle Fuels Tax Refund Claim |

Diesel |

(Gasoline - Gasohol) |

|||||||||

Excise Taxes Unit |

||||||||||||

|

|

|

|

|

|

|

|

|

Motor Vehicle Fuels |

|||

25 Sigourney Street |

|

Nutrition Program |

|

|

|

|

|

|

||||

|

|

Claim Type |

|

|

|

|

||||||

You must check the appropriate fuel type box on the right. |

|

|

|

|

||||||||

Hartford CT |

|

|

|

|

||||||||

Refund claims must be filed on or before May 31, 2005, for |

Nutrition Program |

|

||||||||||

(Rev. 09/04) |

|

|||||||||||

fuel used during calendar year 2004. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||

Name of Claimant (Type or print) |

|

|

|

|

|

Period of Claim in Calendar Year |

2004 |

|||||

|

|

|

|

|

|

|

|

____/____ through ____/____ |

||||

Telephone Number |

|

|

|

|

|

CT Tax Registration Number |

|

|||||

( |

) |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and Street |

|

|

|

|

|

FEIN |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or Town |

|

|

|

|

|

SSN |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

ZIP+4 |

|

|

|

Due on or before |

|

|||

|

|

|

|

|

|

|

|

|

|

|

May 31, 2005 |

|

Type of Business |

|

Location of Records (if different from above) |

|

DRS use only |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

Schedule A Statement of Motor Vehicle Fuel Purchases. Receipts must be attached. |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

Name of Supplier |

|

Gallons of Fuel |

Date |

|

Name of Supplier |

|

|

Gallons of Fuel |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (Round to the nearest whole gallon.) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule B Computation of net refund. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

1. |

Total miles for period |

|

|

|

|

|

|

1. |

|

|

||

2. |

Total fuel gallons for period (Enter the total number of fuel gallons from Schedule A) |

|

2. |

|

|

|||||||

3. |

Average miles per gallon (Divide Line 1 by Line 2) |

|

|

|

|

3. |

|

|

||||

4. |

Total miles in delivery vehicles that are used exclusively for the delivery of meals to senior citizens |

4. |

|

|

||||||||

5. |

Refund gallons (Divide Line 4 by Line 3) |

|

|

|

|

5. |

|

|

||||

6. |

|

Tax refund claimed (Multiply Line 5 by _____ per gallon. (See refund rate table on reverse side for appropriate rate) |

6. |

$ |

.00 |

|||||||

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer Signature |

Title |

Date |

|

|

|

Paid Preparer Signature |

Telephone Number |

Date |

|

|

|

Print Preparer Name |

Preparer’s Address |

Preparer’s SSN or PTIN |

|

|

|

Instructions

Your motor vehicle fuels tax refund claim for fuel used during calendar year 2004 must:

1.Be filed with Department of Revenue Services (DRS) on or before May 31, 2005; and

2.Involve at least 200 gallons of fuel eligible for tax refund.

The appropriate fuel type box must be marked on the front of this form in order to process this claim. You must file a separate Form

Be sure to provide a telephone number where you can be contacted.

You must indicate your Connecticut tax registration number or Social Security Number in the space provided.

For all purchases of fuel listed, you must attach a copy of each numbered slip or invoice issued at the time of the purchase. The slip or invoice may be the original or a photocopy and must show the:

•Date of purchase;

•Name and address of the seller (which must be printed or rubber stamped on the slip or invoice);

•Name and address of the purchaser (which must be the name and address of the person or entity filing the claim for refund);

•Number of gallons of fuel purchased;

•Price per gallon;

•Total amount paid; and

•If payment is made within a discounted period, provide proof of amount paid.

You must retain records to substantiate your refund claim for at least three years following the filing of the claim and make them

Table of Motor Vehicle Fuels Tax Refund Rates for 2004

for Nutrition Program

Diesel January 1, 2004 |

through |

December 31, 2004 |

26¢ |

per Gallon |

Motor Vehicle Fuels |

|

|

|

|

January 1, 2004 |

through |

December 31, 2004 |

25¢ |

per Gallon |

Note: You must file a separate Form

available to DRS upon request.

Rounding Off to Whole Dollars: You must round off cents to the nearest whole dollar on your motor vehicle fuels tax refund claim. Round down to the next lowest dollar all amounts that include 1 through 49 cents. Round up to the next highest dollar all amounts that include 50 through 99 cents. However, if you need to add two or more amounts to compute the total to enter on a line, include cents and round off only the total.

Example: Add two amounts ($1.29 + $3.21) to compute the total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered on the line.

You must attach a copy of your contract with your local area agency on aging as evidence of your eligibility to provide Title

Mail the completed refund application to: Department of Revenue Services State of Connecticut

Excise Taxes Unit

25 Sigourney Street Hartford CT

Additional Information

If you need additional information or assistance, please call the Excise Taxes Unit at

www.ct.gov/DRS

Your refund will be applied against any outstanding DRS tax liability.

Form

Common Questions

What is the Connecticut AU-738 form used for?

The Connecticut AU-738 form is a refund claim for motor vehicle fuels tax. Specifically, it is designed for individuals or businesses that have used diesel or gasoline fuels in the delivery of meals to senior citizens during the calendar year 2004. By submitting this form, you can reclaim excise taxes paid on eligible fuel purchases.

What are the eligibility requirements for filing the AU-738 form?

To be eligible to file the AU-738 form, you must have used at least 200 gallons of fuel eligible for a tax refund during the calendar year 2004. Additionally, you must be involved in providing meals to senior citizens, and you need to attach a copy of your contract with your local area agency on aging to prove your eligibility.

When is the deadline for submitting the AU-738 form?

The completed AU-738 form must be submitted to the Department of Revenue Services (DRS) by May 31, 2005. It is crucial to adhere to this deadline to ensure that your refund claim is processed without complications.

What information is required on the form?

The form requires basic information, including your name, contact number, Connecticut tax registration number or Social Security Number, and the period of claim. You must also provide details about your fuel purchases, including supplier names, dates, and the number of gallons purchased. Receipts must be attached to substantiate your claims.

How do I calculate the refund amount?

To calculate your refund, you will first need to determine the total miles driven during the claim period and the total gallons of fuel used. From there, you can find the average miles per gallon. The total miles driven in delivery vehicles exclusively used for delivering meals to seniors will then be divided by the average miles per gallon to find the refund gallons. Finally, multiply the refund gallons by the applicable refund rate to determine the total tax refund claimed.

What should I do if I have outstanding tax liabilities?

Be aware that any refund you receive from the AU-738 form may be applied against any outstanding tax liabilities you have with the Department of Revenue Services. This means that if you owe taxes, your refund could be used to offset that amount.

What records do I need to keep?

You must retain all records related to your refund claim for at least three years after filing. This includes receipts for fuel purchases, contracts, and any other documentation that supports your claim. These records should be made available to the DRS upon request.

Where do I send the completed form?

Once you have completed the AU-738 form, mail it to the Department of Revenue Services, Excise Taxes Unit, at 25 Sigourney Street, Hartford, CT 06106-5032. Ensure that you send it well before the deadline to avoid any issues.

Who can I contact for more information?

If you need further assistance or have questions regarding the AU-738 form, you can contact the Excise Taxes Unit at 860-541-3224. They are available Monday through Friday from 8:00 a.m. to 5:00 p.m. Additionally, forms and further information can be found on the DRS website at www.ct.gov/DRS.

Common PDF Forms

Connecticut Capital Improvement - The need for improvements must be backed by reliable data and assessments.

For those seeking clarity in their business operations, a solid understanding of the Operating Agreement framework is vital, ensuring that all partners are well-informed about the management dynamics. You can find more information about this important document at critical Colorado Operating Agreement guidelines.

Ct Premium Pay Program Login - This application is designed to simplify the path for aspiring educators meeting specific testing criteria.

Guide to Filling Out Connecticut Au 738

Filling out the Connecticut AU-738 form is an essential step if you're seeking a refund for motor vehicle fuels tax. Before you begin, ensure you have all necessary documentation at hand, including receipts and any required contracts. This process will guide you through each section of the form to make it as straightforward as possible.

- Obtain the Form: Download the AU-738 form from the Connecticut Department of Revenue Services website or request a physical copy.

- Identify the Fuel Type: On the front of the form, check the box that corresponds to the type of fuel you are claiming (Diesel or Gasoline/Gasohol).

- Fill Out Claimant Information: Type or print your name, address, and telephone number. Include your Connecticut Tax Registration Number or Social Security Number.

- Specify the Claim Period: Indicate the period for which you are claiming the refund, using the format ____/____ through ____/____ for the calendar year 2004.

- List Fuel Purchases: Complete Schedule A by entering the date, name of the supplier, and gallons of fuel purchased. Attach receipts for each purchase.

- Calculate Refund: Move to Schedule B and fill in the total miles driven and total gallons of fuel used. Use these numbers to compute your average miles per gallon.

- Determine Refund Gallons: Enter the total miles in delivery vehicles used exclusively for meal delivery to senior citizens. Calculate refund gallons by dividing this number by your average miles per gallon.

- Calculate Tax Refund: Multiply the refund gallons by the appropriate rate per gallon (found in the refund rate table) to determine the total tax refund claimed.

- Sign and Date: Sign the form, providing your title and date. If a paid preparer assisted you, they must also sign and provide their information.

- Mail the Form: Send the completed form and all attachments to the Department of Revenue Services at the specified address.

Once you have submitted your claim, keep a copy for your records. It's also wise to retain all documentation for at least three years, as you may need to provide it if requested. If you have any questions or need assistance, don't hesitate to reach out to the Excise Taxes Unit for help.

Dos and Don'ts

When filling out the Connecticut AU-738 form, there are several important do's and don'ts to keep in mind. These tips will help ensure your refund claim is processed smoothly.

- Do check the appropriate fuel type box on the form to ensure it is processed correctly.

- Do file your claim by the deadline of May 31, 2005, for fuel used in 2004.

- Do provide a valid Connecticut tax registration number or Social Security Number.

- Do attach all required receipts or invoices for fuel purchases.

- Don't forget to round your refund amounts to the nearest whole dollar.

- Don't submit multiple fuel types on one form; use a separate AU-738 for each type.

- Don't neglect to keep records for at least three years after filing your claim.

By following these guidelines, you can help ensure that your claim is accurate and complete, making the process easier for everyone involved.