Fill Your Connecticut 7B Form

The Connecticut 7B form serves as a critical document for individuals applying for a building permit, specifically when the applicant is a sole proprietor or property owner acting as the general contractor or principal employer. This form ensures compliance with state regulations regarding workers’ compensation insurance coverage. Applicants must indicate their status as either the owner of the property or a sole proprietor, and they must provide proof of workers' compensation insurance for all employees involved in the construction project. The form requires the applicant's signature, affirming their role and responsibilities. Additionally, if the applicant does not submit proof of insurance personally, they must attest that they will require such proof from any contractors or subcontractors working on the site. The affidavit section mandates notarization, adding an extra layer of verification to the information provided. Overall, the Connecticut 7B form is essential for safeguarding the rights of workers and ensuring that construction projects adhere to state laws.

Documents used along the form

When applying for a building permit in Connecticut, you may need to submit additional documents alongside the Connecticut 7B form. These documents help ensure compliance with state regulations and provide necessary information about workers' compensation coverage. Below are some common forms and documents that are often used in conjunction with the 7B form.

- Certificate of Insurance: This document serves as proof that the contractor or property owner has active workers' compensation insurance. It includes details about the policy, such as coverage limits and the insurance provider's information.

- Motorcycle Bill of Sale: This essential document officially records the transaction between a buyer and a seller for the sale of a motorcycle. It is crucial for legal and registration purposes and must be accurately completed. For more information, visit billofsaleforvehicles.com/editable-texas-motorcycle-bill-of-sale.

- Affidavit of Compliance: This affidavit confirms that the property owner or contractor will ensure all workers on the site have appropriate workers' compensation coverage. It is a legal statement that emphasizes the responsibility of the owner or contractor.

- Business License: A business license may be required to verify that the contractor or sole proprietor is legally authorized to operate in Connecticut. This document shows that the business is registered and complies with local regulations.

- W-9 Form: This form is used to provide the taxpayer identification number of the contractor or business. It is often required for tax purposes and helps ensure accurate reporting of income to the IRS.

Gathering these documents can help streamline the building permit application process. Ensure that all forms are completed accurately and submitted on time to avoid delays in your project.

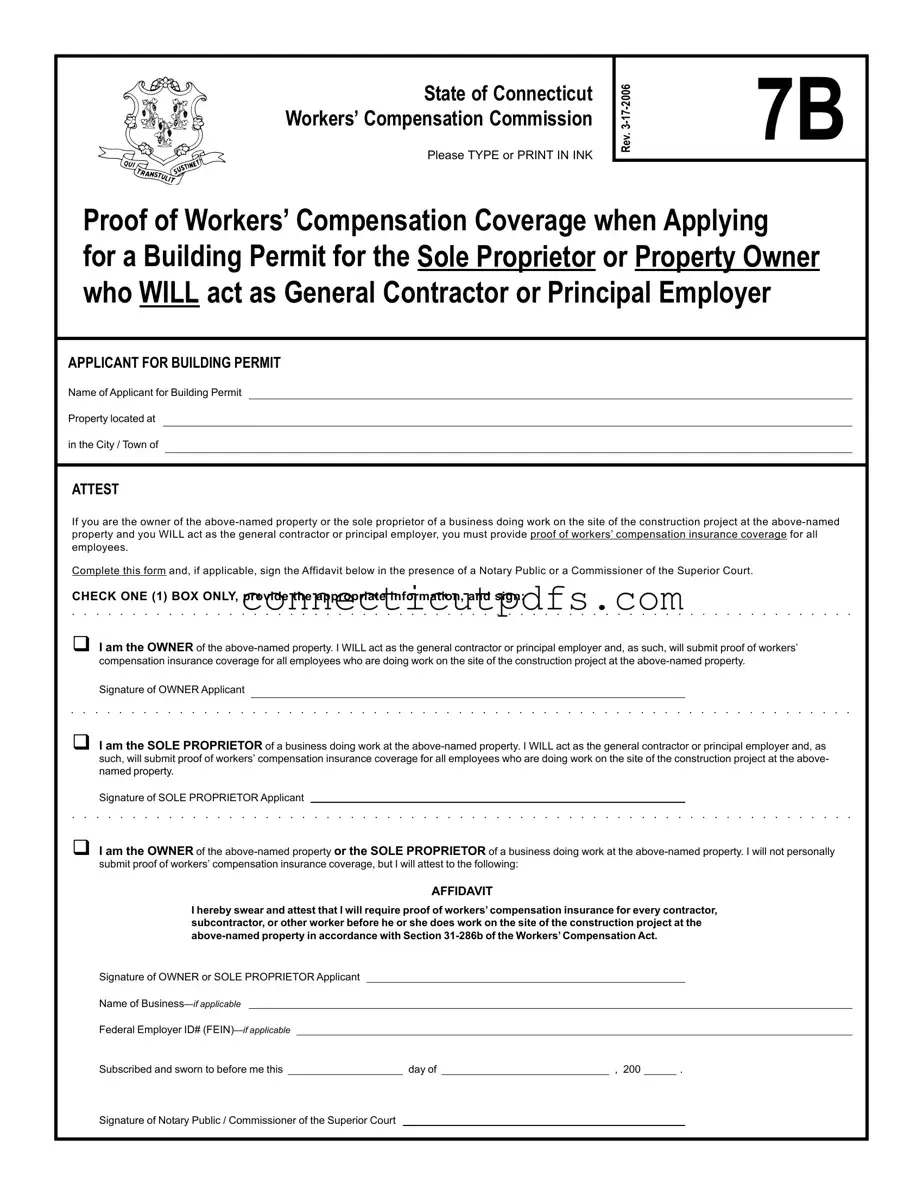

Preview - Connecticut 7B Form

State of Connecticut Workers’ Compensation Commission

Please TYPE or PRINT IN INK

Rev.

7B

Proof of Workers’ Compensation Coverage when Applying

for a Building Permit for the Sole Proprietor or Property Owner who WILL act as General Contractor or Principal Employer

APPLICANT FOR BUILDING PERMIT

Name of Applicant for Building Permit

Property located at

in the City / Town of

ATTEST

If you are the owner of the

Complete this form and, if applicable, sign the Affidavit below in the presence of a Notary Public or a Commissioner of the Superior Court.

CHECK ONE (1) BOX ONLY, provide the appropriate information, and sign:

I am the OWNER of the

Signature of OWNER Applicant

I am the SOLE PROPRIETOR of a business doing work at the

Signature of SOLE PROPRIETOR Applicant

I am the OWNER of the

AFFIDAVIT

I hereby swear and attest that I will require proof of workers’ compensation insurance for every contractor, subcontractor, or other worker before he or she does work on the site of the construction project at the

Signature of OWNER or SOLE PROPRIETOR Applicant

Name of

Federal Employer ID#

Subscribed and sworn to before me this |

|

day of |

|

, 200 |

|

. |

Signature of Notary Public / Commissioner of the Superior Court

Common Questions

What is the purpose of the Connecticut 7B form?

The Connecticut 7B form serves as proof of workers' compensation coverage when applying for a building permit. It is specifically designed for property owners or sole proprietors who will act as general contractors or principal employers on construction projects. By completing this form, applicants demonstrate their compliance with state regulations regarding workers' compensation insurance, ensuring that all employees involved in the project are covered in case of workplace injuries.

Who needs to fill out the Connecticut 7B form?

Any individual who is either the owner of the property or a sole proprietor of a business undertaking work at that property must fill out the Connecticut 7B form. If you plan to act as the general contractor or principal employer, it is essential to provide proof of workers' compensation insurance for all employees who will be working on the construction site. This requirement helps protect both the workers and the property owner from potential liabilities associated with workplace injuries.

What information is required on the Connecticut 7B form?

The form requires several key pieces of information. Applicants must provide their name, the property address where the construction will take place, and their status as either the owner or sole proprietor. Additionally, they must indicate whether they will submit proof of workers' compensation insurance or attest that they will require it from any contractors or subcontractors before work begins. If applicable, the name of the business and the Federal Employer ID number should also be included. Finally, the form must be signed and, if necessary, notarized to validate the information provided.

What happens if I do not submit the Connecticut 7B form?

Failing to submit the Connecticut 7B form when applying for a building permit can lead to significant complications. Without this proof of workers' compensation coverage, your application may be denied, delaying your construction project. Additionally, you could face legal liabilities if any employees are injured on the job site without proper insurance coverage in place. It is crucial to ensure compliance with state regulations by submitting the form to avoid these potential issues.

Common PDF Forms

How to Gift a Car in Ct - Compliance with this process can protect the owner's interests legally.

Connecticut Coaching Certification - Be mindful of deadlines related to the renewal of the five-year coaching permit.

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the property’s title. This form is often utilized in situations such as transferring property between family members or clearing up title issues. To begin the process of transferring property, fill out the form by clicking the button below, or visit Texas Documents for more information.

How to Gift a Car in Ct - All vehicles reported under this form must lack a valid marker plate.

Guide to Filling Out Connecticut 7B

Completing the Connecticut 7B form is an essential step for property owners or sole proprietors applying for a building permit. This process ensures that you provide necessary proof of workers’ compensation coverage, which is crucial for any construction project. Follow the steps below carefully to fill out the form accurately.

- Begin by typing or printing your information in ink on the form.

- In the section labeled "Name of Applicant for Building Permit," enter your full name.

- Next, provide the address of the property where the construction will take place in the "Property located at" field.

- Check the appropriate box to indicate your status: either as the OWNER of the property or as the SOLE PROPRIETOR of a business.

- If you are the OWNER, sign your name in the designated area labeled "Signature of OWNER Applicant." If you are the SOLE PROPRIETOR, sign in the area labeled "Signature of SOLE PROPRIETOR Applicant."

- If you do not plan to submit proof of workers’ compensation insurance personally, check the box that indicates you will require proof from every contractor or worker. Sign in the area labeled "Signature of OWNER or SOLE PROPRIETOR Applicant."

- If applicable, fill in the "Name of Business" and "Federal Employer ID# (FEIN)" sections.

- Finally, you must have the form notarized. Sign and date the form in the presence of a Notary Public or a Commissioner of the Superior Court, who will then complete their section.

Dos and Don'ts

When filling out the Connecticut 7B form, it is essential to approach the process with care. Here is a list of things you should and shouldn't do to ensure accuracy and compliance.

- Do type or print clearly in ink to ensure legibility.

- Do check one box only to indicate your status as either the owner or sole proprietor.

- Do provide proof of workers’ compensation insurance coverage for all employees.

- Do sign the affidavit in the presence of a Notary Public or a Commissioner of the Superior Court.

- Do include your Federal Employer ID number if applicable.

- Don't leave any sections blank; complete all required fields.

- Don't submit the form without verifying that all information is accurate.

- Don't forget to date your affidavit; it must be current.

- Don't use correction fluid or tape on the form; if you make a mistake, start over.

- Don't ignore the requirement for proof of insurance; it is mandatory for all employees.