Fillable Connecticut Articles of Incorporation Document

The Connecticut Articles of Incorporation form serves as a fundamental document for individuals and groups looking to establish a corporation in the state. This form captures essential information that outlines the corporation's structure and purpose. Key components include the corporation's name, which must be unique and compliant with state regulations, and the address of its principal office. Additionally, the form requires the identification of the corporation's registered agent, who will serve as the official point of contact for legal matters. The Articles also stipulate the number of shares the corporation is authorized to issue, along with any relevant classifications of those shares. Furthermore, the form may include provisions regarding the management structure, detailing whether the corporation will be managed by its shareholders or a board of directors. By completing and submitting this form, applicants initiate the legal process of forming a corporation, ensuring compliance with state laws and regulations while laying the groundwork for future business operations.

Documents used along the form

When incorporating a business in Connecticut, the Articles of Incorporation form is a fundamental document. However, it is not the only paperwork required to ensure compliance with state regulations. Several other forms and documents are typically needed to complete the incorporation process and establish a functioning corporation. Below are four essential documents that often accompany the Articles of Incorporation.

- Bylaws: These internal rules govern the management and operation of the corporation. Bylaws outline the responsibilities of directors and officers, procedures for meetings, and guidelines for decision-making. While not filed with the state, they are crucial for maintaining order and clarity within the organization.

- Initial Report: In Connecticut, newly formed corporations must submit an Initial Report within a specific timeframe after incorporation. This document provides essential information about the corporation, including its address, officers, and registered agent. It helps the state maintain updated records about the business.

- Real Estate Purchase Agreement: This legal document outlines the terms and conditions of a real estate transaction and is essential for buyers and sellers. To get started, you can find the necessary form at Texas Documents.

- Employer Identification Number (EIN): Obtaining an EIN from the Internal Revenue Service (IRS) is necessary for tax purposes. This unique identifier is essential for opening a business bank account, hiring employees, and filing taxes. The application can often be completed online, making it a straightforward process.

- Business Licenses and Permits: Depending on the nature of the business and its location, various licenses and permits may be required. These could include state, local, or federal licenses, and they ensure that the business complies with regulations specific to its industry. Researching the necessary permits is crucial for lawful operation.

Understanding these accompanying documents is essential for anyone looking to establish a corporation in Connecticut. Each plays a significant role in ensuring that the business operates smoothly and in accordance with the law. By preparing these forms alongside the Articles of Incorporation, business owners can set a strong foundation for their new venture.

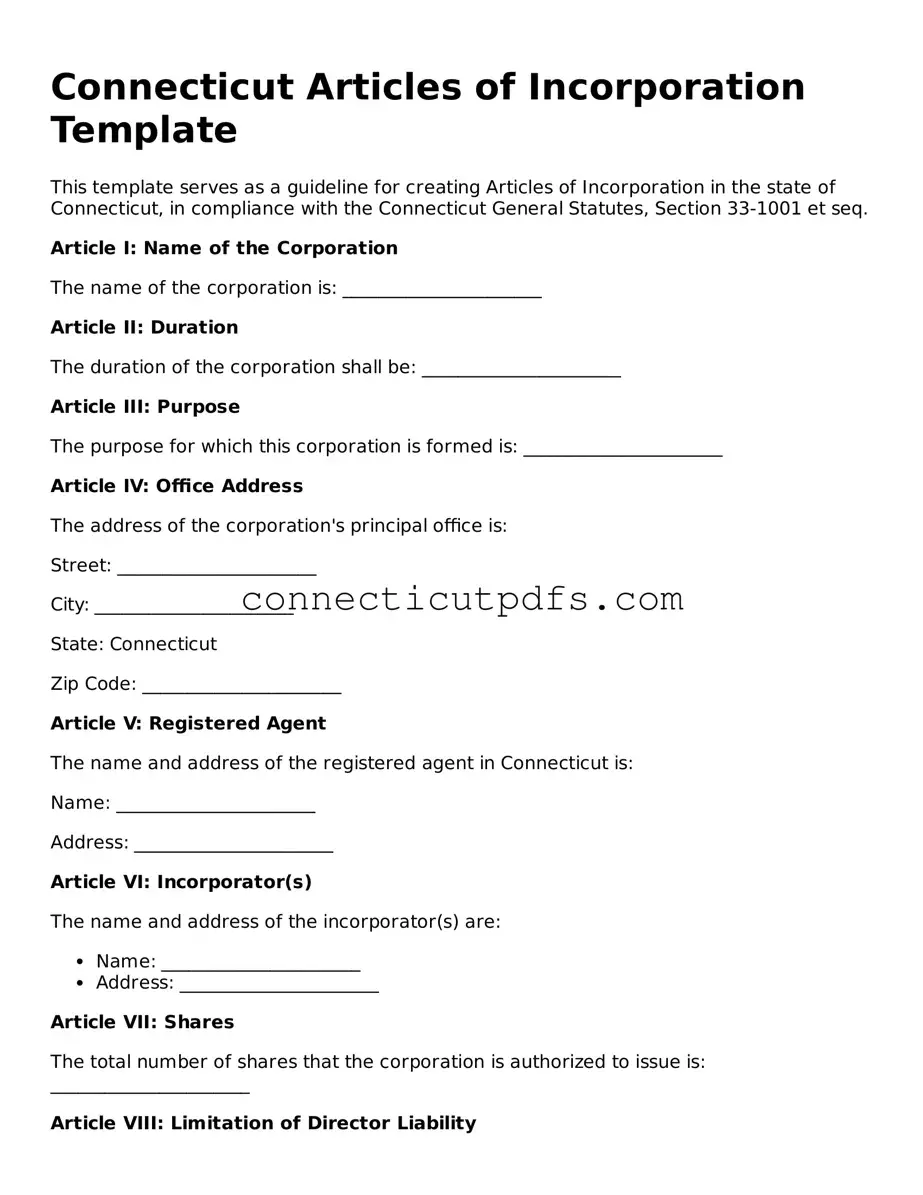

Preview - Connecticut Articles of Incorporation Form

Connecticut Articles of Incorporation Template

This template serves as a guideline for creating Articles of Incorporation in the state of Connecticut, in compliance with the Connecticut General Statutes, Section 33-1001 et seq.

Article I: Name of the Corporation

The name of the corporation is: ______________________

Article II: Duration

The duration of the corporation shall be: ______________________

Article III: Purpose

The purpose for which this corporation is formed is: ______________________

Article IV: Office Address

The address of the corporation's principal office is:

Street: ______________________

City: ______________________

State: Connecticut

Zip Code: ______________________

Article V: Registered Agent

The name and address of the registered agent in Connecticut is:

Name: ______________________

Address: ______________________

Article VI: Incorporator(s)

The name and address of the incorporator(s) are:

- Name: ______________________

- Address: ______________________

Article VII: Shares

The total number of shares that the corporation is authorized to issue is: ______________________

Article VIII: Limitation of Director Liability

To the fullest extent permitted by Connecticut law, no director of the corporation shall be personally liable to the corporation or its shareholders for monetary damages for breach of fiduciary duty as a director.

Article IX: Effective Date

This corporation will be effective upon filing, unless a specific date is stated:

Effective Date: ______________________

IN WITNESS WHEREOF, the incorporator(s) have executed these Articles of Incorporation on this ______ day of __________, 20____.

Signature: ______________________

Name: ______________________

Common Questions

What is the purpose of the Articles of Incorporation in Connecticut?

The Articles of Incorporation serve as a foundational document for establishing a corporation in Connecticut. They outline key details about the corporation, including its name, purpose, and the address of its registered office. This document is essential for legally recognizing the corporation as a separate entity from its owners.

What information is required to complete the Articles of Incorporation?

When filling out the Articles of Incorporation form, you will need to provide several pieces of information. This includes the corporation's name, the purpose of the corporation, the address of the principal office, the registered agent's name and address, and the number of shares the corporation is authorized to issue. Ensure that the name you choose is unique and not already in use by another business in Connecticut.

How do I file the Articles of Incorporation in Connecticut?

To file the Articles of Incorporation, you must submit the completed form to the Connecticut Secretary of the State's office. You can file online, by mail, or in person. If filing by mail, include the appropriate filing fee. If you choose to file online, ensure you have the necessary information ready to complete the process efficiently.

Is there a fee associated with filing the Articles of Incorporation?

Yes, there is a filing fee required when you submit your Articles of Incorporation. The fee amount may vary, so it is important to check the current fee schedule on the Connecticut Secretary of the State's website. Payment can typically be made by check, credit card, or electronic payment, depending on the filing method you choose.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, if filed online, you may receive confirmation within a few business days. If you file by mail, it may take longer. For the most accurate timeline, consider checking with the Connecticut Secretary of the State’s office for current processing times.

Can I amend the Articles of Incorporation after they are filed?

Yes, you can amend the Articles of Incorporation after they have been filed. If there are changes to the corporation's name, purpose, or other key details, you will need to file an amendment with the Secretary of the State. This process typically requires completing a specific form and paying a fee. Keeping your Articles up to date is important for compliance and transparency.

What is a registered agent, and why do I need one?

A registered agent is an individual or business entity designated to receive legal documents on behalf of your corporation. This includes service of process, tax documents, and other official correspondence. Having a registered agent is a legal requirement in Connecticut, ensuring that your corporation can be reached for important matters.

Do I need a lawyer to file the Articles of Incorporation?

While it is not mandatory to hire a lawyer to file the Articles of Incorporation, consulting with one can be beneficial. A lawyer can help ensure that all required information is included and that the document complies with state laws. This can save you time and prevent potential issues down the road.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially formed. You will receive a certificate of incorporation from the Secretary of the State. After this, you should establish bylaws, hold an organizational meeting, and obtain any necessary licenses or permits to operate your business legally.

Can I use the Articles of Incorporation form for any type of business?

The Articles of Incorporation form is specifically designed for creating a corporation. If you are starting a different type of business entity, such as a limited liability company (LLC) or a partnership, you will need to use the appropriate forms for those structures. Each business type has its own requirements and benefits, so consider your options carefully.

Check out More Forms for Connecticut

How Long Does Probate Take in Connecticut - The document can help heirs efficiently manage and distribute real property without unnecessary hurdles.

A New York Boat Bill of Sale form is an essential document for anyone involved in the sale or transfer of a boat in the state of New York. This legally binding agreement not only confirms the transaction but also ensures that all relevant details, such as the boat's description and sale price, are clearly stated. To effectively complete this crucial step in the boat ownership process, you can access the Boat Bill of Sale form and ensure all information is accurately recorded.

Are Non Competes Enforceable in Ct - Employees should thoroughly review the terms before signing a Non-compete Agreement.

How to Get Power of Attorney in Ct - Establishes who can make decisions for a child when necessary.

Guide to Filling Out Connecticut Articles of Incorporation

Once you have the Connecticut Articles of Incorporation form ready, it's time to fill it out carefully. Each section requires specific information about your business, so attention to detail is crucial. After completing the form, you will submit it to the appropriate state office for processing.

- Begin by entering the name of your corporation. Ensure it complies with Connecticut naming requirements.

- Provide the principal office address. This should be a physical address, not a P.O. Box.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Specify the purpose of the corporation. A brief description is sufficient.

- Indicate the number of shares authorized for the corporation. Include any classes of shares if applicable.

- Fill in the names and addresses of the incorporators. At least one incorporator is required.

- Sign and date the form. Ensure that the signature is from an authorized person.

- Review all entries for accuracy and completeness before submission.

After completing these steps, prepare to submit the form along with any required fees to the Connecticut Secretary of State's office. Be sure to keep a copy for your records.

Dos and Don'ts

When filling out the Connecticut Articles of Incorporation form, it's important to follow certain guidelines to ensure your submission is successful. Here are six things you should and shouldn't do:

- Do: Provide accurate information for all required fields.

- Do: Double-check your spelling and grammar before submission.

- Do: Include a valid business name that complies with state regulations.

- Do: Ensure that the registered agent's information is current and correct.

- Don't: Leave any required sections blank; incomplete forms may be rejected.

- Don't: Use abbreviations or acronyms that are not widely recognized.

By following these guidelines, you can help ensure a smoother incorporation process in Connecticut.