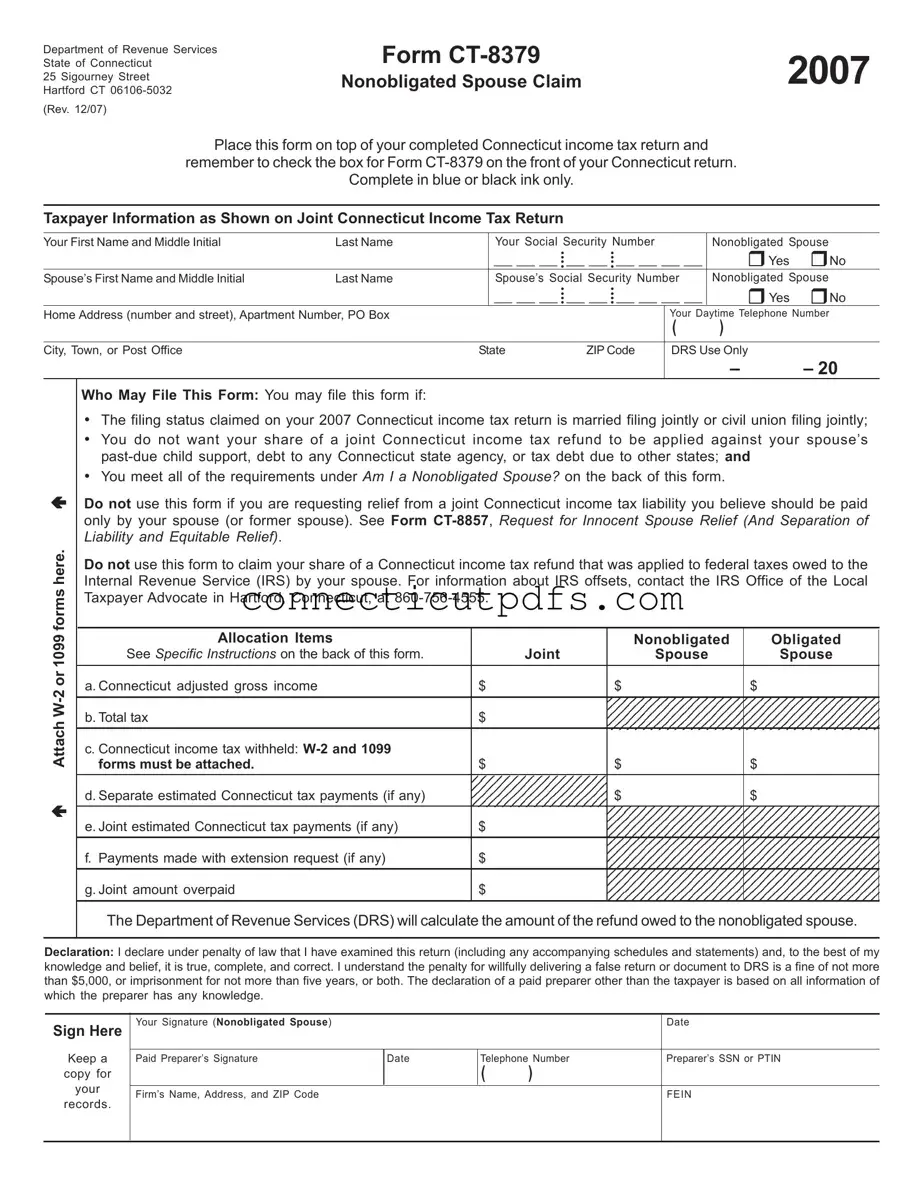

Fill Your Connecticut 8379 Form

The Connecticut 8379 form, officially known as the Nonobligated Spouse Claim, plays a critical role for individuals navigating the complexities of joint tax filings in Connecticut. Specifically designed for couples who file their income taxes jointly, this form allows the nonobligated spouse—who does not owe any debts such as child support or tax liabilities—to claim their rightful share of a tax refund that may otherwise be applied to the obligated spouse's debts. To utilize this form, taxpayers must meet specific criteria, including having filed a joint return and demonstrating that their share of the refund is at risk of being offset by the other spouse's obligations. The form requires detailed taxpayer information, including Social Security numbers and income allocations, and must be submitted alongside the completed Connecticut income tax return. Additionally, it mandates the attachment of relevant W-2 or 1099 forms to substantiate claims of withheld taxes. The Connecticut Department of Revenue Services (DRS) is responsible for calculating the appropriate refund amount for the nonobligated spouse, ensuring that they receive the funds they are entitled to without interference from the other spouse's financial responsibilities. Understanding the nuances of Form CT-8379 is essential for taxpayers in Connecticut who wish to protect their financial interests while complying with state tax laws.

Documents used along the form

The Connecticut 8379 form is an important document for nonobligated spouses seeking to claim their share of a tax refund that may otherwise be applied to their spouse's debts. When filing this form, there are several other documents that may be necessary to ensure a complete and accurate submission. Below is a list of forms and documents often used alongside the Connecticut 8379 form.

- Form CT-1040: This is the standard Connecticut income tax return form. It must be completed by all residents who earn income in Connecticut. The CT-8379 form should be placed on top of this completed return.

- Form CT-1040EZ: A simplified version of the CT-1040 for taxpayers with straightforward tax situations. It is designed for those with basic income and fewer deductions, making it easier to file.

- Texas Quitclaim Deed: To transfer property ownership without title warranties, consider completing the Texas Quitclaim Deed. For the necessary form, visit Texas Documents.

- Form CT-1040NR/PY: This form is for nonresidents and part-year residents of Connecticut. It is used to report income earned in Connecticut while living in another state or only part of the year in Connecticut.

- Form CT-1040X: If you need to amend your original Connecticut income tax return, this form is necessary. It allows taxpayers to correct any mistakes or omissions made on their initial filing.

- W-2 and 1099 Forms: These documents report income and tax withheld from wages or other payments. It is crucial to attach copies of these forms to the CT-8379 to verify income and tax payments.

When preparing to file the Connecticut 8379 form, ensure that all relevant documents are gathered and reviewed. This will help streamline the process and increase the chances of a successful claim for your share of the tax refund. Proper preparation can make a significant difference in navigating tax responsibilities effectively.

Preview - Connecticut 8379 Form

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT

(Rev. 12/07)

Form |

2007 |

Nonobligated Spouse Claim |

Place this form on top of your completed Connecticut income tax return and

remember to check the box for Form

Complete in blue or black ink only.

Taxpayer Information as Shown on Joint Connecticut Income Tax Return

Your First Name and Middle Initial |

Last Name |

|

Your Social Security Number |

|

Nonobligated Spouse |

|||

|

|

|

• |

• |

__ __ __ __ |

Yes |

No |

|

|

|

|

__ __ __ •• |

__ __ •• |

||||

|

|

|

• |

• |

|

|

Nonobligated Spouse |

|

Spouse’s First Name and Middle Initial |

Last Name |

|

Spouse’s Social Security Number |

|||||

|

|

|

• |

• |

__ __ __ __ |

Yes |

No |

|

|

|

|

__ __ __ •• |

__ __ •• |

||||

|

|

|

• |

• |

|

|

|

|

Home Address (number and street), Apartment Number, PO Box |

|

|

|

|

Your Daytime Telephone Number |

|||

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

City, Town, or Post Office |

|

State |

ZIP Code |

DRS Use Only |

|

|||

|

|

|

|

|

|

|

– |

– 20 |

Attach

Who May File This Form: You may file this form if:

•The filing status claimed on your 2007 Connecticut income tax return is married filing jointly or civil union filing jointly;

•You do not want your share of a joint Connecticut income tax refund to be applied against your spouse’s

•You meet all of the requirements under Am I a Nonobligated Spouse? on the back of this form.

Do not use this form if you are requesting relief from a joint Connecticut income tax liability you believe should be paid only by your spouse (or former spouse). See Form

Do not use this form to claim your share of a Connecticut income tax refund that was applied to federal taxes owed to the Internal Revenue Service (IRS) by your spouse. For information about IRS offsets, contact the IRS Office of the Local Taxpayer Advocate in Hartford, Connecticut, at

|

Allocation Items |

|

Nonobligated |

Obligated |

|

See Specific Instructions on the back of this form. |

Joint |

Spouse |

Spouse |

|

|

|

|

|

|

a. Connecticut adjusted gross income |

$ |

$ |

$ |

|

|

|

|

|

|

b. Total tax |

$ |

|

|

|

|

|

|

|

|

c. Connecticut income tax withheld: |

|

|

|

|

forms must be attached. |

$ |

$ |

$ |

|

|

|

|

|

|

d. Separate estimated Connecticut tax payments (if any) |

|

$ |

$ |

|

|

|

|

|

|

e. Joint estimated Connecticut tax payments (if any) |

$ |

|

|

|

|

|

|

|

|

f. Payments made with extension request (if any) |

$ |

|

|

|

|

|

|

|

|

g. Joint amount overpaid |

$ |

|

|

|

|

|

|

|

The Department of Revenue Services (DRS) will calculate the amount of the refund owed to the nonobligated spouse.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Sign Here

Keep a

copy for

your

records.

Your Signature (Nonobligated Spouse) |

|

|

|

Date |

|

|

|

|

|

Paid Preparer’s Signature |

Date |

Telephone Number |

Preparer’s SSN or PTIN |

|

|

|

( |

) |

|

|

|

|

|

|

Firm’s Name, Address, and ZIP Code |

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

Form

Purpose: Use Form

•You are a nonobligated spouse and all or part of your overpayment was (or is expected to be) applied against:

•Your spouse’s past due State of Connecticut debt (such as child support, student loan, or any debt to any Connecticut state agency); or

•A tax debt due to other states; and

•You want your share of the joint overpayment refunded to you.

Any reference in this document to a spouse also refers to a party to a civil union recognized under Connecticut law.

General Instructions

Am I a Nonobligated Spouse?

You are a nonobligated spouse, if you meet all of the following requirements:

•You filed a joint Connecticut income tax return with a spouse who owes

•You received income (such as wages, interest, etc.) reported on the joint return;

•You made Connecticut income tax payments (such as withholding or estimated tax payments) reported on the joint return;

•You do not owe

•You filed a joint return reporting an overpayment of Connecticut income tax, all or part of which was or is expected to be applied against

Filing the Return: You must file Form

You must place this form on top of the completed Connecticut income tax return. If you previously filed your 2007 Connecticut income tax return, mail this form separately to: Department of Revenue Services, PO Box 5035, Hartford CT

Important: Attach copies of all forms

showing Connecticut income tax withheld to Form CT- 8379.

Specific Instructions

Taxpayer Information: Enter the taxpayer information exactly as it appears on your Connecticut income tax return. The name and Social Security Number (SSN) entered first on the joint tax return must also be entered first on Form

Allocation Items

a.Connecticut adjusted gross income: Enter the joint amount as reported on your joint Connecticut income tax return (Form

Nonresidents and

Nonresidents and |

Connecticut Source Income |

|

(Form |

||

Only |

||

|

Allocation Item

Joint

Nonobligated Spouse

Obligated Spouse

b.Total tax: Enter the joint Connecticut tax liability as reported on your joint Connecticut income tax return (Form

c.Connecticut income tax withheld: Enter the joint Connecticut withholding as reported on your joint Connecticut income tax return (Form

d.Separate estimated Connecticut tax payments: Enter any separately paid estimated Connecticut income tax payments in the appropriate spaces.

e.Joint estimated Connecticut tax payments: Enter the total amount of any joint estimated Connecticut income tax payments. Include overpayments applied from a previous year.

f.Payments made with extension request: Enter the joint amount as reported on your joint Connecticut income tax return (Form

g.Joint amount overpaid: Enter the joint amount overpaid as reported on your joint Connecticut income tax return (Form

Nonobligated Spouse Refund: DRS will calculate the amount of the nonobligated spouse’s refund. The nonobligated spouse’s share of the joint Connecticut tax overpayment cannot exceed the joint overpayment.

Signature: The nonobligated spouse must sign this form.

Others Who May Sign for the Nonobligated Spouse: Anyone with a signed Power of Attorney may sign on behalf of the nonobligated spouse. Attach a copy of the Power of Attorney.

Paid Preparer’s Signature: Anyone you pay to prepare your return must sign and date it. Paid preparers must also enter their SSN or Personal Tax Identification Number (PTIN), and their firm’s Federal Employer Identification Number (FEIN) in the spaces provided.

Form

Common Questions

What is the purpose of the Connecticut 8379 form?

The Connecticut 8379 form, also known as the Nonobligated Spouse Claim, is designed for individuals who filed a joint Connecticut income tax return but wish to claim their share of a tax refund that may be applied against their spouse’s debts. This form allows a nonobligated spouse—one who does not owe any past-due child support or other debts—to request their portion of the overpayment, ensuring that their tax refund is not used to satisfy their spouse's obligations.

Who qualifies to file the Connecticut 8379 form?

To qualify, you must have filed a joint tax return with a spouse who has outstanding debts, such as past-due child support or tax liabilities to other states. Additionally, you must have reported income and made tax payments on that joint return. Importantly, you cannot owe any debts yourself. If you meet these criteria, you can file the Connecticut 8379 form to reclaim your share of any overpayment.

How do I file the Connecticut 8379 form?

To file the Connecticut 8379 form, place it on top of your completed Connecticut income tax return. Be sure to check the box indicating that you are including Form CT-8379 on your return. If you have already submitted your tax return, you can mail the form separately to the Department of Revenue Services. Remember to attach copies of all W-2 and 1099 forms that show Connecticut income tax withheld.

What information do I need to provide on the form?

You will need to provide personal information such as your name, Social Security number, and address. Additionally, you must include details about your spouse, including their name and Social Security number. The form requires you to allocate income, tax withheld, and any estimated tax payments between you and your spouse. This information helps the Department of Revenue Services calculate the appropriate refund amount for the nonobligated spouse.

What happens if I do not qualify as a nonobligated spouse?

If you do not meet the criteria to be considered a nonobligated spouse, you cannot use this form to claim your share of a tax refund. Instead, you may need to explore other options, such as filing Form CT-8857, which requests innocent spouse relief. This alternative form addresses situations where you believe you should not be held responsible for a joint tax liability due to your spouse's actions.

How does the Department of Revenue Services calculate the refund?

The Department of Revenue Services will assess the information provided on the Connecticut 8379 form to determine the nonobligated spouse’s share of the joint tax overpayment. The calculation will be based on the income reported, tax payments made, and any applicable debts of the obligated spouse. The refund amount cannot exceed the total joint overpayment reported on your tax return.

Can someone else sign the form on my behalf?

Yes, if you are unable to sign the form yourself, someone with a signed Power of Attorney can do so on your behalf. Make sure to attach a copy of the Power of Attorney document to the form. Additionally, if you hire a paid preparer to assist with your tax return, they must also sign the form and provide their identification information.

Common PDF Forms

Connecticut Fpd 124 - Dealers should be familiar with Connecticut's regulations concerning precious metals.

A properly structured Operating Agreement is vital for any Colorado LLC, ensuring members understand their roles and responsibilities. For a clear guide on the necessary elements and considerations, check out this resource on creating an effective Operating Agreement template: important points to consider in your Operating Agreement.

Inheritance Tax in Ct - The completeness of the claim is verified through the included statement affirming the truthfulness of the report.

Guide to Filling Out Connecticut 8379

Filling out the Connecticut 8379 form requires careful attention to detail. After completing this form, it must be placed on top of your finished Connecticut income tax return. Remember to check the box indicating that you are submitting Form CT-8379 on your tax return. The Department of Revenue Services will review your submission and calculate any refund owed to you.

- Gather your completed Connecticut income tax return and any W-2 or 1099 forms showing Connecticut income tax withheld.

- Use blue or black ink to fill out the form.

- In the "Taxpayer Information" section, enter your first name, middle initial, last name, and Social Security Number as they appear on your joint tax return.

- Indicate whether you are the nonobligated spouse by checking "Yes" or "No." Repeat this for your spouse's information, entering their name and Social Security Number.

- Provide your home address, including apartment number or PO Box, city or town, state, and ZIP code.

- Enter your daytime telephone number.

- In the "Allocation Items" section, fill out the Connecticut adjusted gross income for both spouses, as well as the total tax, Connecticut income tax withheld, separate estimated tax payments, joint estimated tax payments, and any payments made with extension requests.

- Calculate and enter the joint amount overpaid.

- Sign and date the form as the nonobligated spouse. If applicable, include the signature of a paid preparer along with their identification information.

- Attach all W-2 and 1099 forms to the completed CT-8379 form.

- Place the CT-8379 form on top of your completed Connecticut income tax return.

Dos and Don'ts

When filling out the Connecticut 8379 form, it is essential to adhere to specific guidelines to ensure accuracy and compliance. Below is a list of ten things to do and avoid during this process.

- Do complete the form in blue or black ink only.

- Do place the Connecticut 8379 form on top of your completed Connecticut income tax return.

- Do check the box for Form CT-8379 on the front of your Connecticut return.

- Do ensure that all required W-2 or 1099 forms are attached.

- Do enter taxpayer information exactly as it appears on the joint tax return.

- Don't use this form if you are requesting relief from a joint tax liability that should only be paid by your spouse.

- Don't submit this form if your share of the refund was applied to federal taxes owed by your spouse.

- Don't forget to sign the form; the nonobligated spouse must provide a signature.

- Don't leave any required fields blank; ensure all necessary information is filled out completely.

- Don't mail the form to the wrong address; ensure it is sent to the correct Department of Revenue Services address.