Fillable Connecticut Bill of Sale Document

The Connecticut Bill of Sale form is an essential document for anyone involved in the buying or selling of personal property in the state. This form serves as a legal record of the transaction, providing important details about the item being sold, the parties involved, and the terms of the sale. Typically, it includes information such as the names and addresses of both the seller and the buyer, a description of the item—whether it's a vehicle, furniture, or equipment—and the sale price. Additionally, the form may outline any warranties or guarantees associated with the item, as well as the date of the sale. Having a properly completed Bill of Sale can protect both parties in the event of disputes and can serve as proof of ownership. Understanding how to fill out this form accurately is crucial for ensuring a smooth transaction and safeguarding your interests.

Documents used along the form

When completing a transaction in Connecticut, especially involving the sale of a vehicle or personal property, several other forms and documents may be necessary alongside the Connecticut Bill of Sale form. These documents help clarify ownership, protect both parties, and ensure compliance with state regulations. Here’s a list of common forms that often accompany a Bill of Sale.

- Title Transfer Form: This document is essential for transferring ownership of a vehicle. It officially changes the title from the seller to the buyer and must be submitted to the Department of Motor Vehicles (DMV).

- Odometer Disclosure Statement: Required for vehicle sales, this statement confirms the vehicle's mileage at the time of sale. It protects against fraud and ensures transparency in the transaction.

- Vehicle Registration Application: After purchasing a vehicle, the buyer must fill out this application to register the vehicle in their name with the DMV.

- Emissions Certificate: In certain cases, especially for older vehicles, an emissions certificate may be required to confirm that the vehicle meets environmental standards.

- Sales Tax Form: This form documents the sales tax collected during the transaction. It’s important for both the seller and buyer to keep accurate records for tax purposes.

- Affidavit of Ownership: This document is used when the seller cannot provide a title. It serves as a sworn statement verifying ownership and the right to sell the property.

- Buyer’s Guide: For the sale of used vehicles, this guide provides important information about the vehicle's condition and any warranties or guarantees.

- Warranty Deed: If real estate is involved, a warranty deed transfers ownership of the property and guarantees that the seller has the right to sell it.

- General Bill of Sale: A crucial document that serves as a receipt for the transfer of ownership of personal property. It details the transaction, including the item's description, sale price, and the names of both parties involved. For more information, you can refer to the General Bill of Sale form.

- Power of Attorney: This document allows one person to act on behalf of another in the transaction, which can be useful if the seller is unavailable to sign documents.

Having the right forms and documents ready can streamline the buying or selling process, ensuring that both parties feel secure and informed. Always check for specific requirements based on the type of transaction to avoid any complications down the road.

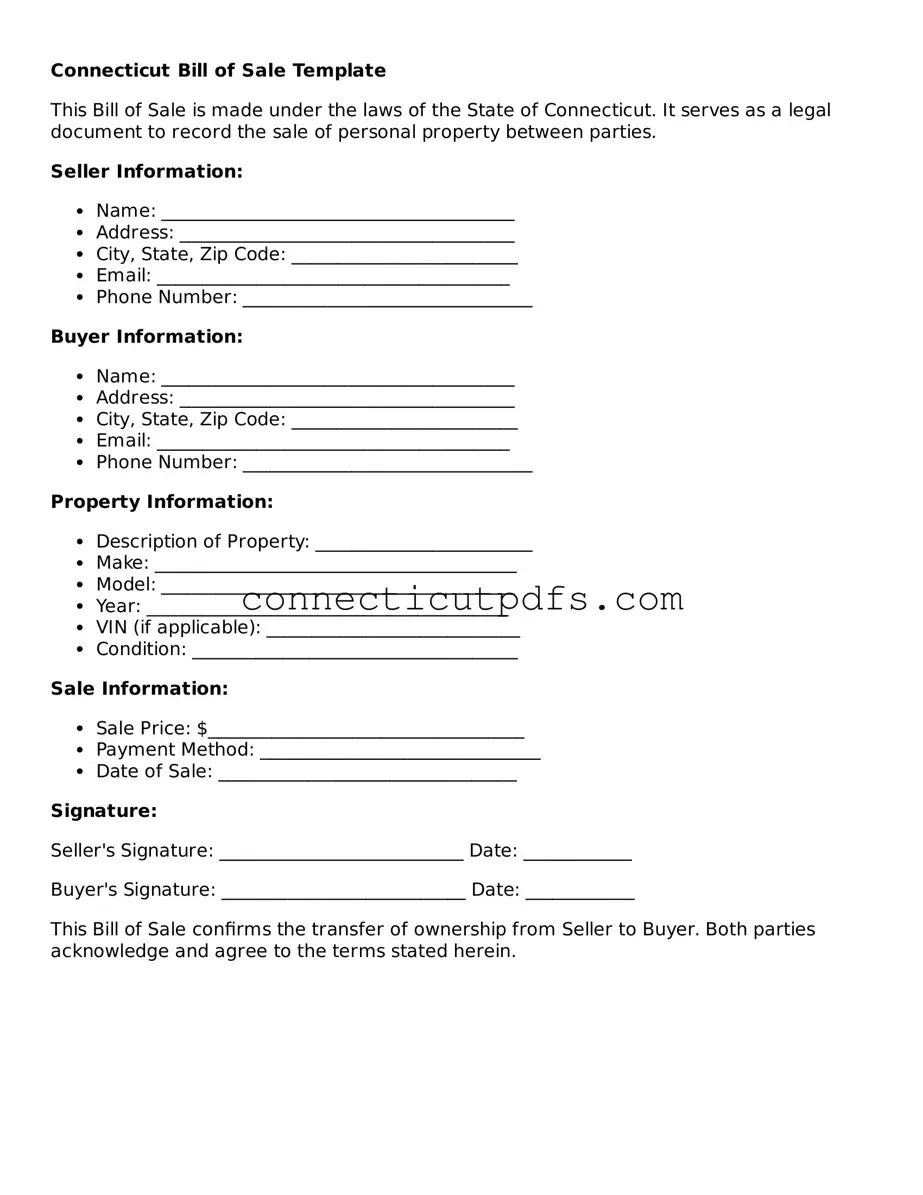

Preview - Connecticut Bill of Sale Form

Connecticut Bill of Sale Template

This Bill of Sale is made under the laws of the State of Connecticut. It serves as a legal document to record the sale of personal property between parties.

Seller Information:

- Name: _______________________________________

- Address: _____________________________________

- City, State, Zip Code: _________________________

- Email: _______________________________________

- Phone Number: ________________________________

Buyer Information:

- Name: _______________________________________

- Address: _____________________________________

- City, State, Zip Code: _________________________

- Email: _______________________________________

- Phone Number: ________________________________

Property Information:

- Description of Property: ________________________

- Make: ________________________________________

- Model: _______________________________________

- Year: ________________________________________

- VIN (if applicable): ____________________________

- Condition: ____________________________________

Sale Information:

- Sale Price: $___________________________________

- Payment Method: _______________________________

- Date of Sale: _________________________________

Signature:

Seller's Signature: ___________________________ Date: ____________

Buyer's Signature: ___________________________ Date: ____________

This Bill of Sale confirms the transfer of ownership from Seller to Buyer. Both parties acknowledge and agree to the terms stated herein.

Common Questions

What is a Connecticut Bill of Sale form?

A Connecticut Bill of Sale form is a legal document that serves as proof of the transfer of ownership of an item from one party to another. It details the transaction, including information about the buyer, the seller, and the item being sold. This document is important for both parties to establish clear ownership and can be useful for record-keeping or in case of disputes.

When do I need a Bill of Sale in Connecticut?

You need a Bill of Sale in Connecticut when you buy or sell certain items, especially vehicles, boats, or other significant assets. It is particularly important for transactions involving items that require registration or titling. Having a Bill of Sale can help protect both the buyer and seller by documenting the terms of the sale.

What information is included in a Connecticut Bill of Sale?

A typical Connecticut Bill of Sale includes the names and addresses of both the buyer and seller, a description of the item being sold (including make, model, and identification numbers), the sale price, and the date of the transaction. It may also include any warranties or conditions agreed upon by both parties.

Is a Bill of Sale required for all transactions?

No, a Bill of Sale is not required for every transaction in Connecticut. However, it is highly recommended for significant purchases, especially vehicles and boats. For smaller transactions, such as personal items sold at garage sales, a Bill of Sale may not be necessary but can still provide useful documentation.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale in Connecticut. It is important to ensure that it includes all necessary information and is signed by both parties. There are also templates available online that can help guide you in creating a valid Bill of Sale.

Do I need to have the Bill of Sale notarized?

In Connecticut, a Bill of Sale does not need to be notarized to be valid. However, having it notarized can add an extra layer of authenticity and may be required by certain institutions, such as banks or the Department of Motor Vehicles, when registering a vehicle.

What should I do with the Bill of Sale after the transaction?

After the transaction, both the buyer and seller should keep a copy of the Bill of Sale for their records. This document can be important for future reference, especially if questions about ownership or the terms of the sale arise later.

Where can I obtain a Bill of Sale form?

You can obtain a Bill of Sale form from various sources. Many websites offer free templates that you can download and customize. Additionally, some office supply stores sell pre-printed forms. If you prefer, you can also draft your own document following the guidelines provided by the state.

Check out More Forms for Connecticut

Connecticut Residential Lease Agreement - The lease often describes the owner's rights concerning access and privacy of their property.

The Illinois Articles of Incorporation form is a crucial document that establishes a corporation in the state of Illinois. This form outlines essential details about the corporation, including its name, purpose, and structure. A related concept to be aware of is the Memorandum of Association, which further clarifies the foundational aspects of a company's constitution. Completing this form accurately is the first step in ensuring that your business operates legally and effectively.

Vacate Quit Notice Letter From Landlord to Tenant - Understanding the implications of a Notice to Quit is crucial for tenants.

Dealership Bill of Sale Template - The Trailer Bill of Sale captures essential details of the transaction, ensuring clarity.

Guide to Filling Out Connecticut Bill of Sale

Completing the Connecticut Bill of Sale form is a straightforward process that requires attention to detail. Once you have filled out the form, you will need to ensure both parties sign it to finalize the transaction. Follow these steps carefully to complete the form accurately.

- Obtain the Connecticut Bill of Sale form from a reliable source.

- Fill in the date of the transaction at the top of the form.

- Provide the full name and address of the seller in the designated section.

- Enter the full name and address of the buyer in the appropriate section.

- Describe the item being sold, including its make, model, year, and Vehicle Identification Number (VIN) if applicable.

- Indicate the sale price clearly in the designated area.

- Include any additional terms of the sale, if necessary.

- Have both the seller and buyer sign and date the form at the bottom.

- Make copies of the completed form for both parties’ records.

Dos and Don'ts

When filling out the Connecticut Bill of Sale form, there are several important considerations to keep in mind. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do include a detailed description of the item being sold, such as make, model, year, and VIN for vehicles.

- Do ensure that both parties sign the document to validate the transaction.

- Do keep a copy of the completed Bill of Sale for your records.

- Do check for any specific requirements that may apply to the type of item being sold.

- Don't leave any sections blank; incomplete forms can lead to confusion or disputes later.

- Don't use outdated forms; always download the most current version from official sources.

- Don't rush through the process; take your time to ensure all information is correct.

- Don't forget to mention any warranties or conditions associated with the sale.

- Don't overlook the importance of notarization if required for your specific transaction.